As 2021 draws the curtain to usher in 2022, it is important to look at some of the events that impacted the economy.

While many Nigerians believe that nothing can surprise them, the federal government took some steps that impacted the economy positively and negatively in the year.

Some applauded the decisions while others knocked and expressed anger.

TheCable looks at some of the issues that impacted the economy in 2021.

Advertisement

TWITTER BAN

As Nigerians settled into the evening of June 4, 2021, the federal government announced the indefinite suspension of Twitter. The suspension came after the microblogging site deleted tweets from President Muhammadu Buhari’s account.

The president had tweeted that the country will treat the Indigenous People of Biafra (IPOB) in the “language they understand”.

Advertisement

Defending the decision, Lai Mohammed, the information minister, condemned the deletion of the president’s post and accused Twitter of “double standard”.

Many described the decision of the Buhari government as an effort to shrink civil space.

Apart from the civil space, the Nigerian economy has lost over N500 billion due to the shutdown, according to estimates by NetBlocks Cost of Shutdown Tool, a data-driven online service.

Advertisement

Per NetBlocks estimates, the country’s economy loses N104.02 million ($250,600) every hour to the ban on Twitter.

CRYPTO BAN

The Central Bank of Nigeria (CBN) directed banks to close accounts of persons or entities involved in cryptocurrency transactions within their systems. The directive came as a shock to Nigerians.

The CBN said crypto investments have high risk and are used for money laundering, terrorism financing, illicit fund flows and criminal activities.

Advertisement

“Further to earlier regulatory directives on the subject, the bank hereby wishes to remind regulated institutions that dealing in cryptocurrencies or facilitating payments for cryptocurrency exchanges is prohibited, ” a circular signed by Bello Hassan, director for banking supervision and Musa Jimoh, director of the payment system management department, read.

“Accordingly, all DMBs, NBFIs and OFIs are directed to identify persons and/or entities transacting in or operating cryptocurrency exchanges within their systems and ensure that such accounts are closed immediately.”

Advertisement

Nigerians on social media also expressed grievances.

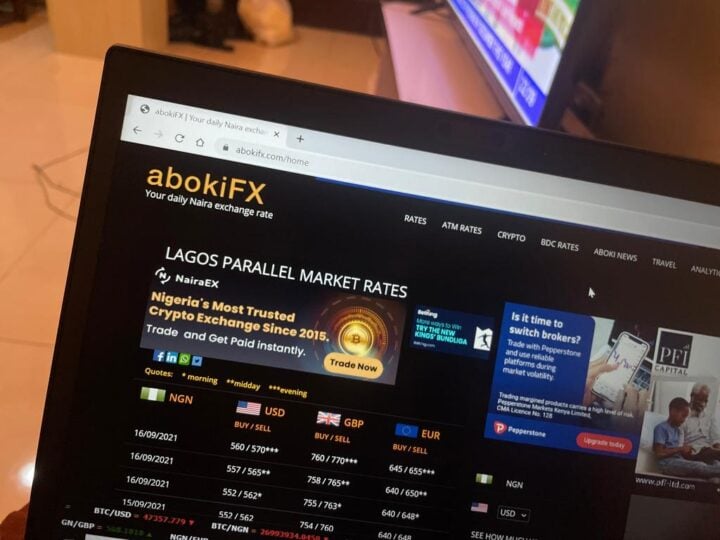

BAN ON FX SALE TO BDCs, INVESTIGATION OF ONIWINDE ADEDOTUN Of ABOKIFX

Advertisement

In September, Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), said the apex bank is investigating Oniwinde Adedotun, the founder of abokiFX over alleged forex data manipulations.

abokiFx founder distanced himself from the allegations, saying the platform is solely for parallel rate information and not trading. He later shut down the parallel market trading segment on the website.

Advertisement

In the spirit of what the government refers to as stabilising the economy and bringing sanity to the process, the Central Bank of Nigeria (CBN) within the year stopped the sales of foreign exchange (FX) to Bureau De Change (BDCs) operators in the country.

On Bureaux de Change operators, Emefiele said the apex bank received about 5,000 applications every month for BDC registration, adding that the operators are making efforts to dollarise the Nigerian economy.

The CBN governor said BDC operators had become a conduit for illegal financial flows working with corrupt people to conduct money laundering in Nigeria. The bank stated that several international organisations, embassies patronise BDC through illegal forex dealers to fund their institutions.

The bank also promised to “deal ruthlessly” with Nigerian banks that deal with illegal BDCs, and we will report foreign organisations patronising them.

Since then, the Nigerian naira is still trading between N560 and N570 to a dollar at the parallel market.

PETROLEUM INDUSTRY BILL SIGNED INTO LAW

In August, President Muhammadu Buhari signed the petroleum industry bill into law.

The passage of the PIB, which proved to be a nightmare for successive administrations, was conceived during the tenure of former President Olusegun Obasanjo.

In 2018, after the national assembly passed a harmonised version of the bill — the petroleum industry governance bill (PIGB), President Muhammadu Buhari refused assent over “legal and constitutional reasons”.

The Petroleum Industry Act provides a legal, governance, regulatory and fiscal framework for the Nigerian petroleum industry, the development of host communities, and related matters.

The PIA is expected to facilitate Nigeria’s economic development by attracting and creating investment opportunities for local and international investors.

BAN ON SALES OF SIM CARDS, NIN-SIM LINKAGE

In December 2020, Isa Pantami, minister of communications and digital economy, directed the Nigerian Communications Commission (NCC) to audit the subscriber registration database.

The directive instructed mobile network operators to suspend the sale, registration and activation of new SIM Cards until the completion of the audit exercise.

The policy denied new entrants into the country access to purchase mobile lines while existing users who want to retrieve their lost lines were not allowed access. This resulted in a massive decline in telecoms’ mobile subscriptions and impacted earnings — and in turn, affected the Nigerian economy.

The policy also affected the performance of the information and communication (Telecommunications) sector of the economy.

Add a comment