The Asset Management Corporation of Nigeria (AMCON) has repaid its N867 billion worth of bonds, cutting its liabilities to around N3 trillion.

According to Reuters, said 30 per cent of the bond, representing about N260 billion, is expected to come in the system in form of cash, while the balance would be in treasury bills, transferring that part of the liability to the central bank.

AMCON was set up to absorb bad debts left over from a 2008/9 financial crisis that nearly bankrupted nine lenders until the central bank bailed them out to the tune of $4 billion, forcing many of them to restructure. There was no immediate comment from AMCON.

But AMCON had indicated that in line with its restrictive monetary policy, the Central Bank of Nigeria (CBN) would sterilise a large portion of the bond redemption.

Advertisement

The matured debt instrument was the third tranche of AMCON bonds held by private investors.

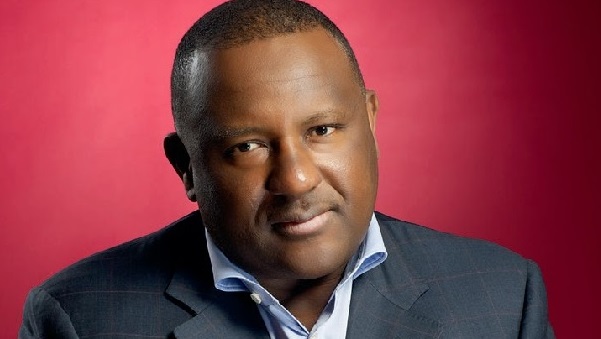

In a recent interview, Mustafa Chike-Obi, managing director/chief executive officer of AMCON (pictured), had pointed out that the central bank determines the volume of liquidity that goes into the economy.

“The issue of how much cash goes into the system is of course, a Central Bank of Nigeria’s issue and the CBN is aware of this and they might make move to sterilise that large amount of money, instead of allowing it to go into the banking system,” he had said.

Advertisement

Indications emerged that the investors holding the AMCON bonds received treasury bills in exchange for the debt instrument in order not to allow excess liquidity in the system.

With the bond redemption, the CBN is now the only bondholder in AMCON.

Add a comment