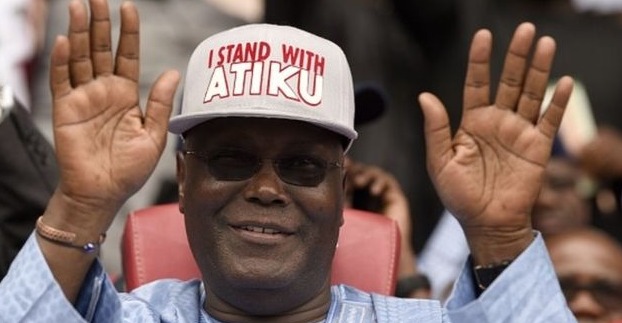

Atiku Abubakar is Nigeria's top trending politician on Google in 2018 | TheCable.ng

No modern capitalist economy allows its forex management policy to be in the hands of just one man – one man so powerful that he decides who gets the forex and how much. It’s even worse where the one man in question is not only unelected but came directly from one of the country’s commercial banks. And with this immense power, he could only pretend to decide the value of the naira in respect of other currencies.

Of course, it can’t be more bizarre that this is happening in a modern capitalist democracy with the chief banker of the nation overly powerful to be handing forex to whom he pleases. Can’t we, then, understand why rather than our current forex management policy — particularly CBN’s dirty floating of the naira — being pro-investment, pro-economic growth and pro-job creation and anti-poverty, it is the opposite?

No one seems to be alarmed that Nigeria’s current forex management policy based on multiple windows is what is causing the biggest forex fraud ever in the country’s history. Or should those who are supposed to be alarmed be when, in order to keep their mouths shut, they have been fully bought over? Atiku Abubakar in his infinite patriotism and based on his understanding of the clear difference between clean and dirty floating is telling Nigerians what no other politician currently seeking election would dare raise their voice about.

Before Atiku, the Emir of Kano (Emefiele’s predecessor) as well as my humble self has been voicing it out: that Emefiele is mismanaging the country’s forex and is doing so with his multiple forex windows. We have noted time without number that it is this multiple window, dirty floating of the naira that has helped forex hoarders create artificial forex scarcity that creates huge supply and demand gap, and, as a result of the gap between the official and parallel market rates, the business of round-tripping has created billionaire men and women who by mere telephone calls and with access to the apex bank governor make millions of dollars.

Advertisement

In his endless warnings about this fraud, the outspoken Emir of Kano has continued to insist that the Buhari administration is knowingly creating forex subsidy billionaires who rather than engage in real-sector business now engage in forex round-tripping, the same way previous governments created oil-import billionaires who did nothing other than using oil subsidy to engage in round-tripping. He has even gone as far as telling us that it is CBN governor Ifeanyi Emefiele’s four multiple forex windows that are at the root of the unheard-of fraud that is causing the country’s forex instability and the governor’s spending of over $15 billion annually while pretending to be defending the same naira though forex intervention.

Atiku’s boldness comes from his argument that the four forex windows — namely bureau de change, interbank, investment and export, and official window — are the puzzle that scares international investors and multilateral institutions. Management of these multiple exchange rate windows has certainly depended on the discretionary decisions of one man, the governor. It is this governor’s forex allocation at will that has continued to distort what should have been market-determined equilibrium rates.

Those who understand forex economics know the immense drag and fraud that go on here, since sustaining discretion in the exchange markets does not enthrone transparency let alone corruption-free forex management policy especially in a way that prevents forex round-tripping. Understandably, it is these forex hoarders whose banks’ free access to cheap forex has ensured they only sell the same forex to importers of finished consumer goods instead of to importers of plants and equipment, and manufacturing raw materials. This is why it has become extremely difficult for the real-sector economy to have enough forex to effectively deploy to the country’s economic development and job creation.

Advertisement

It is also bizarre how the governor, as soon as he took over from his predecessor, turned the apex bank into a fractional reserve banking system. This has given some powerful businessmen like Aliko Dangote discretionary forex in billions of dollars along with billions of naira handed them without thoroughly involving risk analysts, given that the Dangote Group is debt-ridden. In fact, performing the same role commercial banks have the sole licence to perform means challenging their role since the 17th century when fractional reserve banking was invested and reserved only for commercial banking.

Why is Emefiele fighting back? Why is he arguing that Atiku’s clean floating of the naira is going to be “disastrous and a road to perdition” when he knows that it is his unnecessary four forex windows along with his frequent interventions that have continuously distorted the forex market and as a result leading to dollar subsidy that are causing fraud and artificial scarcity in the forex market? It is also diverting the CBN from what central banks all over the world are known for, which is policy institution.

First, Emefiele should agree that when a currency is fully floated the following will happen: the value of that currency becomes stable, given that it is at the mercy of supply and demand and the currency will cease to be at the discretionary power of the country’s central bank governor, including handing the likes of Dangote billions of dollars in forex at far below what is obtainable at the bureau de change window.

Second, he should know that with the naira fully floated, it becomes extremely difficult for forex hoarders to create artificial scarcity that has to require the governor’s interventions falsely seeking the currency’s stability. With this opening up of Nigeria’s financial economy to the world, this will trigger unprecedented dollars inflows into economy. This will drastically grow forex supply in a way that equally raises the values of the naira. The continued high arbitrage in financial system will lead to over one hundred billion dollars brought into the country’s economy by foreign investors scrambling to take full advantage of that.

Advertisement

Third, President Atiku Abubakar’s floating of the naira and making the currency have its true value will drastically reduce the economy’s high import dependency. This is because without forex subsidy importers of finished consumer goods would have their imported goods easily priced out of the reach of most consumers. And it is also because importers of 41 items banned from accessing official forex still do so at the black market that the prices of these items have skyrocketed, leading to high inflation rates in the economy. The question that comes to mind is: if these 41 items were banned from accessing forex officially, how come official forex intervention has not reduced?

Fourth, of course, Atiku is fully aware that our endless import dependency, especially on manufactured consumer goods, has continued to make forex demand always far outstrip supply, with resultant pressure mounted on our foreign reserves. And that also has meant exports of millions of jobs we are supposed to be creating here for our unemployed youths.

Fifth, when we fully float the naira, we stop distorting the forex market through unnecessary defence of the naira that does nothing other than subsidising dollars for importers at the expense of the local producers of same goods such as the Aba shoemakers and the Kaduna textile manufacturers.

Sixth, with President Atiku floating the naira, the present unheard-of forex round-tripping business that has caused the equally unheard-of forex fraud will immediately come to an end, as banks’ attention will shift from forex trading to real-sector financing. This is the kind of good news that the economy badly needs.

Advertisement

Finally, it is very important to note here that all we need for our economy to begin to grow at as high as double-digit is not by engaging in the frequent forex intervention, but rather — and Atiku fully knows that — by giving the economy the kind of investor confidence it is right now lacking. To bring foreign investors in their large numbers, we need an Atiku-led government that knows how to provide the right business environment. Unfortunately, the Buhari administration has so scared foreign and local investors that they prefer sitting on the fence while it lasts.

Atiku’s floating of the naira will signal to global investors that Nigeria is now a place to do business, since there wouldn’t be any more obstruction of forex inflows into the country and outflows from the country. This is the secret and the game changer that we need right now, especially at a time we badly need foreign investors in our infrastructure development as well as foreign investors more in the Greenfield than in the Brownfield industries. It will not only lead to a lot of portfolio investors’ forex into the economy, it will lead to their keeping their money in the country for a long period, leading to the stabilisation of the naira value.

Advertisement

Enwegbara, a development economist, can be reached at [email protected] or 07038501486

Advertisement

Add a comment