The International Development Association (IDA) is Nigeria’s single biggest creditor, with a portfolio worth $12.57 billion, according to Debt Management Office (DMO) latest figures.

IDA, a member of the World Bank Group, is followed by China (Exim Bank of China) with $3.93 billion and International Monetary Fund (Fund) with $3.27 billion in credit facilities.

While World Bank and IMF are multilateral lenders, the Exim Bank of China is a bilateral lender. Multilateral financing is a credit facility provided to a borrower by more than one lender on uniform terms and conditions using common documentation. Bilateral lending is usually between an individual and the lender.

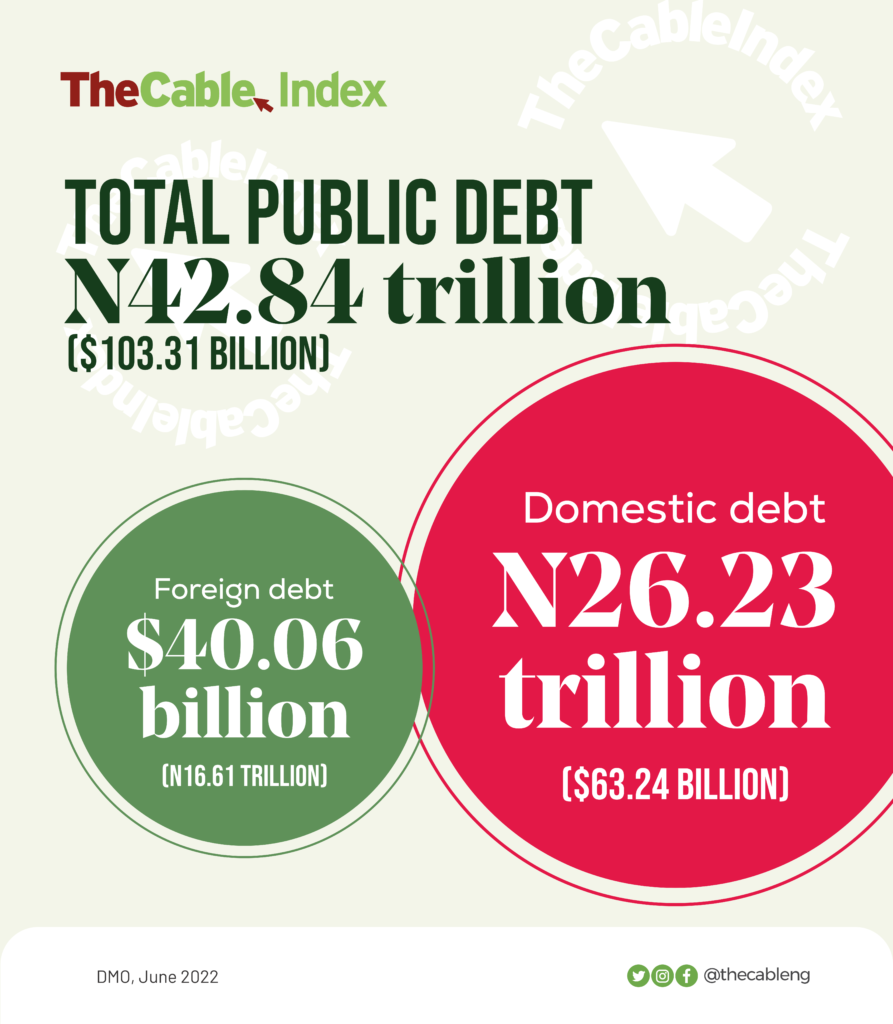

In June 2022, Nigeria’s total public debt was N42.84 trillion ($103.31 billion) compared to N41.60 trillion ($100.07 billion) in March 2022.

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Public debt consists of domestic and external debt stocks of the federal government, thirty-six states and the federal capital territory (FCT).

While the domestic debt stood at N26.23 trillion ($63.24 billion), the foreign debt stood at $40.06 billion (N16.61 trillion).

The federal government’s borrowing from the Central Bank of Nigeria (CBN) through Ways and Means Advances is not part of the public debt.

According to DMO, over 58 percent of the external debt stock are concessional and semi-concessional loans from multilateral lenders such as the World Bank, International Monetary Fund, Afrexim and African Development Bank and bilateral lenders, including Germany, China, Japan, India and France.

WHO ARE THE EXTERNAL LENDERS?

Eurobonds — $15.62 billion

MULTILATERAL LENDERS

- International Monetary Fund (Fund) $3.27 billion

World Bank

- International Development Association (IDA) — $12.57 billion

- Int’l Bank for Reconstruction and Development — $486 million

African Development Fund Group

- African Development Bank — $1.55 million

- Africa Growing Together fund — $5.02 million

- Africa Dev Fund — $955.18 million

- Arab Bank for Economic Development in Africa — $5.70 million

- European Development Fund — $39.35 million

- Islamic Development Bank — $43.69 million

- International Fund for Agric Development — $229.40 million

BILATERAL LENDERS

- China (Exim Bank of China) — $3.93 billion

- France (Agence Francaise Cooperation Agency) — $60.65 million

- India (Exim Bank of India) — $31.50 million

- Germany (Kreditanstalt Fur Wiederaufbua) — $153.77 million

COMMERCIAL

- Promissory Notes — $588.19 million

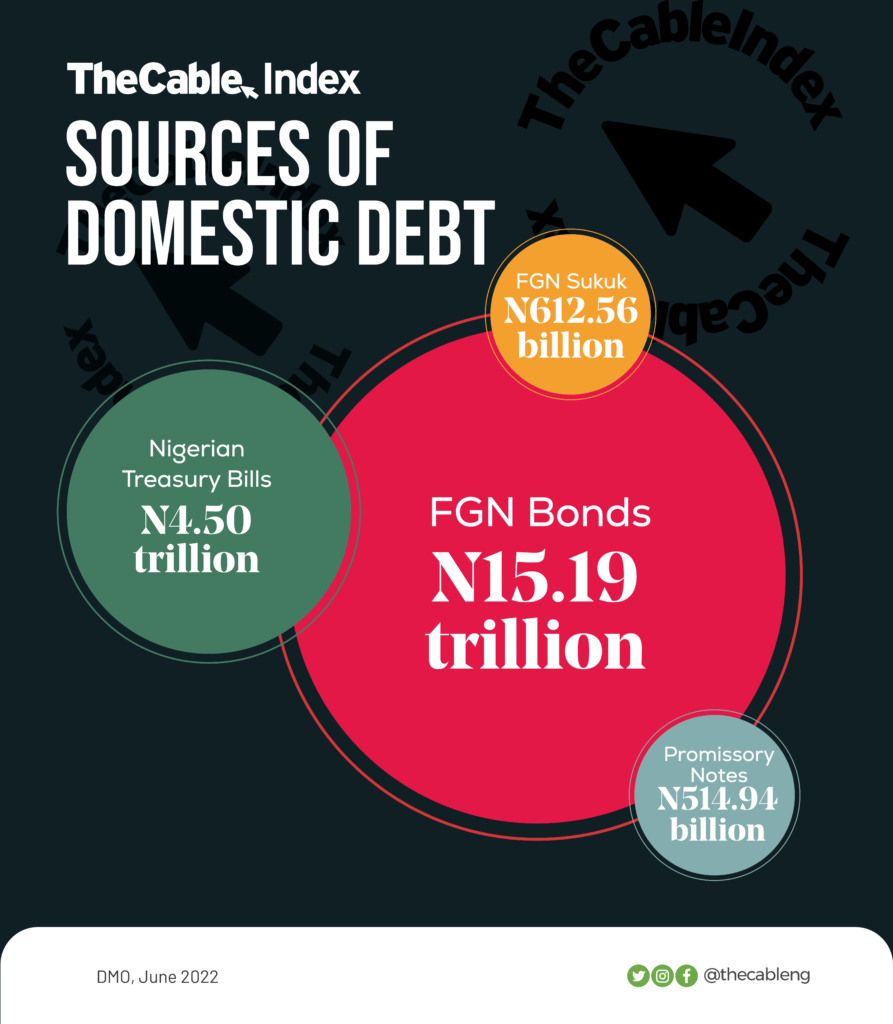

WHERE LOCAL BORROWING CAME FROM?

- FGN Bonds — N15.19 trillion

- Nigerian Treasury Bills — N4.50 trillion

- Nigerian Treasury Bonds — N75.99 billion

- FGN Savings Bond — N20.87 billion

- FGN Sukuk — N612.56 billion

- Green Bond — N25.69 billion

- Promissory Notes — N514.94 billion.

Zainab Ahmed, minister of finance, budget and national planning, had said Nigeria’s debt is still below the 40 percent threshold set by the government in the borrowing strategy.

Add a comment