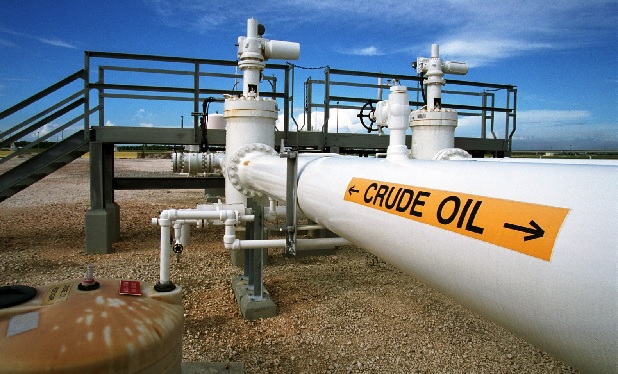

Nigeria’s gross oil receipts, which constituted 63.2 per cent of the country’s total revenue in October, dropped below the monthly budgeted estimate by 21.3 per cent to N470 billion during the month.

The Central Bank of Nigeria (CBN) stated this in its economic report for October 2014 released on its website on Tuesday.

According to the CBN, the decline in oil receipts relative to the monthly budget estimate was caused by the fall in receipts from crude oil and gas exports due to the fall in the price of crude oil in the international market.

The price of a barrel of crude oil has almost halved from $115 per barrel to about $60 per barrel.

Advertisement

Also, the CBN report showed that at N273.54 billion, gross non-oil receipts, constituted 36.8 per cent of the total revenue and was lower than the monthly budget estimate and receipts in the preceding month by 11.5 and 3.9 per cent respectively.

The banking sector regulator explained that the decrease in non-oil revenue relative to the monthly budget estimate reflected largely, the fall in receipt from corporate tax and customs/excise duties.

The data also revealed that total federally-collected revenue in October 2014, at N743.57 billion, was lower than both the monthly budget estimate and the receipts in the preceding month by 18 per cent and 10.6 per cent, respectively.

Advertisement

“Provisional data indicated that growth in the major monetary aggregate contracted at the end of October 2014.

“Broad money supply (M2), at N16,323.0 billion, fell by 1.5 per cent, on month- on-month basis, in contrast to the growth of 2.7 per cent at the end of the preceding month.

“The development, relative to the preceding month, reflected the 9.1 per cent decline in foreign asset net of the banking system, which more than offset the effects of the 4.1 and 0.9 per cent increase in other asset (net) and net domestic credit, respectively.

“Relative to its level at end-December2013, broad money supply (M2), however, grew by 4.2 per cent due to the 11.2 and 9.1 per cent increase in other assets (net) and domestic credit (net) of the banking system, respectively.”

Advertisement

According to the CBN, at N16, 408.5 billion, aggregate banking system credit (net) to the domestic economy grew by 0.9 per cent, on month-on-month basis, at end-October 2014, compared with the growth of 2.7 per cent at the end of the preceding month.