The board of directors of the African Development Bank (AfDB) has approved a $288.5 million loan to help Nigeria tackle the COVID-19 pandemic.

In a statement on Saturday, the bank said the loan would support government’s plans to improve surveillance and response to COVID-19 emergencies, ease the impact on workers and businesses, as well as strengthen the social protection system.

According to the statement, the loan is the bank’s initial response to help mitigate the slump in oil prices and its impact on the national economy.

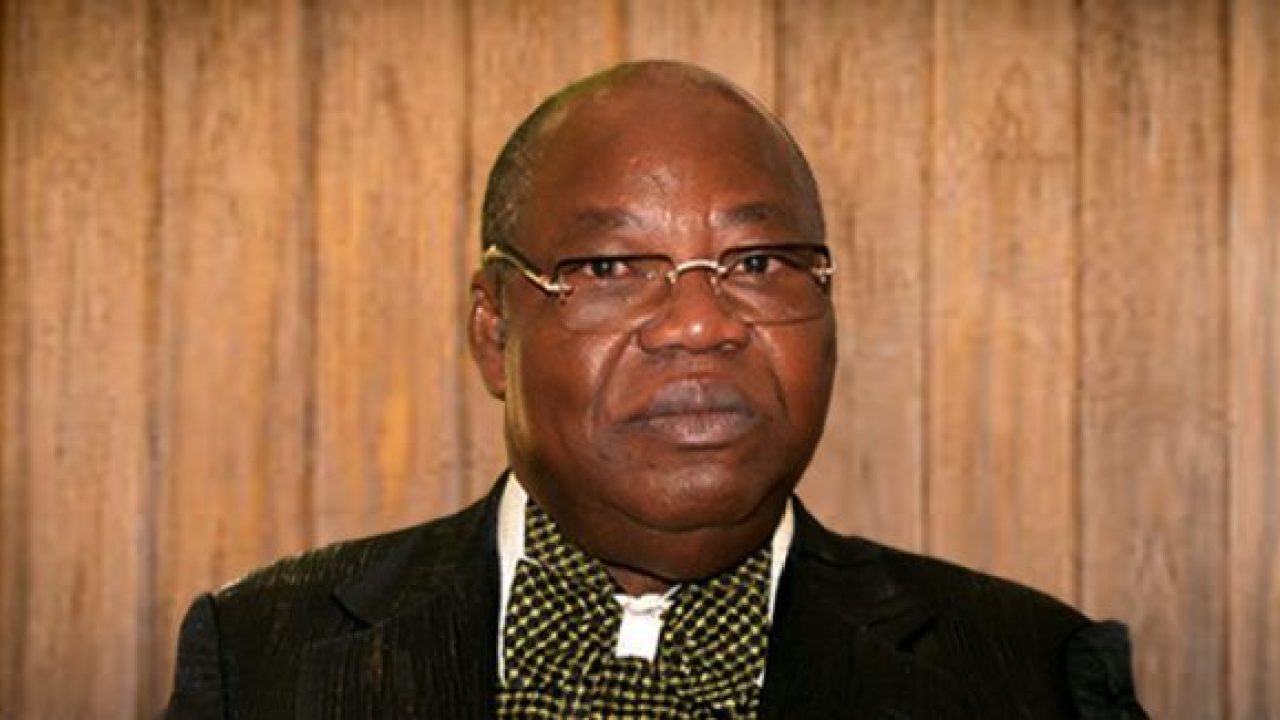

“The proposed programme will ensure that the fiscal position and the economy are sufficiently supported to weather the COVID-19 shocks, thereby limiting its potential adverse impact on livelihoods and the economy more generally,” Ebrima Faal (pictured), the bank’s senior director for Nigeria, said.

Advertisement

“Beyond the country’s immediate economic recovery needs, the bank and other development partners will dialogue with the government on proposals for medium-term structural reforms to diversify and boost domestic revenues away from the oil sector.

The bank also said it had instituted strong fiduciary measures to monitor the use of COVID-19 funds and will maintain dialogue, particularly with the Office of the Auditor-General in Nigeria, to ensure transparency and accountability.

A country strategy paper for 2020-2024 was also approved to “build on the successes and challenges of the 2013-2019 edition, and incorporate emerging developmental realities and opportunities shaping Nigeria’s political and economic landscape, including in the post-COVID-19 period”.

Advertisement

According to the statement, the new CSP identifies supporting infrastructure development and promoting social inclusion through agribusiness and skills development as key priority areas for Nigeria.

The bank said its active portfolio in Nigeria as of December 2019 comprised 61 operations, with a total commitment of about $5 billion.

These active operations include 29 in the public sector, with a commitment of $2 billion (43%) and 32 non-sovereign operations with a total commitment of $3 billion, equivalent to 57% of the total portfolio.

Advertisement

Add a comment