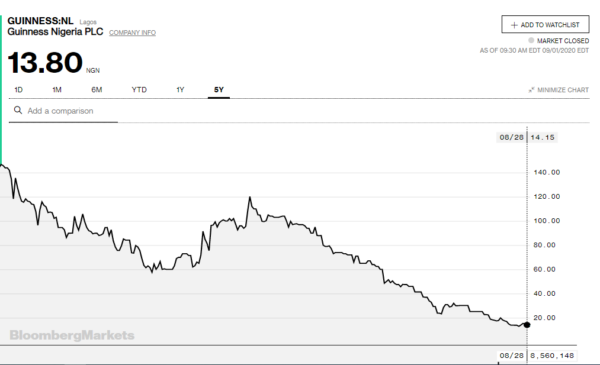

Equity analysts have predicted a further decline in the share price of Diageo-owned Guinness Nigeria which has been on a free-fall after the release of its financials for the period ended June 30, 2020; printing its biggest loss in nine years.

Sadly, shareholders who bought a stake in the makers of Guinness Stout five years ago should be counting their losses by now as the share price continues to fall; currently trading at its lowest price since 2012.

Specifically, its share price which traded at N230 on March 9, 2012, traded at N13.80 on August 31, 2020, translating to a 94 percent loss in eight years.

While competition in Nigeria’s beer market has become more intense in recent years, with players doubling down on advert and promotion in a bid to regain market share, a combination of macroeconomic factors such as stifling economic growth – aftermath of 2016 economic contraction-; shrinking consumer wallet and with price-sensitive consumers shifting to cheaper brands has been a disadvantage for a largely premium portfolio like Guinness.

Advertisement

The final straw that broke the camel’s back was the COVID-19 lockdown which saw the closure of bars and pubs in major cities across the country.

According to equity analysts, on-premise demand for alcohol in Nigeria accounts for an estimated 64 percent of total demand.

Recent foreign exchange illiquidity in the local market has also made it difficult for the makers of Origin to refinance its $23 million debt.

Advertisement

At a recently held investor call, Stanley Njoroge, Guinness’ finance and strategy director, said the company is currently struggling with managing its $23 million debt.

“Foreign exchange is a big concern for us,” he lamented.

Manufacturers in the country are struggling to access the greenback after a slump in oil prices led to a decline in export earnings, thereby piling pressure on the CBN’s capacity to meet dollar obligations to investors and businesses.

“The outlook is not so attractive at the moment and revenue may likely take further hit,” Yinka Ademuwagun, a Lagos-based equity analyst with United Capital, said.

Advertisement

According to Ademuwagun, Guinness has been losing market share to more popular brands and its inability to pass-on the graduated exercise duty to consumers amid sustained inflationary pressures and sluggish economic growth is a major downside risk to the company’s profitability.

Guinness suffered a 21 percent decline in revenue to N104. 37 billion from N131.49 billion in full-year 2019 and the loss for the year worsened further to N12.57 billion from N5.48 billion in 2019.

Marketing and distribution expenses tanked N18.51 billion from N21.75 billion in 2019 while administrative expenses ballooned to N14.3 billion from N9.85 billion in 2019.

Despite battling with huge losses, the remuneration for its managing director, the highest-paid director, skyrocketed to N255 million in 2020 from N19 million in 2019 and remuneration paid to executive directors surged N474.8 million from N366.49 million in 2019.

Advertisement

Fees and remuneration paid to the chairman also increased N35.93 million from N32.49 million.

Femi Oloruntoba, a Lagos-based stockbroker, said Guinness is the only player among the three brewers in the country that has premium spirit drinks in its portfolio relying heavily on imports, noting that the current foreign exchange illiquidity has introduced a new conundrum into the narrative.

Advertisement

Advertisement

Add a comment