In a continuing negative reaction to President Muhammadu Buhari’s re-election, banking stocks recorded its biggest fall since 2016.

Since Wednesday when the Independent National Electoral Commission (INEC) announced the results of the presidential election, the Nigerian Stock Exchange has lost N281 billion.

Amidst this loss, the 10 largest banking stocks dropped by 4.6% at the close of trading on Thursday.

According to data monitored by Bloomberg, the market’s biggest laggers by index points were Guaranty Trust Bank Plc, which dropped 6.9%, Zenith Bank Plc, which fell 4% and Nigerian Breweries Plc, down 4.5%.

Advertisement

“We are seeing investors react negatively in the short term” to the election results, Olabisi Ayodeji, an analyst at Exotix Capital, said.

Ambrose Omordion, another market analyst, attributed the development to investors disappointment over the outcome of the elections.

Omordion said smart investors that took a position earlier in the market ahead of the presidential election and earnings seasons were disappointed.

Advertisement

He said that apart from the outcome of the elections, everything was against the stock market ranging from delayed budget, expiration of the tenure of Central Bank of Nigeria (CBN) governor by June.

“The only factor for the stock market now is this earnings season, because nothing will happen between now and May 29,” Omordion said.

Omordion said that the trend might likely continue unless there was a change in economic policies and reforms by the president.

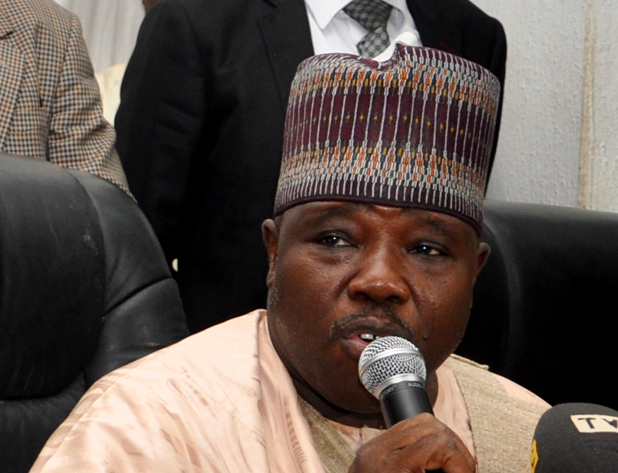

Speaking at a press conference on Thursday, Adams Oshiomole, chairman of the All Progressives Congress (APC), said investors who did not believe in the Nigerian dream are free to leave.

Advertisement

Oshiomole, who is a former governor of Edo state, said the country did not need investors who invested for selfish reasons.

1 comments

They say, what goes up… must come down. Banking stocks have seen huge increases in recent years, so maybe it is time for a correction?