All attention yesterday was on those central banks now easing monetary policy to try and combat freefalling oil prices. The decline is going to derail several economies and I expect further easing measures to be introduced over the coming months.

Both the Norwegian Central Bank (Norges Bank) and Russian Central Bank (RCB) acted yesterday, albeit in different fashions. The Norges Bank cut the country’s interest rate back to a record low 1.25%, in a move seen as an effort to reinvigorate economic growth. The bank was fully aware it is likely only a matter of time before the lower commodity prices impact economic data. The NOK subsequently weakened to its lowest value against the USD in over a decade at 7.3121 following the news, with the Norwegian currency also falling to its weakest in five year versus the Euro at 9.026.

In contrast, the RCB raised Russian interest rates to 10.5%. Unlike the Norges Bank, the motivation behind the move wasn’t to reinvigorate economic growth but to combat an alarmingly weak Ruble, which is continuing to decline as no floor has been found yet in oil markets. Despite the rate increase from the RCB, the Ruble continued to weaken a historic low against the USD of 55.7799. Why was the move to raise rates ignored by the currency markets? The economic conditions are so heavily piled against the Russian economy that investors are aware any moves to strengthen the Ruble will have a limited impact at present.

The monetary tightening from the RCB made no real impression on the Ruble yesterday because oil is continuing to decline. Until the oil markets find a floor, the Ruble will remain under pressure and moves from the RCB to rebalance the currency will be largely ignored. The unfortunate news for the RCB is that it’s likely that by the time the oil markets find a floor, the Russian economy will be approaching a recession and the Ruble will further crumble.

Advertisement

It is not only these two central banks who are taking drastic action to alleviate the influence of the woeful oil price on their economies. The Royal Bank of Canada (RBC) announced only a day previously that lower commodity prices will be negative for Canada. This weakened the CAD, with the USDCAD since advancing to a fresh five-year high at 1.1549. I am not sure if the RBC will ease policy on the back of lower commodity prices, because it was previously under pressure to raise rates. What will probably happen is that the central bank will continue to adopt the same neutral stance for a prolonged period. The comments can also be seen as a warning to the markets that the Canadian economy is also going to suffer from lower oil prices, which is music to the ears of traders as it is expected the CAD will devalue as well.

As mentioned already, I think we are far away from being done with central banks making dovish comments following the drop in oil prices.

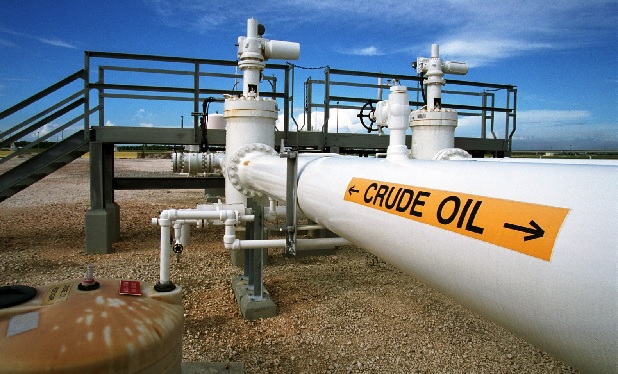

Both Brent and Crude Oil dropped to yet another fresh low yesterday – Brent hit $63.08, while Crude sank below $50 at $59.03. Despite this, some are still optimistically talking about prices making a comeback. I find this increasingly difficult to believe when the current economic conditions, including demand for the USD being strong and concerns over an oversupply heightening anxieties of global economic weakness.

Advertisement

Lower oil prices are going to have a long-lasting impact on many economies and bearish currency inspiring moves from central banks are likely to become the new norm. We are potentially looking at the Reserve Bank of Australia (RBA) taking its turn when the latest RBA minutes are released on Tuesday. After flying down from 0.86 in recent weeks, the Aussie has found some tentative support around 0.8223. Any potential comments threatening interest rate changes would likely lead to this tentative support being smashed.

The EURUSD fell back below 1.24, with the pair declining to 1.2396 on Thursday. An announcement from the European Central Bank (ECB) showed that demand for its Long-Term Refinancing Operations (LTRO) remained low, which is seen as another sign that the ECB will be forced into increasing stimulus next year. It is hardly surprising demand for loans are low in Europe as investor confidence remains bleak. Earlier this week, traders were taking advantage of the impact of the ECB leaving monetary policy unchanged last week and low US economic data inspiring USD softness, and used this as a reason to purchase the EURUSD. However, data in the past two days where we have seen woeful Industrial Output from France and now weak LTRO demand increasing pressure on the ECB to do more to reinvigorate growth has just underpinned that the risks to the EURUSD are strictly to the downside.

The GBPUSD fell to 1.5615 on the unplanned news the Bank of England (BoE) will publish policy decisions and minutes of its policy meetings at the same time. Traders likely saw this revelation, as twelve less opportunities to learn about any hawkishness from the BoE. There was also some confusion among how it would even be possible to release the minutes at the exact same time the interest rate decision is announced. It seems that the effect of Twitter is even reaching the esteemed heights of the Bank of England!

Meanwhile Sterling bulls are really desperate to learn of a third member of the Monetary Policy Committee (MPC) becoming a dissenter and voting for a rate increase. The current bearish outlook from the BoE suggests this will not happen anytime soon.

Advertisement

*Ahmad is chief market analyst at FXTM.

For more information please visit: Forex Circles

Add a comment