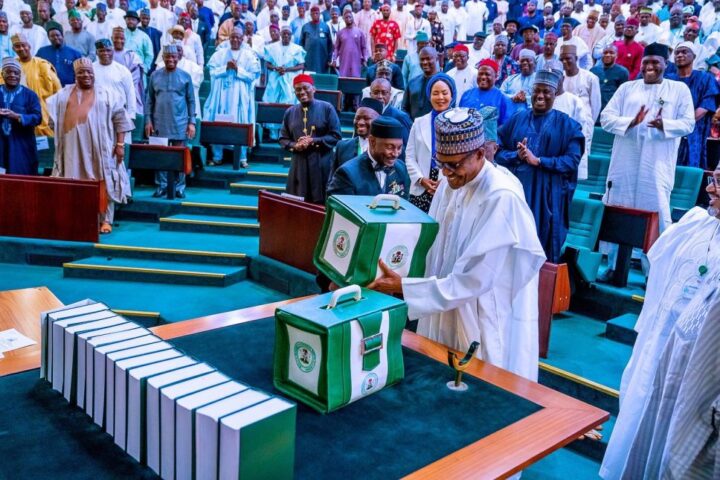

President Muhammadu Buhari presents the 2020 budget to the national assembly

The working relationship between the 9th National Assembly (NASS) and the Executive branch has been good and two of the benefits are a return to January to December budget cycle and enactment of a Finance Act, which improves current tax laws. However, the good relationship can’t seem to get the Federal Government out of its fiscal mess. In fact, it appears both the Executive and Legislature are bent on frantic digging, while in a hole.

Without doubt, the most difficult job in President Buhari’s cabinet is that of the Minister of Finance, Budget and National Planning. After all, the ministers of interior, police and defence seem to be insulated from taking responsibility for the security mess. She, on the other hand, has to balance vital competing needs and deal with a NASS happy to racket up spending in a tight fiscal environment. Since 2016, government finances have been under pressure and then coronavirus came along and laid bare the country’s fiscal weaknesses. For example, Federal government revenue in dollar terms was $19.3 billion in 2014 and collapsed to $11.6 billion in 2016 and $8.7 billion in 2017. In Naira terms, actual revenues grew from N3.24 trillion in 2014 to N4.12 trillion in 2019 (mainly due to devaluation), an increase of only 27% in five years. Meanwhile, expenditure doubled from N4.1 trillion in 2014 to N8.3 trillion in 2019. This rate of growth of expenditure (an average growth of 20% per annum) is not sustainable in an economy that has managed only 1.24% annual growth in five years and with revenue growth of only 5.4% per year. The third quarter numbers for 2020 showed further deterioration, which is not entirely surprising given the impact of coronavirus on oil price and the economy.

Financing the record deficits required both record borrowings from the capital market as well as record central bank financing. At the end of 2014, total Federal Government (FG) domestic debt was N7.9 trillion and external debt was $6.5 billion (excluding external debt of States). By the end of the third quarter of 2020, FG domestic debt was N15.85 trillion, an increase of N7.95 trillion compared to end of 2014. Meanwhile, external debt was $27.7 billion (FG only) at the end of 3rd quarter 2020, an increase of $21.2 billion compared to 2014. To put it in context, it means as at end of 3rd quarter 2020, the FG had added N1.33 trillion and $3.55 billion annually to its total debt. While the quantum of debt is still within prudent thresholds, if debt to GDP is the yardstick, the rate of growth is too fast at 28% (simple growth) per annum in a sluggish economy that is growing at only 1.24%, before coronavirus made nonsense of the minuscule growth and turned it into a recession. Debt service is also accelerating. According to 3rd quarter 2020 CBN economic report and second quarter Budget Implementation Report, the FG received only N2.49 trillion in revenue during the first nine months of 2020 but spent N2.13 trillion to service debt. Meaning, the FG spent 85.4% of its revenues for the first nine months of 2020 to service debt. A clearly unsustainable state of affairs, which requires immediate attention to forestall a debt crisis. Alas, both the Executive and Legislature have decided to racket up the debt in 2021.

The Executive submitted a N13.08 trillion budget for 2021 to the National Assembly with a record deficit of N5.2 trillion. By the time President Buhari assented to the budget on 31 December 2020, the budget had ballooned to N13.59 trillion with a frightening record deficit of N5.6 trillion. The budgeted deficit is 70% of budgeted revenue, such is the scale of the fiscal mess, which the NASS approved, while adding its own pork. While the FG thinks it is doing the economy a favour through an expansionary fiscal policy, it is probably doing more damage by financing the deficit partly through Central Bank financing, which increases inflation and weakens the Naira. Inflation is very bad for the poor as it erodes further their already weak purchasing power.

Advertisement

What is equally worrying is the quality of the spending. The FG’s entire revenue will not cover the planned recurrent expenditure (debt service and non-debt service), as the FG will have to borrow N1.48 trillion to cover recurrent expenditure, in violation of the Fiscal Responsibility Act. Meanwhile, the entire capital budget will be debt financed. Unfortunately, a significant part of the capital spending will not have any major impact on economic growth. The stark reality is that the Federal Government is in a big fiscal mess.

To get out of this fiscal mess requires a change in mindset and creativity by the Federal Executive and the National Assembly. The two need to understand that the oil party is over and oil price is not going to bail Nigeria out anytime soon. There are three main ways to get out of a fiscal hole, namely: increase in taxes; reduction in spending; and higher economic growth. The first two are politically difficult, while economic growth will be welcome by most.

The first place to start is to slow down growth of expenditure. As noted earlier, expenditure is growing too fast in a stagnant economy. The argument put forward is that the FG is trying to engineer economic growth through expansionary fiscal policy. However, since FG’s actual annual expenditure in prior years is less than 6% of nominal GDP, it is hard to see how even a 20% growth in Federal expenditure will translate into a significant boost for economic growth. This is not a call for austerity, considering the havoc wrecked by the coronavirus pandemic, but rather a call to adjust to a fiscal situation that is prudent and sustainable by slowing down the rate of growth of FG expenditure, until growth of revenue starts accelerating.

Advertisement

Furthermore, there is a need to prioritize and improve the quality of spending. For example, the Ministry of Humanitarian Affairs plans to spend an incredible N19.3 billion on local travel (recurrent). The Ministry is so awash with cash that it could spend such humongous sums on local travel. It has also managed to convince the President to increase its spending power by receiving an additional N365 billion to expand the social investment program from the traditional N400 billion per year to N765 billion. An incredible sum, perhaps a way of silencing protesting youths. But it will come at a huge cost because the entire additional N365 billion will be debt financed and it is part of the increase in deficit from the initial N5.2 trillion submitted in October to NASS to the final deficit of N5.6 trillion in the 2021 Appropriation Act.

In addition, over N23 billion will be spent on solar street lights, over N8 billion on fences and several billions on buying cars and office renovations by various ministries. These sums will have minimal impact on the economy and lives of Nigerians. Spending on such non-essentials, such as travelling, buying cars, solar street lights, renovation of offices and building fences should be removed from the budget for the next three years. There is also a need to scrap and merge some agencies as have been recommended by many others in order to reduce administrative costs. The Federal civil service can be reduced by half and not much will be lost in terms of services to citizens.

The capital budget also needs a complete overhaul. There are too many projects simultaneously being implemented by the likes of Ministry of Works and Housing, Water Resources, Power, Transportation and Agriculture. The Ministries should reduce the number of projects by 80% and focus on finishing 20% of existing projects every year. This will ensure value for money and reduce cost variations. No new projects should be introduced, except emergency spending, until existing projects have been completed or adequately funded. Projects that have the highest impact on productivity should be prioritised. The FG should collaborate with private sector to finance viable projects under concessionary arrangements, contractor financing and other viable financing alternatives. The FG cannot do it alone and the sooner it realises this and use the private sector to solve Nigeria’s deep infrastructure deficit and other gaps, the better.

The second way the FG can begin to get out of its fiscal mess is by improving revenue collection and by creating new taxes. For example, it is time for a Federal Personal Income Tax. The tax can start at 3% payable by those earning N100,000 and above. Secondly, the next government should raise VAT to 10%, as an increase by current government will probably elicit a backlash given the increase in 2020. The FG needs to continue blocking revenue leakages in revenue collecting Agencies and also cap their spending power.

Advertisement

The third and best way the FG can get out of its current fiscal hole is by engineering higher economic growth. But this is the most difficult. It requires a complete change in mindset from the current statist approach and the involvement of the private sector to take up the challenge. The current less than 1% average annual growth in the last 6 years won’t cut it. Real GDP growth rate of 6% or higher is required to reduce poverty. The fact is the FG is too fiscally weak to on its own get the country out of its current economic malaise and sluggish growth through fiscal policy. However, the FG thinks it can and Nigerians wrongly think it can, and consequently Nigerians have outsize expectations of what the FG can do. The sooner both realise the limitations, the earlier the country will start getting fixed.

The private sector is the engine of Nigeria’s economy and it is the private sector, with the support of government, both Federal and States, that can get the economy going. Higher economic growth led by the private sector means more employment and taxes for FG and the States. Nigeria is in dire need of investments in practically every sector: infrastructure; agriculture; education and health. With the right incentives, investments will surely follow as we have seen with the successful telecoms reform, cement backward integration policy and self-sufficiency in rice.

A low hanging fruit that could be quickly implemented is creating the right incentives for private sector investments in real estate, given the housing deficit in the country. It is also one that can be competently executed by the private sector. However, to succeed, a creative model should be adopted. Rather than large scale developments, small developments of 100 two-bedroom houses could be built on 5 hectares of land or high-rise flats on smaller land in dense urban areas. The houses can be built at between N2.5 million and N3 million and will thus be affordable to middle income earners. State Governments could give the land to private sector firms at no charge, while the private sector firms will mobilise funds. This will complement the current National Social Housing Program (NSHP) of the Federal Government. While the NSHP is a step in the right direction, the FG should get the private sector involved to complement its effort, because it neither has the capacity nor the fiscal space to do any large-scale housing projects within a short period of time.

The Federal Ministry of Finance, Budget and National Planning and the Federal Ministry of Industry, Trade and Investment need to take the lead in creating the right incentives for the private sector to thrive and take Nigeria to the promised land.

Advertisement

To summarise, the FG is in a deep fiscal mess and it will require deep thinking, creativity and time to get itself out of a mess of its own making. The time to start fixing the mess is now. Further delay means it will become even more difficult to stabilise other macroeconomic indicators, such as inflation, unemployment and the external account, that have all been deteriorating on account of the fiscal mess and other economic policy missteps.

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment