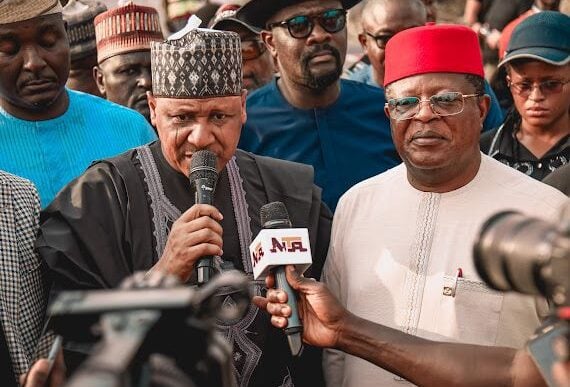

Abdullahi Sule

Abdullahi Sule, governor of Nasarawa state, says northerners were misled into believing that the tax reform bills would result in additional financial burden.

Sule’s comments come on the heels of the Nigeria Governors’ Forum (NGF) throwing its weight behind the proposed tax legislation before the national assembly.

On Thursday, the NGF in a statement issued after its meeting with the presidential tax reform committee, proposed an “equitable” sharing formula for value-added tax (VAT).

The governors recommended that there should be no terminal clause for TETFUND, National Agency for Science and Engineering Infrastructure (NASENI), and National Information Technology Development Agency (NITDA) in the sharing of development levies in the bills.

Advertisement

They also supported the continuation of the legislative process at the national assembly that will culminate in the eventual passage of the bills.

Speaking on Politics Today, a programme on Channels Television, on Thursday, Sule said the endorsed tax reforms by the NGF aim to eliminate inefficiencies and create a fairer tax system.

Sule also dispelled notions of a divide between the northern governors and the President Bola Tinubu administration.

Advertisement

“Most of the people in the north have been sold the idea that there are going to be additional taxes. Today, by this agreement, there is no additional tax,” the governor said.

“Definitely it will settle the dust. And if you look at most of the debates, people are saying ‘we don’t want additional taxes’. We are saying today that by this, there are no additional taxes.

“And it also puts people who want to put heads between the president and some other people to rest. Now, they can understand that what those other people have done is actually in the interest of Nigeria.”

‘ENACTMENT OF TAX BILLS WILL ATTRACT MORE INVESTMENT’

Advertisement

The Nasarawa governor said if the tax legislation is passed, it will stimulate economic growth and attract investment to the country.

Sule noted that the reforms extend beyond VAT, covering critical areas like stamp duties and royalties to foster a more investment-friendly environment.

“The bigger picture at the end of the day is to get it passed for the interests of Nigeria in order to attract more investment into Nigeria. Part of the reform is actually the attraction of additional investments into Nigeria,” he added.

“That’s why you are eliminating multiple taxations in the first place. You are also going to look at stamp duties. You are also going to look at all the other royalties and the rest of that; and you are addressing them.

Advertisement

“This will encourage some of these companies that are moving away from Nigeria to stay. That’s why I say the tax bills are more than just VAT matters.

“There are so many other issues in it. So if you have not taken time to go through them, you may not understand. So I think this is the first catch that is going to be there for Nigeria.”

Advertisement

The Nasarawa governor said his state is attracting investments in mining and agriculture, making it an ideal destination for investors.

He added that a harmonised tax system will be implemented through coordination between the Federal Internal Revenue Service (FIRS) and the state’s Internal Revenue Service (IRS), ensuring that taxpayers are given a specific tax amount to avoid double taxation.

Advertisement

BACKGROUND

On October 13, 2024, Tinubu asked the national assembly to consider and pass four tax reform bills.

Advertisement

The proposed legislations are the Nigeria tax bill, tax administration bill, and joint revenue board establishment bill.

The president is also seeking to repeal the law establishing FIRS and replacing same with the Nigeria Revenue Service.

However, the northern governors have urged the national assembly to reject any legislation that may harm the region’s interests.

The governors called for equitable and fair implementation of national policies and programmes to prevent marginalisation of any geopolitical zone.

The presidency, on October 31, 2024, assured the governors that the proposed laws would not disadvantage any part of the country but will improve the lives of Nigerians and optimise existing tax frameworks.