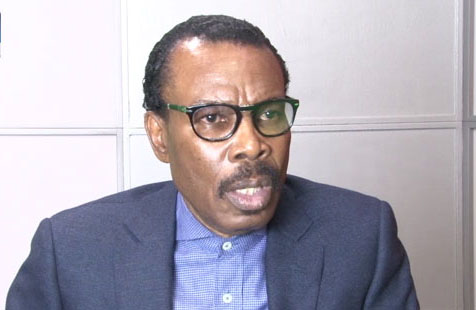

Bismarck Rewane, chief executive officer of Financial Derivatives, says the federal government should create more breathing space in the economy by meeting with creditors, including the International Monetary Fund (IMF), to restructure the country’s debt.

Rewane spoke about the debt restructuring while addressing the N27 trillion appropriation bill President Bola Tinubu presented before the joint sitting of the national assembly on Wednesday.

Speaking on Thursday on Arise TV, he said the budget does not address productivity and the debt service projected might not have taken into consideration, the possibility of hikes in interest rates.

“In terms of productivity, I do not think that this budget actually addresses the issue of productivity because you need to debottleneck the economy because there are constraints and impediments to growth, and these impediments include bureaucratic bottlenecks, civil service lethargy, obstacles to productivity, roadblocks, and many other things,” he said.

Advertisement

“But the reality is that the federal government funds public finances only about 52 to 54 percent of total fiscal financing in Nigeria. The state and local governments have another 48 percent so to speak.”

He added that the federal government is fiscally prudent, compared to the state governments.

Rewane said state governments’ finances are “bizarre”, adding that they are extremely fragile and in a “failing state than what is happening in the federal government”.

Advertisement

“So, when you now begin to take the borrowing environment, we want to test these assumptions and tell you that if interest rates are going to increase, as I’ve heard the CBN governor said, then the debt service we are projecting today, I am not so sure that it has taken into consideration the fact that these interest rates will increase,” he said.

“But what gives me comfort is that I think eventually, we will come to the realization and have to accept it whether we like it or not, inconveniently for that matter, that we will have to meet with our creditors, including the IMF, to restructure our debt to give us some breathing room, because the economic frustrations that are going to be let out on the street by people who are paying higher prices for the problems that we see today may not be bearable.”

He said it is almost imperative that “we have to restructure our debt” and that will give the country some breathing room to invest in capital expenditure to increase productivity, and to achieve accelerated and optimal growth.

Advertisement

Add a comment