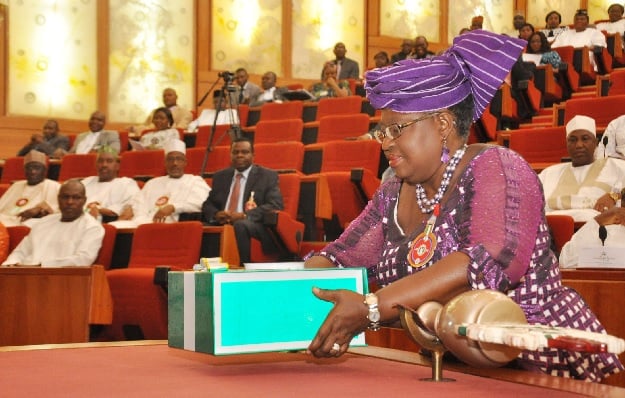

President Jonathan sounding the closing gong at the Nigerian Stock Exchange in Lagos, March 12

How to rev up the Nigerian economy and stabilise financial markets will be the main concern of policymakers and operators after the election-induced downsizing and outright shutdowns of many economic activities. Options are limited by the absence of sufficient fiscal space and a monetary policy solution, specifically a cut in interest rate, appears to be the consensus. The role of the stock market in capital formation, production capacity building and foreign investment capital inflow calls for greater recognition and optimisation.

The effectiveness of high interest rate policy as an instrument for stabilising the exchange rate has come under question. This is due to high mobility of financial capital with destabilising forces originating largely externally. The Nigerian economy, which has received a lot of deliberate interest rate choke since the last financial crisis, will expectedly need an urgent stimulatory push in the post election period. It is hoped that the Central Bank realises this quickly and acts promptly in order to avoid the election-induced slowdown hang on to full year.

While foreign portfolio traders are attracted by high interest rate differential, they are as well easily scared by high exchange rate risk. The high return on investment therefore fails in retaining them amid the increasing speculative fever cast around the naira. The presence of ‘ready to flee’ foreign portfolio investors has now become a major source of financial markets disturbance rather than a source of stability.

Analysts expect that a lot of pressure will be off the naira in the post election trading for three main reasons. First, the recent significant depreciation has weakened the internal demand capacity for the dollar considerably. Second, the pressure on the currency induced by heightened electoral spending is now out of the way. Third, the run from the naira to the dollar in anticipation of post election violence will be reversed.

Advertisement

Much heat will expectedly turn on the real economy if policymakers let the strain of naira depreciation exacerbate the effect of high interest rate on the production and consumption functions in the economy. Releasing the firm grip on interest rate appears to be one of the few options available to policymakers to give the economy and financial markets the critically needed breathing space.

The Central Bank is pressing and promising to implement development functions stimulatory to the economy, which dovetails into some job creating initiatives expected from government in line with electoral promises. These are not expected to happen in a sustained manner without creating sufficient liquidity inlets into the economy to both sustain and possibly improve productive capacities and also stimulate consumer spending reasonably.

It is considered quite necessary that policymakers put good money in the hands of consumers even for producers to be able to improve sales. Companies have long been waiting to be empowered to resume building capacities for future growth instead of over flogging existing capacities.

Advertisement

Equities traders and investors are waiting to see signals of growth in corporate earnings happening in the future for them to break free from their current cautious mood. A lot of investor confidence need to be injected into the equities market to reinforce the gradual revival of the new issues market. A cut down on short-term interest rates will help equities market, which is the main attraction of foreign portfolio investors.

Financial markets move on the basis of anticipation and so expectation of interest rate reduction can be expected to attract a lot of investors to take long-term positions on existing financial instruments. This can be expected to spur foreign direct investments, which is preferred for job creation and exchange rate stability. This is expected to give financial markets the long-term money critical needed to break the cycle of destabilizing portfolio flows.

Meanwhile, equities closed lower last week, losing far more than the mild recovery witnesses in the preceding week. All the key indices of the market closed lower in the week, bringing the all-share index below its year’s opening by 0.49% to 34,485.72.

Advertisement