The United States of America is experiencing its own version of Brexit, probably even a worse one. At the time of writing Trump needed 1 electoral vote to win the elections and he’s leading in most of the remaining states.

Trump previously said “I think we’re going to have beyond Brexit — I think we’ll call it beyond Brexit”, and obviously, we’re experiencing a similar post-Brexit reaction in markets today.

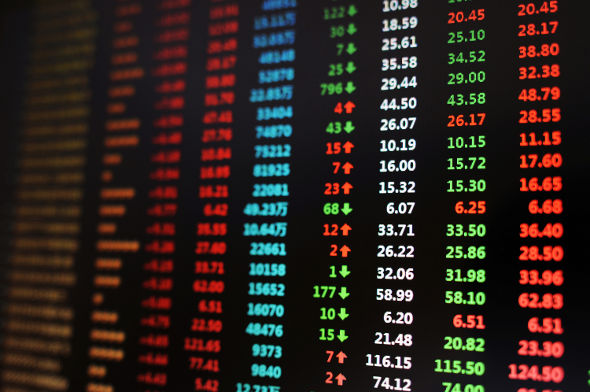

Investors are panicking as a Trump victory means economic and political turmoil ahead, his plans are unpredictable, and he wants to make America great again on the cost of other economies with trade agreements and immigration being the biggest threat.

Once again polls failed to provide a clear indication and investors were almost sure that there’s no way for Trump to the White house, but he made it! Going forward investors will no more base their decisions on polls, they would rather protect their investments through insurance policies such as protective options.

Advertisement

Safe havens are soaring with gold gaining more than $60 from today’s low, meanwhile Japanese officials might consider intervening in the currency with USDJPY dropping to 101.2 earlier today. Investors are also fleeing to bonds, U.S. 10-year treasury yields dropped by more than 14 basis points at one point and yields on German 10-year bunds are approaching negative territory.

Looking forward to the European and U.S. session, it’s better to have your seat belts on, it’s going to be an ugly red day with losses possibly exceeding 5%. However, I would suggest to remain calm and start thinking long term investments with many companies set to look attractive when valuations drop.

Advertisement

Add a comment