Bloomberg, a US-based media organisation, on Friday, predicted that the naira will decline further in 2024.

According to the publication, the naira is poised for its worst year since the return to democracy in 1999 adding that analysts are predicting further depreciation in 2024.

The report said naira fell 55 percent this year to N1,043 per dollar at the official market on Thursday.

The decline, Bloomberg said, made the naira the third worst-performing currency in the world behind the Lebanese pound and the Argentine peso — among 151 currencies tracked by the media firm.

Advertisement

It reported foreign reserves in Nigeria are at the lowest in six years with most of them burdened by overdue short-term overseas obligations.

In the non-deliverable forwards market, according to the report, the naira’s 12-month contract is trading near a record low of N1,294.44 to the dollar.

The depreciation began in June 2023, after the Central Bank of Nigeria (CBN) unified all segments of the forex exchange (FX) market, allowing the currency to trade more freely.

Advertisement

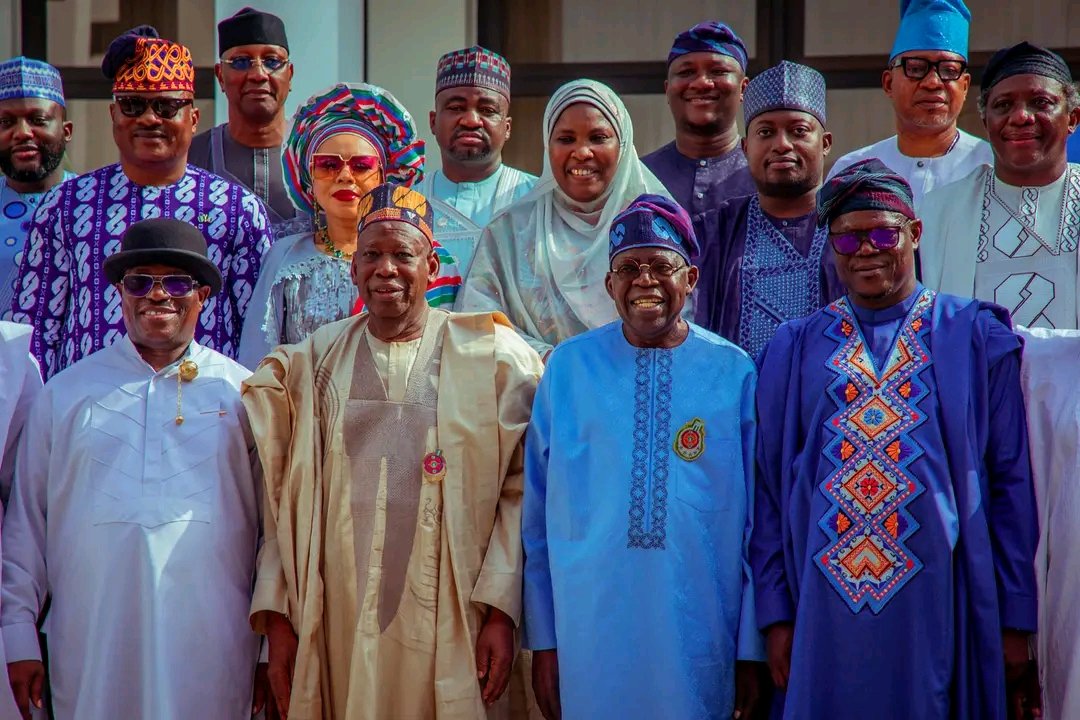

Thereafter, President Bola Tinubu scrapped the petrol subsidy.

The publication said the end of the petrol subsidy and naira depreciation fueled inflation, which is at 28.2 percent, while the benchmark interest rate is at 18.75 percent.

“The negative real interest rate has dissuaded overseas investors,” the report said.

Vetiva Capital Management Ltd told the publication that the naira may depreciate further unless Tinubu’s government attracts international investments or ramps up oil output.

Advertisement

Bloomberg’s prediction is at variance with that of Bismarck Rewane, chief executive officer, Financial Derivatives, who said Nigeria’s exchange rate is expected to rise in 2024.

Olayemi Cardoso, the apex bank governor, also projected that exchange rate pressures are expected to reduce significantly in the coming year.

Add a comment