In the preceding days, a number of media outlets have published articles mentioning the Azura-Edo IPP. As the facts and dates cited therein are frequently incorrect or misleading, we thought it might be helpful to issue a brief guide to the project’s chronology and current operational status.

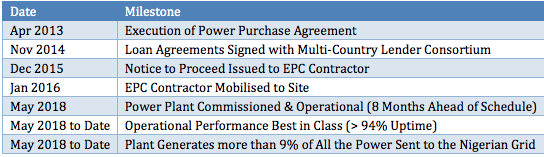

Key Milestones from Inception to Date

Azura’s Construction Performance

The Azura-Edo IPP was built by a consortium composed of Siemens and Julius Berger in exactly 28 months. Its completion occurred 8 months ahead of its 36 month construction schedule; under-budget; and without a single lost-time injury. As a result of this best-in-class construction performance, the Azura-Edo IPP has become a performance benchmark for other large-scale infrastructure projects across the African continent.

Azura’s Operational Performance

The plant was commissioned in the first quarter of 2018 and attained full commercial operations on 1st May 2018. Since then, the plant’s operational performance has been amongst the highest of any newbuild plant anywhere in the word. Its availability rate, to date, has exceeded 94% and its equivalent forced outage rate has been lower than 1%. The plant is also Nigeria’s most heavily dispatched plant with dispatch rates averaging nearly 90% during the last four quarters. In other words, each of the plant’s three turbines are constantly in operation and generating power at close to their maximum capacity. The Transmission Company of Nigeria (TCN) also relies heavily on the plant’s PFI capability to stabilize the grid at all times. In consequence, during the four years since we reached commercial operations, the Azura-Edo IPP has provided more than 9% of all the power sent to the national grid. Our performance – hour by hour – can be viewed online, all the time, by the general public through our website and via our Web App at https://tinyurl.com/azurapower.

Azura’s Investor

Base The majority and controlling shareholder in Azura is Actis LLP, a specialist emerging markets growth capital investor headquartered in London. Since inception, Actis has raised $15 billion from global investors, of which more than $3 billion has been deployed in Africa across 19 countries. Actis has a specialist team investing and operating in the power sector in its global markets, which has committed $5 billion to energy investments across more than 25 countries. Actis’ power sector investments account for around 20GW of electricity generating and distribution capacity delivered to over 88 million customers worldwide.

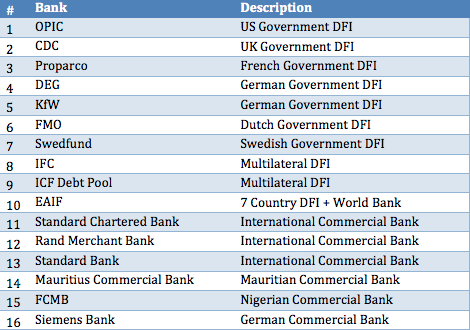

Azura’s debt finance is provided by a consortium comprising sixteen banks, of whom the majority are sovereign development finance institutions (“DFIs”), as shown in the table below:

The contractual structure of the Azura-Edo IPP is also supported by two World Bank Partial Risk Guarantees; and World Bank MIGA insurance cover.

Signed: The Management of Azura Power West Africa Ltd

Add a comment