I just read the suggestion about curbing the currency crisis around the naira as postulated by the firm of Agusto and Co. I had been a trainee student of the company in 1992 when I was enrolled by my bank for a course titled: ‘Accounting for Non-Accountants’. I would later become chartered in 1996. I loved their training, anchored then by Dima Oruene. Brilliant. But I have discovered over time that Agusto and Co is decidedly a promoter of liberal economics, just like its contemporary, and industry leader – Phillips Consulting.

Well, in their position, Agusto believes that the best way forward for the naira is a ‘crawling peg’ with the US dollar. This means that we would benchmark the naira with the US dollar by looking at the inflation rates in the two countries. The difference in the inflation rates will form the basis of the devaluation of the naira on a yearly basis. So, if in Nigeria, we have average yearly inflation of say 18% and the US has average inflation of say 6%, we devalue the naira by 12%, the difference. This gives some sort of structure, but like the use of purchasing power parity (PPP) to analyze exchange rates, it is artificial, academic, and flawed.

For one, inflation in Nigeria is often understated for some reason. Bismarck Rewane has put out his own estimate of inflation at about 45%. Imagine devaluing yearly by say 40%! So, disputes will arise around the average inflation rate at least in Nigeria. And from that point on, the entire analysis falls apart. In truth, we all know that the value of a country’s currency should be largely dependent on its productivity. What are you selling versus what are you buying? In fact, we should be looking at what are you producing versus what you need from the rest of the world. If we compare the two economies, we may end up suggesting that the naira exchanges at N5,000 to one dollar. Why? Whereas Nigeria produces only cash crops (cocoa, ginger, sesame, sorghum, soya beans, hibiscus flowers, palm kernel oil, okra, yam, cassava and a few more crops and note that the crude oil we produce has nothing of our own indigenous technological input), the USA produces some of the best education in the world where we pay top dollar (our house speaker is presently at Harvard, and then there is Yale, Princeton, Chicago, Southern California, MIT, and the rest), that country also produces the best defence weaponry and technology in the world.

The USA is maintaining the lead in technology with its Silicon Valley, it has the most sophisticated financial markets out of New York, Chicago and San Francisco, and remains one of the world’s top tourist countries (Las Vegas, Florida, New York, and so on). The USA’s economy is the most diversified in the world. An average American does not need an international passport in his lifetime. Everything you need is available in-country. Food is cheap and agriculture is super-protected. And based on future projections of what their research and development sector can achieve, where Nigeria basically has none, well, N5,000/$1 may be a good benchmark.

Advertisement

But are we ready? Can we survive that? Given that when we set such a rate, our imports become super expensive from everywhere and our people will surely starve to death. I doubt we can afford that. This is one of the reasons why countries have governments… to manage such a crisis. As Nigeria grows, we need to encourage ourselves not only to produce more in terms of volume but in terms of sophistication. This is called economic complexity – in short, the knowledge quotient in the goods and services a country produces and sells. Every good and service entails some knowledge quotient, but some more than others. Planting cassava of sesame requires you to know the planting season and how to tend the crops to gestation and harvesting. But the knowledge required to stick a seed into God’s blessed earth, is nowhere near what is required to manufacture a phone – from design to mechanics, electronics, technology, and even aesthetics.

The value chain in bringing a phone to you in the shops is a lot more sophisticated than what is required to transport yam to the breakfast table. This is where the N5,000 comparison comes up. It could even be worse. A big tuber of yam in the market costs about N1,500 or N2,000. A Toyota Prado costs about N90 million or maybe N100 million. You need 50,000 tubers of yam to buy one Toyota Prado. You will need say nine months and vast acres of land to get such a harvest. If we planted yams all over Nigeria we could only probably afford a handful of Toyota Prados in a given year. This means that we have been living on borrowed time, as we have these luxury machines everywhere like ‘pure water’. A country has no choice but to see how it can play catch up with global leaders. It is an unending journey.

The Agusto strategy also means that as far as the eyes can see, we shall simply continue to devalue the naira. And when we look at compounded rates, 10% yearly means that the currency would have tumbled 100% within six years and it gets worse from there. In a decade, the naira could have become worthless… like tissue paper. Why lock ourselves into a situation where we must always devalue the naira? And if we also try to chase inflation, we do so at the expense of GDP growth. We need growth, or else our people will continue to be very jobless, and the economy remains stagnant. So, I say we try something else.

Advertisement

Professor Pat Utomi has also spoken. But he suggested that the approach will not be short-term in nature. He mentioned the need to produce and export and get productive, even as he made a detour into how markets are built and accused the current government and by extension the central bank of jettisoning market precepts by creating multiple exchange rates. I am of the view that an explanation of how the market works and why we should rely on markets in this instance does us a disservice. Prof Utomi acknowledged the complexity here by speaking about the need to take a long-term view and refocus on the basics. Also, the use of multiple exchange rates is not particularly a recent phenomenon even though the present administration of President Buhari came with some level of arrogance when it carved out some ‘official’ rate of N306/$1 for ‘government functionaries’ in 2016. This has now been abolished for general investors and exporters’ rate determined by the market after much damage had been done.

The other cogent truth is that a singular exchange rate is a myth. Everywhere I have travelled, there are different exchange rates within a tight band depending on your negotiating ability. Exchange rates inside airports are usually more punitive than in the high streets for example. From one BDC to another you can get different rates at the same time. And I reckon that exchange rates for international trade purposes in most countries are also different depending on what is available at your bank at a specific point in time. Our fixation with exchange rates is a problem. This is also part of the financialisation of the economy that is our bane.

Too many Nigerians who should not be concerned with exchange rates are now obsessed with it. We have become attuned to every opportunity to make quick money. Everyone is now a banker. We must help our people to refocus on productivity while monetary authorities clean themselves up and ensure that the volatility around rates reduces to the barest minimum.

The real issues

Advertisement

I believe most people will skirt the issues depending on how it affects them and I humbly opine that we haven’t started to hit the nail on the head. The real issues are:

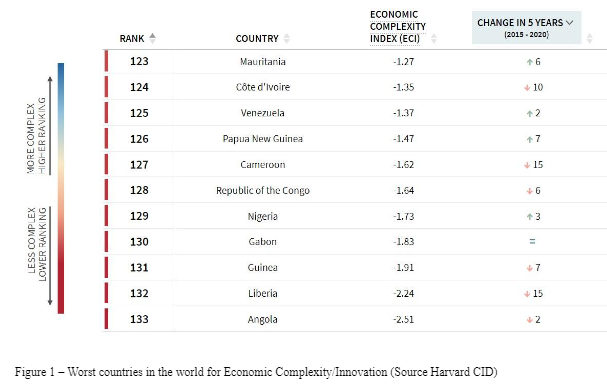

- Low economic complexity

Yes indeed, we are not productive and occupy the 4th lowest position on the Economic Complexity Index – meaning that as sophisticated as our tastes are, we also are one of the countries that adds the least value to anything we produce. This means that we are both physically and mentally lazy and only export crops while seeking the best standards of products – like cars, phones, laptops, building materials, and private jets from abroad.

We are all culpable. We have students who use phones of N2 million and millionaires who buy these things for their spoilt children. This country must halt this nonsense and take a pause to consider its destiny. We are the 4th least innovative country in the world with such a penchant for foolish pride and shameless gratification. We are digging a hole for ourselves and our children.

Advertisement

2. Perennial balance of payment crisis

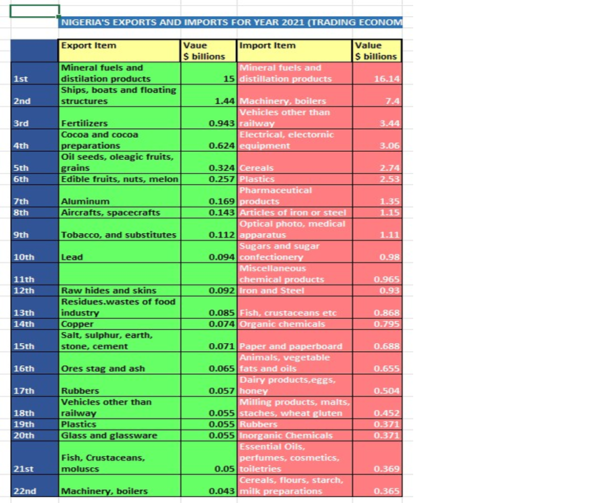

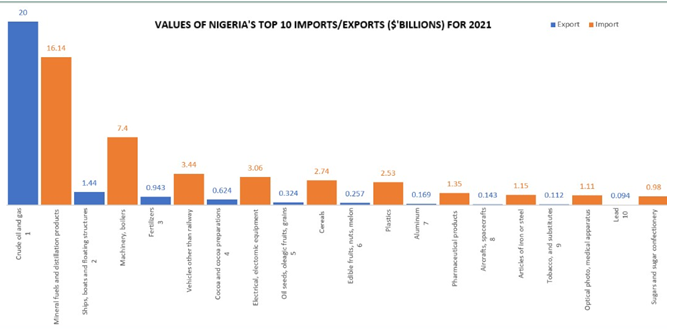

Apart from the problem of economic complexity, the reality of our international trade right now is that we are earning too little from the international community compared with what we are getting. An analysis of our exports for 2021 from Trading Economics statistics show that our only billion dollar export is crude oil and gas (asides from the occasional money we get from exporting scrap ships and aircrafts – which we do not produce). Asides from crude oil and gas, our other exports are crops – cocoa, sesame, sorghum, soya beans, yam, cassava, cashew and such like.

Advertisement

Therefore, asides from crude oil and gas which are in the billions of dollars (and of which we only get about 30% after international oil companies take their lion’s share), our next exports fall in the middle to low hundreds of millions of US dollars. But when we look at the import side of the balance sheet, we find that our first 12 imports are in the billion-dollar range, and our export of crude oil and gas is canceled out by our import of refined petrol, diesel, JET A1 and other fuels (See figure 3). Figure 4 shows a comparison of our first 10 imports and exports in a chart. Our tenth export is almost insignificant compared to our tenth import. With this reality, we do not have a dollar scarcity but a productivity, innovation and commonsense scarcity which must be urgently reversed.

Advertisement

3. Everybody is speculating on the naira

For now, I believe this is the more serious of the many issues we now have. Everybody is speculating. Everybody now owns a domiciliary account. The argument is that people have a right to hedge against the fall in the value of their currency. But there is the need to draw a line somewhere. From my research, there is probably no other country in the world with the kind of culture around its currency like Nigeria. Ghana close by is having it rough with her currency – much worse than the naira – but their people prefer their own currency and indeed a law was passed recently mandating the disuse of the dollar in normal transactions. They tried to be liberal for a while but are now seeing the Gh Cedi disappearing altogether.

Advertisement

A senior friend just told me about how once in Kenya, he was deceived to try the black market to change $20 and immediately he tried, they ganged up and started shouting such that he left the money and ran. Kenya could be like that. My friend also told me that just last year, he was in Finland and could not find anywhere to change money in a university town outside Oslo. His group had to give their dollars to university officials who had to obtain the vice chancellor’s approval to go change to the local currency in a bank.

Nigeria has overdone this financial liberalisation. When the citizens of a country express their lack of confidence in their own currency, all is lost. And like I have said severally elsewhere, this feeds into the second generation of currency crisis theory – when a people believe their country’s currency will devalue, it will. Why? Because someone will make the first move and then everyone starts to convert into another currency (this time the dollar). As I type, anyone with a savings of N100,000 has the money converted into dollars already.

Nigerians who have jobs save in dollars on a monthly basis – including those who work with the regulating bodies. In fact, the president, his vice, all ministers, all members of the national assembly, judges, top policemen, members of the armed forces, bankers, oil workers, and everyone in between save in dollars, and also spend dollars; they, their children, and grandmothers. And in doing this, we are killing our country. Will anyone have the courage to reverse this trend? Because this trend has no end but grief for all. It is a game with no winners.

The person saving $100 per month is actually playing the same crap game with the corrupt civil servant or politician who already has $100 million stashed in different places. Where the poor man gains value when naira loses 50%, the man with the $100 million has gained 50% too. And the man with no money to convert to dollars is much worse-off because, with his naira, he can hardly feed as inflation and devaluation have conspired to snuff life out of him. In time, the man with the $100 million cannot step out of the house because there are zombies waiting to eat him raw. This is what we are doing to our country, most stupidly. We are not acting like people in their right minds. For beyond being smart with finance, we need to build our society first. We cannot continue this game.

4. Compromises, complications and corruption

Can the central bank meet the demands of legitimate users of foreign currencies? Already, there is a long delay to satisfy the demands of importers – sometimes running into months. Even obtaining a travel allowance is an arduous task needing 14 clear days with little assurances. I have had to call the senior staff of the central bank to get banks to avail these travel allowances. The option is to head to the same ‘black market’, which the central bank has marked as illegal. And indeed, it is. But the more we create business for this illegal market, the worse for all of us.

The only way citizens will take their minds off the illegal market is when legit users can obtain foreign currency through official sources – for tangible and intangible trade. The truth is that the volume driven through the black market is not as large as that done through official sources. How? When you see the kind of huge demands made by industries on the central bank you will understand that nobody can source hundreds of millions of dollars weekly from some black market.

The central bank should also note that even the travel allowances approved may be too meagre. If the bank wants to wrestle down this problem, there is a need for policy dynamism and realism. Whereas some people do not need up to $4,000 for a short trip, others may need as much as $20,000 for a longer, or luxury trip. Maybe the central bank can cap it at $10,000 and request for justification for the upper limit. If indeed, people see that the central bank is likely to strengthen the naira through a raft of policies, it will not be in their interest to hoard dollars.

The central bank should meet with stakeholders and remove some of the complications on the road to obtaining foreign currencies. The federal government should also bring out policies that will help reduce other pressures like foreign health and education tourism. As things stand with the ASUU strike, that seems a long shot but this can be done. The key impediment here is an internal compromise, lack of integrity and selfishness/myopia. All those in our helms of affairs have their children overseas. We see them graduating every day. Everyone who has made some good money wants to send their children abroad too. Nigerians are unlikely to change until the oncoming train tramples all of us but let one state this suggestion all the same.

Ways forward

As I close this, I read the suggestion of Aminu Gwadabe, the president of the Association of Bureaux de Change of Nigeria (ABCON). He sounded cynical, triumphal, rather mocking the situation Nigeria has found herself in. Recall that we once had at least 6,000 of these bureaus with all of them obtaining cash forex from the CBN on a weekly basis, purportedly to service travellers. But oftentimes, the financiers of those weekly purchases were there in the CBN banking halls to collect the dollar cash. At a conservative 6,000 BDCs, the CBN at last count gave out $30,000 each or $180 million weekly. The margins then widened to about N100.

Today, the CBN has stopped the practice and conserved the N18 billion being made weekly by those behind that racket. But those guys are not giving up. Gwadabe, in his earlier interventions, acknowledge that some BDCs were up to pranks. Whereas BDCs are strictly for the purpose of tourism, Nigeria is not a tourist destination. So, why did we need thousands of them? I believe they were up to 10,000 with many guys having more than three licenses. Some member of the house or representatives or was it a governor, was said to have up to 400! The BDCs are still mounting pressure to be allowed back into the game – instead of facing their normal duty of buying off travellers and selling to travellers.

Today, Gwadabe is asking the CBN to abolish the official rate and float the naira. In other words, the CBN should hands off and watch as bedlam takes over. He believes though that the CBN could surreptitiously intervene and cause the naira to get stronger. I think this is a big risk though. And this is the typical endgame of a standoff between monetary authorities and speculators. Once you let go, they clean out your reserves. George Soros gamed the UK a billion pounds in 1992.

I believe though, that for the BDCs, the CBN should explore the possibility of their getting involved in foreign remittances. There are exactly 130 BDCs in the UAE (AlAnsari, AlRostamani, AlFardan etc), but they do inward and outward remittances. Dubai is largely a tourist country. These companies are well-established with all the corporate governance present in proper banks. The UK – last time I checked – had 145 BDCs. London is a tourist city. The CBN should cause the BDCs to merge to not more than 50 strong brands, capitalise and roll out, not the present situation where they are constituting themselves into antagonists of policies and probably underminers of it.

Floating the currency

Others have also suggested something similar. They ask that the central bank just equate the official and black-market exchange rates. So, the official rate should become something like N700 now. But because of the externalities, irregularities, and the complications I mentioned above (huge ‘egunje’ money/corruption, inefficiency and/or deliberate snafus caused by regulators or bankers, those who need extra money to travel or need to travel at short notices than the current messy 14 days, smugglers, not to talk of those who do not believe that the naira could ever sustain its value), if the CBN equates official rate at N700, the demands that are illegitimate or untimely will move the black market rates to N900. It will be like a dog chasing its tail till we are at N5,000 to the dollar.

So, floating a legless currency will not work. I have always warned about this. Readers should go back to the charts. Our exports should be the legs of our currency. Diaspora remittances cannot be relied upon. In fact, these days, there are agencies that collect the hard currency and keep them abroad but pay naira from here. So, Nigeria never sees any foreign currency. And we should allow our diasporans to rest and enjoy their lives, please.

The central bank is struggling to boost exports, including the payment of a whopping N65 per dollar to exporters of value-added exports under the RT200 scheme. This helps to reduce the wide chasm between the official and black market, but I understand that owners of export proceeds still do under-the-table deals with users of FX and never sell at the official rate. Floating will not work. Equating the official with the black market rate will also not work. How can you allow the thinner illegal market to dictate the pace for the larger, even if inefficient legal market? Make the larger market more efficient. Seize back control from all sorts of dark agents.

But where on earth will we find honesty in this society?

Ultimately, a sledgehammer approach

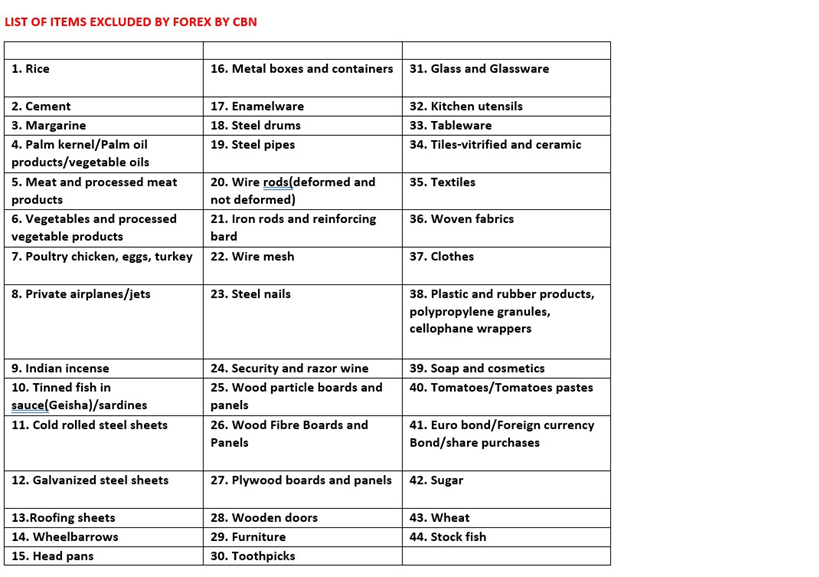

This is a life-and-death issue for Nigeria really. We either keep waltzing our way to disaster, or we do the needful. Someone complained about the 44 items for which the CBN has restricted foreign exchange. They believe that the list should be scrapped after all the goods still come in. I don’t believe we can as yet throw this country open to every import.

The list contains basic things like toothpicks, water, vegetables, steel of different kinds, tomatoes, rice, sugar etc. We will have seen that some of those items still come in no matter what. We cannot ban any product, but just like the US and other big nations, we can prohibit it with tariffs. This list also encourages locals to get involved in businesses and to provide these badly needed essentials. I believe with these hard reforms, we can jettison this list and impose huge tariffs on the products to make them prohibitive – like the US and Europe does. See the list below:

I don’t see anything here that we shouldn’t be hustling hard to provide for ourselves really. Folks should try and get involved in local production while the opportunity lasts.

For those who bring up Japan and China where they crave weak currencies, please note that every country sets out first to have a currency, and then based on geopolitical and geoeconomic considerations, may choose to benchmark other currencies and economies for the sake of export. Again, cash crops are the basic items and do not command much value in international trade. So, we needn’t punish ourselves by making our currency worthless for now, but we can discipline ourselves by getting very productive and becoming innovative around our needs. And we must also cut down on excesses and luxuries. Our people have to understand the science and art of collective responsibility. That you have gamed the system somehow to make loads of money does not grant you the right to binge on luxury and throw your lewd lifestyle in everybody’s faces. Your actions affect everybody else. And resources are held in trust for our generations unborn. We just must caution ourselves, in our private and public affairs.

If weak currencies were the thing, President Biden will not have mocked Russia at the beginning of his sanctions, that the “Rouble has become Rubble”. A country’s currency is its representation and pride. So, when these multilateral lenders insist on devaluation in Africa, they are cynically telling us we aren’t worth anything. We should struggle hard not to tumble into the bottomless pit. Again, I will quote Mrs Maggie Thatcher and Josef Stalin “To destroy a country, first debauch its currency”. Are liberal economists amongst us calling for the destruction of our country and continent?

Ultimately, Nigeria may have to move against the idea whereby every Tope, Dike and Haruna owns a domiciliary account. I have lived for a bit in the UK and it simply doesn’t come up among citizens. In the USA it may be treated as an act of sabotage if it is viewed as you expressing a lack of confidence in the dollar. We must curb our excesses. Our entire citizens cannot be ‘shorting’ our currency and then talking it down everywhere such as to create that self-fulfilling prophecy… working to the answer. Totally unacceptable. Our leaders must shun their silly corruption and think about this, given that they are the real culprits of this dollar worship and romance. They are the ones going around with stash of dollars in their booths. This is also a major failure of the Buhari government and it is sad.

If this will be done, maybe only corporate bodies may be allowed to keep domiciliary accounts and they must be linked to the business they do. All else may be given a timeline to convert back to naira. The case of Russia shows that a country can revalue their currency to gain strength if it creates demand for its currency. There is presently no demand for the naira in international circles, and our citizens don’t even want the currency. Why will the currency not become rubbish? We have to get serious. Something needs to knock us upside the head and reset our brains. On the day this suggestion is taken, the CBN can incentivize those with accounts to convert to Naira at a premium over the official rate, say the same N65 being offered to exporters. The CBN may become awash with dollars. The idea is to gravitate towards knowing exactly what we need for legitimate trade, travel, schooling abroad, health tourism and other such transactions, and by further efficiency in the official market, further thin out the black market after reforming the BDCs. On that day, I suggest the CBN begin to revalue the naira, having drawn the line for people to bring out their dollars or face serious difficulty in exchanging as the illegality of the black market is enforced. This means you stand a great risk trying to change dollars on the streets without documentation. The reformed BDCs can also change for people at the premium mentioned above.

By not losing the narrative on the streets and controlling the perception around a naira that may be revalued officially through intervention in the I&E market to around N400, and then N390, I believe the CBN and Nigerians can rescue this currency and save this entire society. Does this sound too utopian?

Whatever the case, this sledgehammer approach – which has been done in India (even with their local currency – research ‘black money in India’) and elsewhere, will be a bulwark against corruption in Nigeria. If implemented, corruption will become less rife and untenable. Corruption money will become more obvious to carry around too. This is where you know which leader truly wants to end corruption or reduce it markedly in this country and who is a fake. I very much doubt this will be done. But in short, no nation survives when every of its citizen is ‘shorting’ its currency. Tell that to any thinking economist or banker anywhere in the world and they’d almost collapse in shock that that is happening in any country in the world.

Enough already!

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment