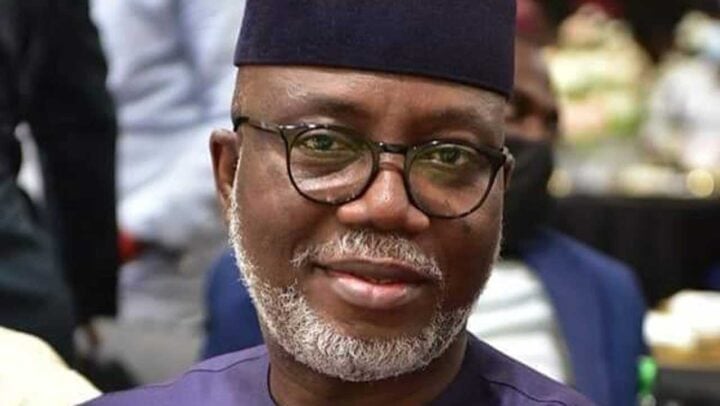

Emmanuel Osodeke, ASUU president

Emmanuel Osodeke, president of the Academic Staff Union of Universities (ASUU), says over 50 percent of students in federal universities may drop out over the next three years if Nigeria fails to address the ongoing arbitrary hike in fees.

Citing a sustainability crisis, federal universities have been hiking their fees in recent weeks, some by up to 600 percent.

This has prompted protests across university campuses nationwide.

Osodeke said during an interview with ChannelsTV, that the hike will lead to more dropouts from schools.

Advertisement

“Universities are arbitrarily increasing fees. Is that correct in an environment where the minimum wage is ₦30,000 per month; where you still have to pay rent and pay heavily for transportation?” he asked.

“And you’re enforcing this thing. If nothing is done about the heavy fees being introduced all over the country today, more than 40 to 50 percent of students who are in school will drop out in the next two to three years.

“Create the environment we had in the 60s and 70s. When I was a student, the government was paying me for being a student. Let’s have an environment where the children of the poor can have access to education.

Advertisement

“Imagine school fees of ₦300,000. How can the children of someone who earns ₦50,000 a month afford such a fee?

“This government should increase the budget for education to at least 15 percent away from last year’s 3.8 to generate enough to fund the system so we won’t have students dropping out of school.”

STUDENTS LOAN ACT

In June, President Bola Tinubu signed the student loan bill into law, with disbursements set to begin on October 1.

Advertisement

The law creates an education loan fund to be serviced by 1% of Nigeria Customs Service (NCS) revenue, 1% of Nigeria Immigration Service (NIS) revenue, 1% of Federal Inland Revenue Service (FIRS) revenue, and 1% of oil profits.

To be eligible, a borrower’s parents’ income must be below ₦500,000 per year while a civil servant with 12 or more years in service and a lawyer of at least 10 years post-call must also stand as guarantors.

Osodeke said 90% of the students in Nigeria’s universities will not be able to access the loan based on this criteria.

“When discussing a student loan, it must be comprehensive. There is nothing to show that it will work,” he said.

Advertisement

“90% of the students will not have access to that loan if you check the condition that you must have parents who earn less than ₦500,000 per annum. How many parents earn less than 500,000 per annum?

“Instead of calling it a loan, let’s call it a grant.

Advertisement

“There is a need for a review to check what happened in the past and see how we can move forward.”

Advertisement

Add a comment