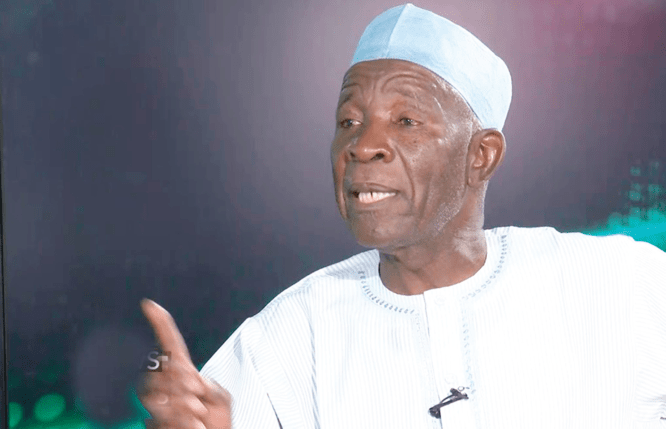

Akinwumi Adesina, president of African Development Bank (AfDB) Group, says the bank’s AAA rating by Moody’s is a validation of its financial and risk management strength.

Moody’s Investor Service, a global credit rating agency better known as Moody’s, affirmed the bank’s long-term issuer default rating (IDR) at “AAA” with a stable outlook.

The ‘AAA’ is the highest rating possible that can be assigned to an issuer’s bonds by any of the major credit rating agencies.

AAA-rated bonds have a high degree of creditworthiness because their issuers are easily able to meet financial commitments and have the lowest risk of default.

Advertisement

A statement released by the bank quoted Adesina as saying: “The AAA rating by Moody’s validates the strength of the bank’s prudent financial and risk management and strong governance systems even in the face of tough challenges imposed by the COVID-19 pandemic”.

“The extraordinary support of the bank’s shareholders boosts our capacity to finance African countries. We will continue to manage risks and capital requirements adequately to help African countries to build their economies back better and faster while assuring economic, health and climate resilience.”

In an annual credit analysis dated October 27, the rating agency said the bank’s credit profile is supported with robust capital and superior risk management, which helps it to alleviate risks.

Advertisement

“An ample liquidity buffer and unfettered access to international capital markets also support its ability to meet its debt-service obligations. Moreover, the bank has a long track record of being the premier development institution in Africa and benefits from shareholders’ ability and willingness to support its development objectives, exemplified by the significant contributions of highly rated non-regional member countries,” Moody’s said.

On her part, Swazi Tshabalala, AfDB acting senior vice president, vice president for finance and chief finance officer attributed the “AAA” rating to the shareholders and solid financial profile of the bank.

AfDB had been similarly rated “AAA” by Fitch Ratings, Standard and Poor’s Global Ratings and Japan Credit Rating Agency.

Advertisement

Add a comment