Calling off the Academic Staff Union of Universities (ASUU) strike — which has spanned over five months – would offer a glimmer of hope for students, but it would jolt Ike Anyanwukane, a student of the University of Calabar, back to harsh reality.

Anyanwukane had lost N65,000 meant for his hostel rent to 86 Football Technology Limited, a sports investment platform, which assured him of getting a three per cent return on investment (ROI) daily. But the company soon vanished into thin air. Anyanwuka is currently biting his fingers in regret.

“The day I finally confirmed that my money was not going to come back again, I had sleepless nights for more than a week because the money was meant for my house rent in school. I have never lost such a huge amount of money in my life before. It really taught me a lesson,” he said in a submissive tone.

But Anyanwukane also had a memorable time with the “investment company”, also called 86FB or 86Z.

Advertisement

“I started investing with N3,500 and in a month, I’d get up to N10,000 profit,” the undergraduate said, adding that the high yield encouraged him to plunge more money into the scheme with the hope of cashing out big.

For Olalekan Olamilekan, 86FB’s offer initially seemed too good to be true until he visited the company’s branch office in Ikeja, Lagos state, and was assured of the “genuineness” of the investment.

Olamilekan, who was overwhelmed with emotions as he narrated his ordeal, said he also received reassurance from his friend who introduced him to the business before he finally took the step. Then, he staked N700,000.

Advertisement

Now, he has lost everything, while the renewal of his house rent is just in a few months’ time. Olamilekan doesn’t know where and whom he would turn to for help. Everything seems to be crashing before him.

While most companies would offer a return of 7 to 13 per cent per annum on investment, what 86FB promised investors like Anyanwukane culminated in 1,095 per cent ROI annually — and that’s not all to the lip-smacking offer.

86FB said it had a reverse prediction algorithm and a capital preservation plan, which means “capital is always safe”. Hence, the firm insisted its operations were more like an investment than a betting company, where capital is lost on wrong predictions.

According to the Lagos State Lottery and Gaming Authority (LSLGA), sports betting involves predicting and placing bets on the outcome of different kinds of sports events.

Advertisement

Bettors with 86FB were required to pay money into designated bank accounts or online wallets. They were also mandated to predict unlikely match scores – popularly called anti-correct score betting. An investor told TheCable that they were paid whether their predictions were right or wrong.

HOW THINGS FELL APART

Things were going smoothly until March 20 when investors began to experience glitches on the platform. They were unable to withdraw both their capital and interest from the online wallets on the company’s website. The site crashed some weeks after and reality began to set in.

Investors began to fret as the bad news went viral on the internet. But 86FB came out to debunk the claim that it had crashed. The company blamed Flutterwave, a digital payment platform, for “maliciously freezing” its accounts.

Advertisement

“This payment company maliciously froze our funds and intends to take the funds as their own and extort us by cooperating with the local police. 86Fb has never yielded as we have been trying our best to protect the rights and interests of every user, but the other party has a strong background in Nigeria. We cannot fight against it, now 86Fb cannot withdraw money normally,” the company said.

Refuting the allegations, Flutterwave, in a statement on May 2, said some merchants were passing transactions on behalf of 86FB against its terms of service and regulatory requirements. It added that the betting company was not registered or approved by Flutterwave.

Advertisement

“During our investigation, we identified direct merchants of Flutterwave who were processing transactions for 86FB/86Z without our approval or authorisation to do so on the Flutterwave platform. As a result, we notified the merchants to cease processing and suspended their use of the Flutterwave platform,” it said. Flutterwave added that it did not hold any funds due to the merchants.

Investors of the betting platform were left hanging. No access to the company and their funds. An investor, who identified himself as Henrysmart, said he had to refund the capital invested by three of his downlines in the company.

Advertisement

“I invested N15,000 and I also referred 16 people. Five of them insisted that I should pay them their capital. I’ve been able to pay three of them,” Henrysmart said.

“Every month, I earn my little salary of N20,000. I now spend most of it on paying back debt. Seriously, I am tired.”

Advertisement

86FB STAGES A COMEBACK TO MILK MORE

On June 30, the investment platform launched a new website and rebranded it as 86FB Recovery. It dumped its football betting scheme and came back as a full-fledged Ponzi scheme – adopting the pyramid method.

A Ponzi scheme is an investment scam that involves the payment of purported returns to existing investors from funds contributed by new investors until investment stops pouring in and the company cannot sustain the scheme.

86FB told its old investors to deposit at least N10,000 into other investors’ bank accounts to be able to “reclaim” 30 per cent of old funds as well as 50 per cent ROI on new investments after six days – a “better and stronger” offer.

The company also asked investors to upload any form of identification like the National Identification Number (NIN) or driver’s licence on its new website for “revalidation”.

“It is a principle devoted to serious investors,” one of its administrators said on a Telegram group chat, fending off an unbelieving old investor. This is believed to be a strategy for Ponzi schemes that have run out of cash.

Yusuf Garkuwa, an investor who lost N78,000 to 86FB in April, said he believed the investment company had no intentions to scam people again. So, he invested fresh funds. “In fact, I have gotten N58,000 from the new investment,” he said.

Another investor, who pleaded anonymity, said he reinvested in the company solely to get his old funds back. “I just want to give it a try. I have told my people not to do it until I get my money back,” he said.

Another investor, Iyanu, told TheCable that the company duped him all over again.

“They are scammers. They have even removed me from the group chat,” he said, saying a Telegram group was the only means of communication with the company.

A REGISTERED, BUT PHONEY COMPANY

According to details obtained from the website of the Corporate Affairs Commission (CAC), the company is registered as 86 Football Technology Limited and as a private company limited by shares.

It was registered under the category of “gambling and betting”, with a share capital of N30 million.

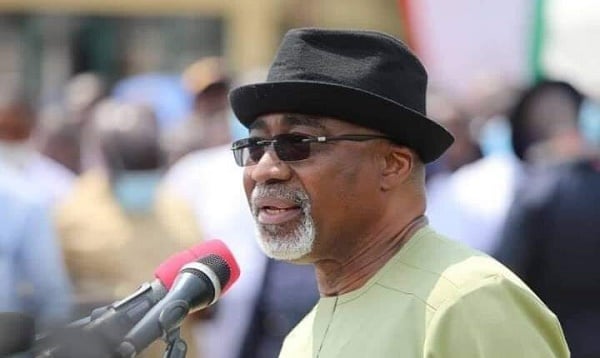

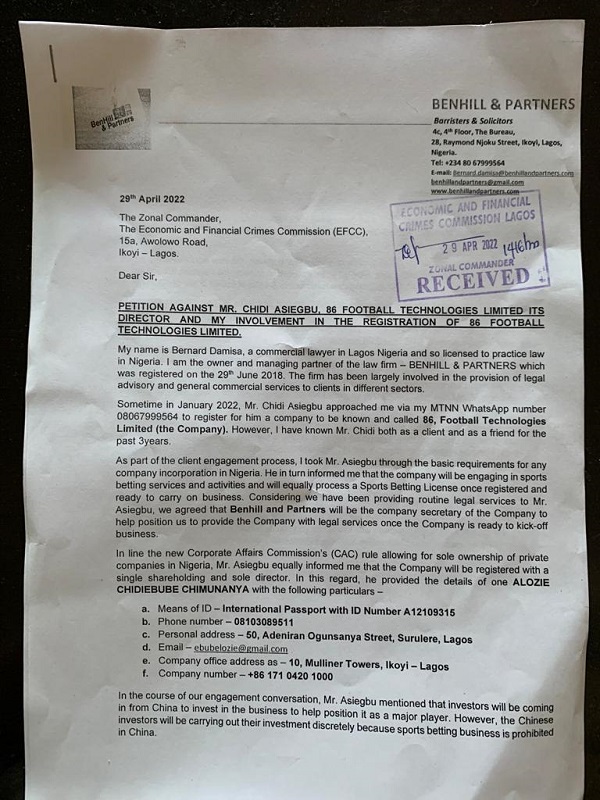

However, the platform, which claimed on its old website that it was established in May 2015, was incorporated on February 9, 2022. According to the CAC, the principal officers include Alozie Chidiebube Chimuanya, a director of the company; Chidi Asiegbu, 86FB’s business development officer, and Benard Damisa of Benhill and Partners, secretary and registrant of the company.

However, Ayodeji Ebo, managing director of Optimus by Afrinvest, told TheCable that anyone could register with the CAC and start a business, advising investors to confirm companies’ status on the website of the Central Bank of Nigeria (CBN) or Securities Exchange Commission (SEC).

In a phone interview, Damisa denied involvement in the investment scam despite registering the company.

After he received tons of threats from investors, Damisa said he sent a petition to the Economic and Financial Crimes Commission (EFCC), asking the anti-graft agency to investigate Chimuanya, Asiegbu and the entire company.

He added that he only registered 86FB through Asiegbu, who often asks him to register companies on his behalf.

“In the usual course of registration and as part of the requirements, the lawyer’s details will be in the registration documents as a presenter and sometimes, company secretary. That was all I did,” he said.

Damisa noted that he did not meet with any of 86FB’s board members prior to and after his firm was contracted.

According to Damisa, Asiegbu informed him that two Chinese nationals – Liang Yongchao and Xiong Quinson – were set to be principal investors and founders of the company since sports betting is illegal in their country.

On the other hand, Asiegbu denied inside knowledge of the operations of 86FB. He said Chinese investors usually get in touch with him typically to set up businesses in Nigeria. He said one of them introduced him to 86FB’s founders and “that is it”.

However, Asiegbu claimed he did not meet the Chinese founders in person. He also claimed he didn’t know Chimuanya, the director, personally. “It was this year they gave me her passport. I just forwarded it to the lawyer (Damisa),” he told TheCable.

“I don’t run the company. I am not involved in the operations. What is happening now is just so sad because all I did was to just help set up a company and ensure that they also got the required licence and tax cards.”

Asiegbu said he has also sent a petition to the EFCC to exonerate himself.

However, Wilson Umujaren, EFCC’s spokesperson, said he couldn’t confirm the petitions filed by Damisa and Asiegbu as there are hundreds of such petitions with the commission. “It is a common thing,” he said.

When this reporter called Chimuanya on phone, she acknowledged her name but denied knowing the company. She argued the reporter must have called the wrong person.

Speaking on the issue, Osita Nwasinobi, CBN spokesperson, told TheCable that it is not under the purview of the apex bank and so, it cannot do anything about it.

“We have put up notices to people that they should desist from patronising institutions not recognised or licensed by the CBN,” he said.

INVESTORS GOING HAYWIRE

When TheCable paid a visit to 86FB’s office in Victoria Island, Lagos, the company had been ejected from the facility.

“86FB is no longer here. You cannot go in,” a security official said at the entrance of the building, signalling to an older man to take charge. After several minutes of convincing the older man, who later identified himself as the chief security officer of the tower, this reporter was eventually allowed to go in.

Explaining the rationale behind their initial resistance, the CSO said the tower was almost set ablaze by angry investors, including a high-ranking officer of the army, who believed all the offices in the building belonged to 86FB.

“I was almost sacked because of this matter,” he said.

According to the front desk officer, 86FB’s office was situated in an office space owned by a workspace provider on the third floor, but the company was evicted following the scam allegations.

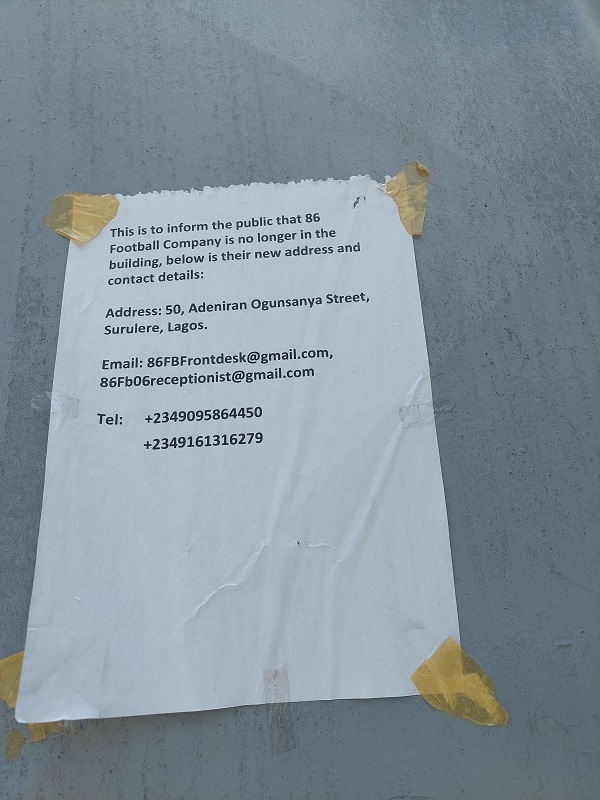

But 86FB left a note at the main gate of the tower, saying it had relocated to a new address in Surulere, in the mainland part of Lagos.

TheCable’s reporter also visited the new office address in Surulere, which turned out to be an eatery. A man, who appeared to be the manager of the eatery, lamented that several people had flocked into the building to ask about “one 86FB”. He added that the company must have dished out the wrong address.

“You will be able to locate our new office soon,” Expereamaka, one of the administrators of the Telegram group, told subscribers.

Adeyemi Aderemi, a middle-aged investor, said he staked N2 million in the Ponzi scheme and vowed he would fight tooth and nail to get his money back.

Aderemi, who created a Telegram group for the purpose, said he has been able to gather 624 aggrieved investors who intend to file a lawsuit against the company and also report a case of fraud to the EFCC.

“On the Telegram page, we are compiling the list of investors and the amount of money they put into the platform so that we can forward it to the EFCC,” Aderemi added.

Another group of investors said they had contracted a lawyer to ensure they get their funds back.

N300BN PONZI LARGESSE: CAN REGULATORS STEM THE TIDE?

Financial regulators have expressed concerns over unlawful schemes in the country.

In March 2021, SEC said three million Nigerians lost N18 billion to Ponzi scheme operators. A report by TheGuardian, however, stated that Nigerians lost N300 billion to Ponzi schemes in the past few years.

The Financial Services Regulation Coordinating Committee (FSRCC), in April, advised members of the public to refrain from dealing with illegal financial operators (IFOs), asking members of the public to report “any individual or entities suspected to be involved in such nefarious activities to the law enforcement agencies”.

Omosuyi Temitope, investment strategy manager, Afrinvest, a financial advisory firm, said regulators should continue to open up more channels for people to report suspecting investment schemes with a very quick response.

Temitope told TheCable that inadequate financial literacy could be a major factor for the surging cases of people falling prey to Ponzi schemes.

“But then, one cannot ignore the role of greed on the consistently rising cases of the schemes as some financially literate investors also get caught up in the web,” he added.

Similarly, the government has moved to clamp down on the activities of illegal investment companies. In January, a bill seeking to prohibit Ponzi and pyramid schemes passed the second reading in the house of representatives.

Halilu Aminu, head of the SEC enforcement department, did not respond to an email seeking information on the commission’s efforts to curb the menace.

DO NIGERIANS EVER LEARN?

86FB is not the first of its kind. Before the betting platform were Ponzi schemes like Mavrodi Mundial Movement (MMM), Ultimatecycler, Help2Get, Givers Forum, Icharity, Twinkas and so many others.

With subsidiaries in up to 110 countries, the MMM scheme, which was first launched in Nigeria in 2016, was short-lived. It crashed in 2017. The Nigerian Deposit Insurance Corporation (NDIC) said an estimated three million Nigerians invested N18 billion in the Ponzi scheme.

Unlike MMM which offered 30 per cent returns on investment, Ultimate Cycler, created in 2014, promised to pay a 400 per cent return to its investors within three days. It was a peer-to-peer donation business model created by Peter Wolfing, a United States-based network marketer. The scheme, however, went down in 2016 disappearing with the funds of thousands of customers.

For Help2Get, another Ponzi scheme touted as a “community currency exchange system that helps to gain finance protected through peer-to-peer assistance”, it promised to pay investors 60 per cent ROI in 30 days. However, the platform crashed a year after its existence. Huge money vanished into thin air.

Givers Forum also surfaced in 2016 as a “mutual-aid fund”, assuring its investors of 10 per cent ROI weekly. After several ebbs and flows, the company finally crashed in 2019.

International Charity Club (iCharity Club) surfaced in 2015 in India, Nigeria, Pakistan and some other countries. Members were directed to register, donate to uplines and become “a grade 1 member” in the system. The system would then “find 5 free members and they, in turn, donate to you”. In contrast to some other schemes which eventually failed, iCharity Club still operates “worldwide”.

While 86FB has taken its share of the largesse and vanished, the major question on the lips of some observers is: do Nigerians ever learn? Despite the failures of some Ponzi schemes that carted away billions of naira and destroyed livelihoods, it appears Nigeria remains a fertile ground where a lot of people are desperate to make a fortune from a penny.

Add a comment