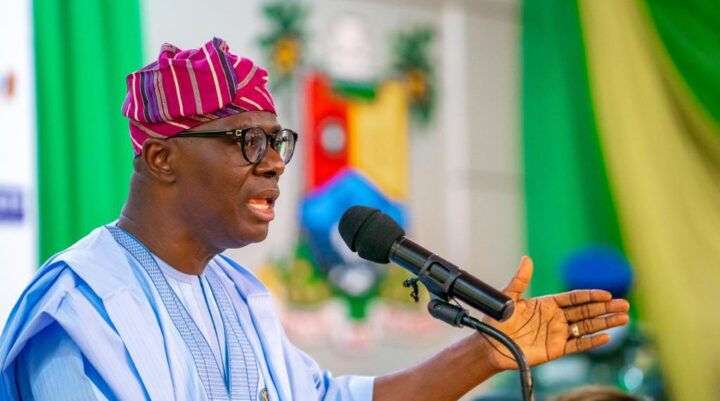

Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), says Nigerians should beware of illegal money lenders, known as loan sharks.

Emefiele said this on Tuesday at the end monetary policy committee meeting in Abuja.

Loan sharks offer loans at extremely high rate returns, strict terms of collection upon failure, and generally operates outside the law.

The CBN governor explained that those who go to collect loans from places other than microfinance banks or recognised institutions are at bigger risk.

Advertisement

“There is no need for you to go to loan sharks for a loan. People normally go to loan sharks because they are desperate and can’t access the bank,” Emefiele said.

“We found out that those that are vulnerable are households who need money to do their businesses but they can’t access bank finance and as a result go to loan sharks who charge them way above or two times higher than the amount borrowed and expected to pay back in 90 days and if that doesn’t happen, they seize your house or bikes.

“We can only continue to advise that there is no need to go for loan sharks. The central bank has put in place the avenue through which you can raise your finance, like through the target credit facility or the SMEs loan that was set up through our microfinance banks.

Advertisement

“You don’t have to owe anybody, just go to the portal and fill the form, send your data, and if it’s correct, you will be able to access loans.”

He said several people have benefited from the microfinance strategy to give out loans at affordable return rates, adding that CBN will go after loan shark perpetrators.

“We have a large number of people who have testimonials from the facilities we’ve made available and do not have to owe anybody,” the apex bank governor said.

“The bank is putting effort to stop loan sharks, and when these people are found, they will be dealt with mercilessly.”

Advertisement

Add a comment