The asset base of the Bank of Industry has exceeded N1 trillion, this is the first time in the history of the existence of the bank.

Olukayode Pitan, the managing director of the development institution, made this known at the bank’s annual general meeting.

“For the first time in the history of the bank, we surpassed N1 trillion in asset base. The group’s profit was over N36 billion. For a bank that is owned basically by government, it is a very good result,” he said.

Aliyu Abdulrahman Dikko, the bank’s chairman, listed the achievements of the previous year to include:

Advertisement

• A 30% increase N36.7 billion profit before tax, compared to the N26.4 billion made in 2017, representing;

• Award of N2 billion dividend to shareholders

• Growth of the group’s total assets by 49 per cent to N1.07 trillion from N713.3 billion in 2017, as well as improvement in total equity which increased by 12.5 per cent year-on-year to N258.3 billion from N241 billion in the previous year,

• Achievement of 130 per cent growth on a year-on-year basis with respect to the disbursement of new loans of N259.6 billion in 2018 with N33.9 billion of the figure going to SMEs while the balance was deployed to support large enterprises.

Pitan attributes these and other achievements to the collective efforts of the board, management and staff of the company, as well as his predecessors and the parent ministry, the ministry of industry, trade and investment with which it has a harmonious relationship.

In recognition of the bank’s achievements under Pitan, the International Bankers Magazine recently conferred on it the Best Development Bank Award.

Advertisement

The award, presented at the London Stock Exchange, was in recognition of the bank’s efforts at widening the spectrum of financial support to the nation’s entrepreneurs, especially the micro, small and medium scale enterprises and the creative industry.

Much more recently at the African Bankers’ Awards ceremony held in Malabo, Equatorial Guinea on June 14, 2019, the Bank of Industry won the Financial Inclusion Award for its role in implementing Federal Government’s Enterprise and Empowerment Programme (GEEP), which includes the popular TraderMoni programme.

The awards event featured financial institutions and projects from all 54 countries in Africa, as well as the international community. GEEP, which is executed through the Bank of Industry, was described as the most impactful financial inclusion programme in Africa.

Despite the political criticism of the programme, it remains popular across the country for its impact on living standards.

Advertisement

GEEP, the ₦112billion fund, which is part of the ₦500billion National Social Investment Programme, commenced in 2016 and has continued to expand in scope and effectiveness. It is aimed at providing microcredit facilities to market women, traders, artisans, farmers and agricultural workers at zero per cent interest rate. It is estimated to reach 1million beneficiaries annually.

Financing Interventions

BoI’s financing intervention programmes are:

Micro, Small and Medium Enterprises for food processing, agro-processing, healthcare and petrochemicals, solid minerals, N-Power, creative industry, gender business.

Advertisement

Youth Enterprise Support (YES) Programme: This is a ₦10billion fund that targets entrepreneurs between 18 – 35 years. The scheme was launched to develop the entrepreneurial capacity of youths and equip young people with the skills and knowledge to be self-employed by starting and managing their own businesses. Specifically, it provides discretionary funding for the National Youth Service Corps (NYSC) members and entrepreneurs that are interested in starting a business

TraderMoni: The Bank introduced the TraderMoni product for micro-businesses across value chain clusters – motorcycle riders, food vendors and petty traders. The fund is expected to ease access to suitable finance by these categories of businesses which in turn will enable them to grow their businesses.

Advertisement

MarketMoni: This is a Government Enterprise and Empowerment Programme (GEEP) created to provide financial aid for the under-banked and unbanked. This objective is being achieved by providing easy and quick loans at no interest rate.

Nigerian Content Intervention Fund: A $200million fund targeted at indigenous players in the Nigerian Oil and Gas Industry for the purpose of procuring fixed assets, funding working capital, refinancing existing loans, etc.

Advertisement

BoI/State Matching Fund: A matching fund based on a partnership between BOI and 25 state governments. In 2017 the Bank signed matching funds agreement with three states: Bayelsa (₦5bn), Borno (₦2bn) and Ebonyi (₦2bn) with interest rate between 5%- 10%pa.

Micro, Small and Medium Enterprise Clinics: The Bank continues to participate in the MSME Clinics in collaboration with the Office of the Vice President.

Advertisement

One-Local Government, One Product Programme: The programme is expected to generate over 4,900 new jobs;

Industrial Development Centres: These centres are being upgraded through a grant from the African Development Bank (ADB) for conversion to MSMEs cluster parks.

Funds Mobilisation

To enhance its support to the industrial sector of the economy for growth, the BOI has improved its capital base through facilities from the following sources:

• A $750 million syndicated loan transaction with AFREXIM as the lead arranger. The initial opening was $500 million but it was oversubscribed to the tune of $750 million. Sixteen international financial institutions, including four banks with Nigerian parents, subscribed to the syndication.

The loan will be made available to entrepreneurs in Nigeria for a period of between five and seven years at a single-digit interest rate, thereby enabling BOI bridge the funding gap for MSMEs. The transaction has been adjudged the single largest facility of its kind to be done by a Development Finance Institution in Nigeria.

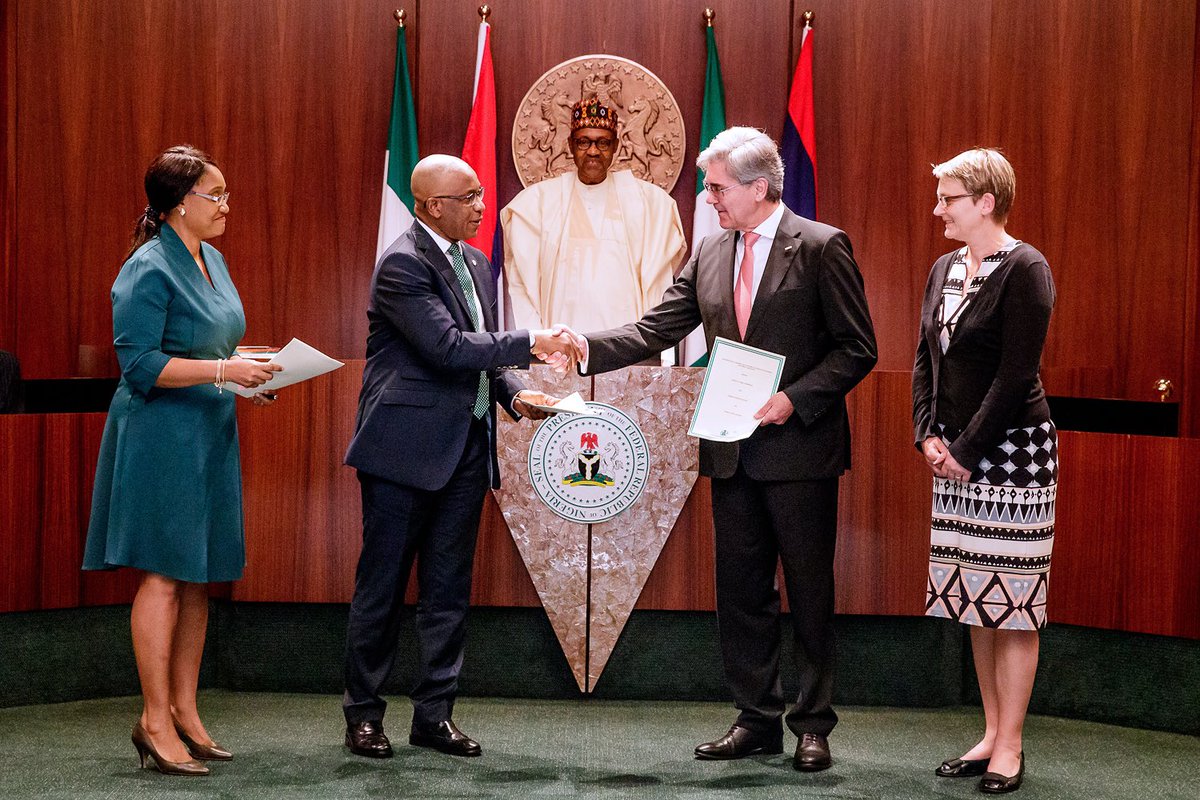

• In September 2018, the Bank signed a Memorandum of Understanding with the Export-Import Bank of China (CEXIM) for a $500 million line of finance. The tenor is expected to be for five to six years.

• An MOU between BOI and the Nigerian Content Development & Monitoring Board for a $200m Nigerian Content Intervention Fund, for which BoI is the manager.

Despite the bank’s achievements, unemployment and poverty levels require more from the country’s DFIs to achieve the dream all-inclusive growth.

Pitan has corporate and banking experience spanning over 25 years. He graduated with a BSc (Hons) degree in Economics as a UAC scholar from the University of Ibadan in 1982 and obtained a Master’s degree in International Management as a Rotary International Scholar from the American Graduate School of International Management, Thunderbird Campus, Glendale, Arizona.

He started his banking career in 1986 at Citibank Nigeria.

Add a comment