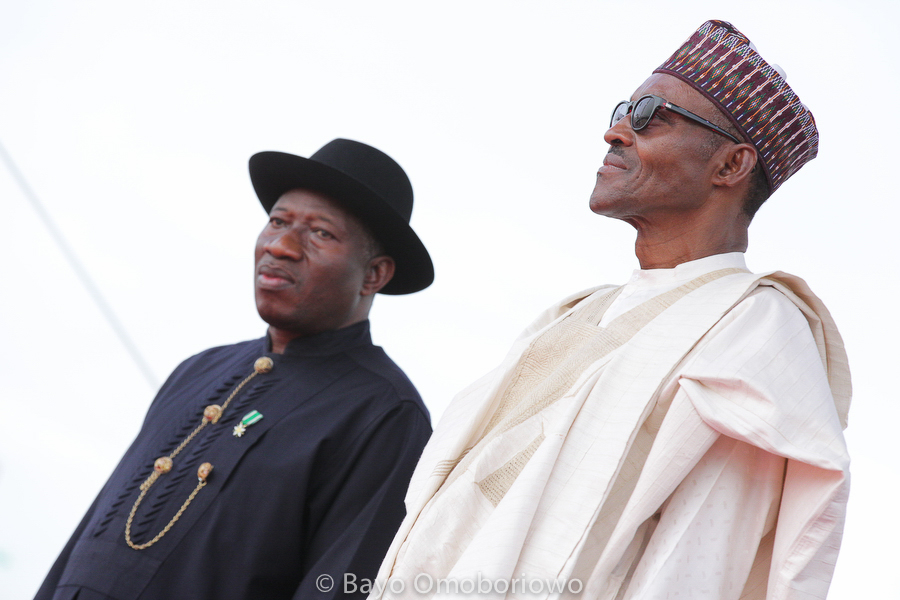

When Asiwaju gave the previous government an advice that looked like asking them to print more Naira notes to bail out the country from its economic troubles, hell broke loose. Dr Okonji Iweala responded by lecturing him on how this ‘ill-thought-out’ solution could cause inflation and end up making our currency worthless. In this article, we shall examine if Tinubu thought through his prescription. Also, we shall be asking why he hasn’t given this prescription to President Buhari and Godwin Emefiele.

Tinubu’s prescription propped up in mind last week after he wrote a strong worded letter on the minister of state for petroleum, Dr Ibe Kachikwu. In that letter, Tinubu sounded like the former UK Labour Party leader, Ed Miliband. He used words like ‘progressives’ and ‘empathy’. I wasn’t surprised at the style of his writing because the APC leader had lived in the UK. Well, I know Tinubu is an astute and dogged politician as well as an intelligent man – at least these were some of the words the presidency used in describing him on his 64th birthday. I am sure he knows that as long as forex remains scarce in Nigeria, imported refined products will continue to be scarce. Thus I might be right to assume that Kachikwu might have done something, not necessarily the ‘offence’ that provoked the reprimand, and he needed to be spanked and called to order.

Let’s get back to Tinubu’s prescription. Why is it that America and Europe can print money (or create electronic money that doesn’t exist) in the name of Quantitative Easing and Nigeria cannot do so easily? If you can answer that question, then, you will understand why Tinubu’s prescription needs to be taken seriously – definitely not the way the last government took it. Asiwaju wanted to inform the debate about the economy, but his thesis, Tinubunomics 101, was shoved aside. I believe, since our economy is in trouble, every possible solution should be looked at.

For those of you who aren’t economists, I hope you understand what I mean by electronic money. Let me break it down. Anytime your employers pay you, you get a bank alert, right? It doesn’t really mean that the money in your account has been printed. It might just be an electronic money. If everyone who has money in his or her account goes to the banks to withdraw these monies, you might find out that there are not enough bank notes to give them.

Advertisement

Now, let’s get back to the main topic. To reflate the economy in the last recession, the US Reserve Bank went about buying bonds and buying debts. This was done with printed money, or money that was electronically created. This resulted in American banks having a lot of cash to pump into the economy. The Euro and dollar can be printed at ease because they are reserve currencies. However, if you attempt to print the Naira at ease, you might end up having these printed notes chasing dollars because we are an import dependent economy. This will result in a drastic fall in the value of the Naira against the dollar. But, this might also happen when you print the dollar in excess, but it might not be that bad as it would be with Naira.

Asiwaju Ahmed Tinubu had a strong point but I am sure he didn’t want to tell the then PDP government how to do it. He probably wanted them to rack their brains. Maybe he even tried to explain the whole thing, but someone wasn’t listening. If you enforce serious capital controls and place embargos on a lot of imported goods, even things like school fees abroad, printing the Naira in excess could reflate the economy and create jobs. In this case, these printed Naira notes will not have to chase the dollar. The first problem here is that it might be difficult, considering our membership of WTO, to impose such capital controls. Two, we might not have the capacity to produce all we need without importing so much.

Printing the currency might cause some inflation, no doubt. But, remember we already have double digit inflation and unemployment at the moment in the country. He that is down needs fear no fall. Excess currency in circulation would result in businesses having more capital to produce more and hire more.

Advertisement

When Tinubu made this prescription, a lot of Nigerians didn’t know that government might have printed our currency in excess at some point. Have you asked yourself where AMCON got the cash to buy back those bad debts? In fact, if things don’t improve, AMCON might have to do same in the coming years. Never mind that some banks declared profits in the 2015 financial year. The facts on ground show that something has to give in the nearest future.

When the US was in recession, it pumped money into the automobile industry in order to reflate the economy. In our case, we are in recession but we have no money to pump because our currency is pegged to the dollar. We can’t print money and give to the construction industry in order to build more houses and roads.

Besides, there are cases where easing money supply did not cause inflation. Did I hear you say that Keynesian theories prevailed in those cases? The question our academics should work on is why this does not apply to Nigeria.

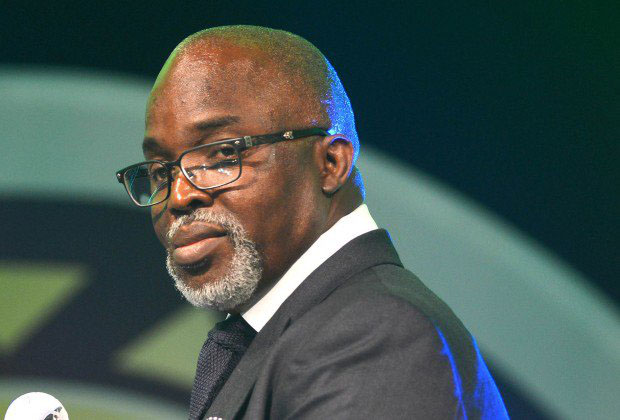

Tinubu has proved himself to be an economic colossus. He proved himself in the way he raised Lagos State’s IGR. He has raised up a strong set of leaders. There is no need reminding Nigerians that he contributed a lot in installing this present government. Tinubu has a strong background in accounting, thus, his economic inputs should be taken very seriously.

Advertisement

Surprisingly, I wonder why the Jagaban has not given Buhari the prescription he gave Jonathan. For Asiwaju not to have given Buhari and Emefiele the prescription he gave Jonathan, makes some of his critics believe he intended giving Jonathan a solution that was bound to fail. Or has Asiwaju given this prescription and it was not taken. The truth is that Tinubu’s prescription, if it will work, is most needed now – especially know that even the market woman knows that the dollar is part of her problems. Inflation has skyrocketed because of the relationship between naira supply and the dollar. Tinubunomics 101 told us that that shouldn’t be.

While we hope to see more of Tinubu’s thesis in the coming years, we hope Tinubunomics 101 doesn’t clash with Buharinomics 101. It might not be in the interest of Nigeria for these two schools of thought to clash. We might be better off if they meet somewhere in between.

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment