Winter is the coldest season of the year, but it’s also a perfect metaphor for a period of financial gloom in a person’s life. Like almost everyone else, I’ve endured several economic winters. A decision I took in 2011 has, however, not convinced some of my friends that I confronted the frosty weather with the right remedy.

An opportunity to hear an authority’s verdict came last week. And I travelled from Abuja to Enugu (by road, of course; the Enugu “international” airport is still out of use) for an important event where I expected to be seated with Governor Ifeanyi Ugwuanyi of Enugu State, the special guest of honour on the occasion.

First, a story.

One Tuesday afternoon in June 2011, the fear of Boko Haram was every Abuja resident’s regular companion. Memories of the terrorist group’s attacks on Police Headquarters, the UNDP office and bus parks in different parts of Abuja, which claimed hundreds of lives, were still fresh. I was on the staff of a daily newspaper but couldn’t leave my home on the outskirts because bomb checkers had made the only road to the city centre impassable. Motorists queued for three hours or longer before they could reach the army checkpoint. You couldn’t turn back after the long wait because the opposite lane itself was choked.

Advertisement

I got the information on the phone and decided to stay back. My job was important but it wasn’t more important than my life, I reasoned. That evening, emergency calls from the newsroom couldn’t deter me; I had to dictate instructions from home until the first edition of the next day’s issue went to bed. I then drove to the office after 10pm to superintend production of the final edition.

As a result of that insecurity threat, my employer decided that three of his prized editors must live close to the office. And, that week, each of us received a N2m cheque to help us secure residential accommodation inside the city. I knew N2m couldn’t get a decent three-bedroom apartment in Wuse or even Garki, but I went for the search anyway. There were vacant flats about 500 metres to the office. But the rents for the first three I found were between N3.5m and N5m per annum. A duplex in Maitama went for N12m. Not a good sign!

“An Igbo man doesn’t spend money that way,” I muttered to myself as I drove back to my residence for which I paid N600, 000 per year at the time. I then decided I would start developing a plot I had bought a year earlier in another part of Abuja. It too was on the suburbs but more and better roads led to my office from there. Although I knew N2m wouldn’t bring a new bungalow up to the window level, I was determined to plough back all my savings into the construction and also seek a loan or an overdraft from my bank.

Advertisement

As work was going on, I approached my bank. That’s when I learned that getting a bank loan was a mission impossible: I was required to prove to the bank I didn’t need the money [provide collateral worth 150% of the amount I was seeking] and pay 33% interest on the loan each year; there were up to 40 pages of forms I had to fill, some to be endorsed by my ancestors.To cut the long story short, I eventually got interest-free loans from two friends and work on the site continued. By the December of that year, I moved into my own four-bedroom house.And that’s how I became a homeowner in Abuja.

The two other colleagues acted differently. One from Edo State [I won’t mention their name to avoid a reprisal] actually paid N4m for an apartment in a block of flats. The other from Kaduna State simply ignored our employer and spent his N2m on other things – I think he went on vacation abroad.

I had figured that our employer wouldn’t be able to sustain the N2m largesse every year; and truly, by 2012, the company couldn’t even pay salaries regularly. My colleague got hooked on the expiration of his N4m rent: he spent five months giving excuses to his landlord until he was able to move out – and back to the suburbs.

I recalled this story as I listened to a reputable accountant’s counsel in Enugu last week. His words, read in my hearing, were actually contained in a new book,My Memoirs on Financial Literacy. The author, Sir Paschal I. P. Okolie, is currently Enugu State’s accountant-general/permanent secretary.

Advertisement

Okolie tells me I took the right decision in 2011: “You cannot be thinking of enjoying when you haven’t created the foundation that will provide money to meet your needs. The idea of investment is to create a sustainable cash flow.” Interestingly, I was already living in my own house before his radio broadcasts were aired and two hosts from two radio stations, Ngozi Eboh and Charity Nwobodo, encouraged and pressured him to compile them and publish as a book.

And to my colleague who gave a fellow man N4m, a part of which was borrowed, as rent for one year, Okolie says: “…you should be able to think and plan [for] the future with wisdom. You should be able to have a mental image of the type of future you want to have.”

An entrepreneur myself, I was tempted to challenge Okolie’s authority on financial literacy. Just before I did, I found these words in the book: “Accountants are better positioned to render appropriate financial literacy and education needed by entrepreneurs and indeed other investors.”

Not every accountant is really financially literate. But the bookkeeper for Enugu State seems to have an answer for almost every query on money management, investment opportunities, entrepreneurship, tips for Christmas planning, acts of charity, business management and even moneymaking skills. Perhaps his deep knowledge of financial literacy endeared him to former governor Sullivan Chime and to current governor Ugwuanyi; the latter has retained him as the state’s accountant-general since his first inauguration in May 2015.

Advertisement

My Memoirs on Financial Literacy was presented in winter – the cold weather is now buffeting residents of the polar and temperate zones of the globe, while we’re contending with the harmattan in most parts of Nigeria. But, as I stated at the beginning, winter is, in a figurative sense, a season of financial quagmire. Okolie’s book has been written especially for people in the winter of their lives: the jobless, the low-income earner, the pensioner and other disadvantaged citizens.For instance, he tells the unemployed youth to “start shifting their thoughts”: “Let them see government work as an alternative; if it comes, well and good. It does not make government work bad, it is good; but the youth should focus on alternatives because the number of people required for government work is shrinking by the day. Information technology (IT) is not even helping matters. So the earlier the youth start thinking of other alternative things they can do, the better for them and the nation.”

And to new business owners: “Anybody planning to start up a business must be ready to take risks. The higher the risk the more likely the gain, if you succeed.”

Advertisement

To the retiring worker: “Then, having planned for other sources of income, you now think of habits that you can drop. You now think about your life: are you engaged in wasteful lifestyle? For instance, if you have been drinking too much, so to speak, can you curtail or stop it entirely? Is there a way I can reduce my drinking habit to improve my family budget? … Are there other wasteful lifestyles? Deal with them.”

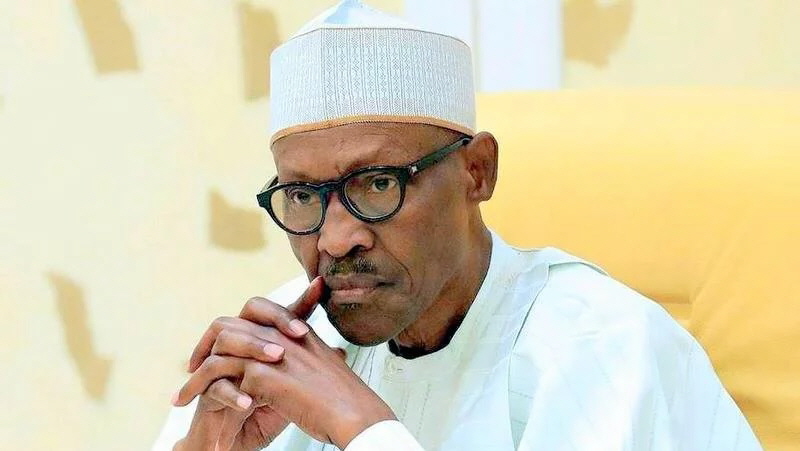

These hard times indeed call for financial literacy, for the economic morass of the Buhari era is winter at its worst! At such times, everyone seeks a leeway or a short-cut to making ends meet. Okolie’s book is a treasure. I wish many could find it as printed copies find their ways into bookstores.

Advertisement

Nwamu, an entrepreneur, is the CEO of Eyeway.ng

+234-8054100220 (SMS/WhatsApp only)

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment