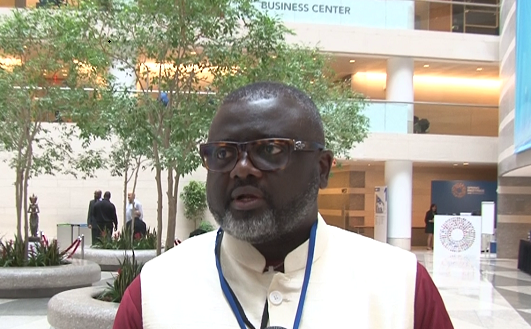

Jones Onyereri, chairman of the house of representatives committee on banking and currency, says banks may pay as high as N20 million per day as fine for infractions like insider abuse.

Speaking to TheCable on the sidelines of the ongoing Spring meetings of the International Monetary Fund and World Bank Group, Onyereri described the current volume of non-performing loans (NPLs) as “a worse grave situation”.

In its recently released World Economic Outlook, the IMF expressed concerns about deteriorating loan quality in Nigeria saying it could affect the “the ability of the banking sector to support growth in these countries and raise the risk of costly recapitalization.”

Advertisement

“That’s why the government introduced AMCON. I think that we are in a worse grave situation, that’s the honest truth because the non-performing loan is far beyond the usual industry threshold and for me it is embarrassing,” the lawmaker said.

“That’s why we have touted the idea that we won’t allow AMCON too. If you look at what we are doing especially in the house of representatives, we are mending the BOFIA act to curb as much is within reasonable limits the whole idea of non-performing loans. The core of non-performing loans is insider abuse.

“They give themselves loans far in excess of the accepted value. What we have at present in the BOFIA is a situation where if there is any infraction, they pay as little as N100,000 or N1000 and any bank can afford that if they have to pay N1000; it means nothing to them.

Advertisement

“Now we have increased it to the extent that thinking about committing such infractions will be scary to anybody that intends to do so. If you know that you need to pay as much as N20 million a day for every day that you continue to have that infraction, you won’t dare do any of those things.”

Onyereri said it is “absolute irresponsibility to have a banking supervision department” and still have a huge volume of NPLs.

“The second one which must be sounded very loud and clear is that it is absolute irresponsibility to have a banking supervision department and you still have huge volumes of non-performing loans because every day you are supposed to have on the site and offsite inspection of the bank books so why are they not doing that?

“You will see it clearly that this loan is not backed by any collateral or didn’t follow due process so why would you approve it? And even if you do because along the line businesses can get bad, but if you monitor adequately, you’ll be able to curb this before it gets so bad.

Advertisement

“That’s why it’s also good for us to strengthen NDIC so that a joint supervision with the CBN will guarantee that we reduce this non-performing loans.”

The lawmaker said the report will be released soon and the amendment will be signed into law.

Add a comment