The Bank of Industry (BOI) is partnering LAPO microfinance bank and 13 other microfinance banks in getting credit facility to micro-entrepreneurs across the country.

The Bottom of the Pyramid (BOP) scheme by BOI in collaboration with the microfinance banks is a said to be a vehicle for credit delivery to the under-served and under-banked micro-entrepreneurs.

According to BOI, the BOP scheme is essentially aimed at poverty reduction through job and wealth creation focusing on the rural micro-enterprise operators with a view to extending financial inclusion to them.

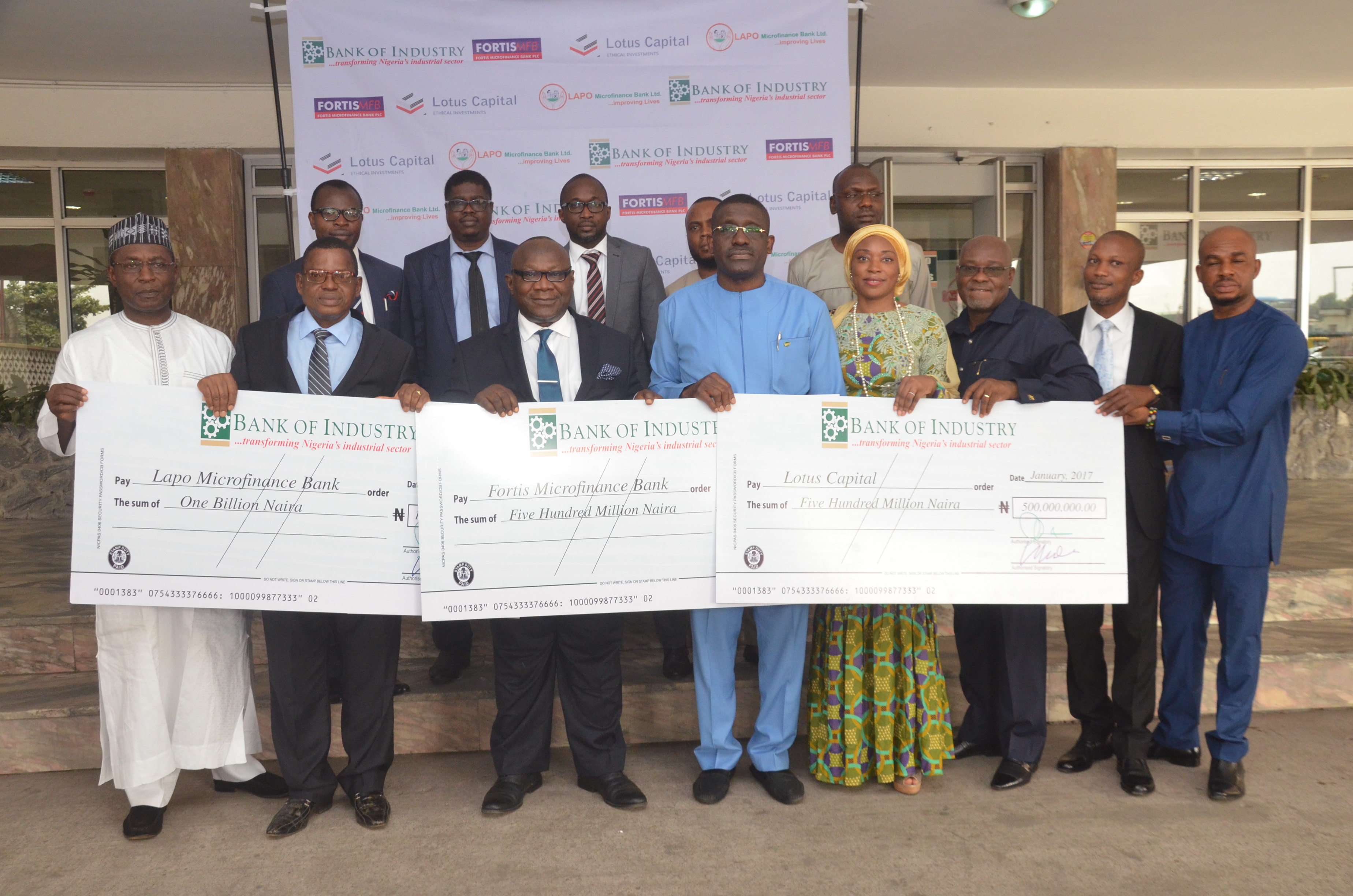

Speaking at the consummation of the latest partnership with LAPO MFB; LOTUS CAPITAL and FORTIS MFB, Waheed Olaguunju, managing director of BOI, said “BOI’s BOP model is consistent with the operating models of some of the world’s best Development Finance Institutions that deliver their services indirectly through intermediary retail finance that have extensive branch network”.

Advertisement

“For instance BNDES of Brazil is the only DFI in that country. It is the most impactful DFI in the world in terms of customer base. As at 2015 they had more than 1,000,000 customers.

“They were able to achieve this through their product called BNDES Card under which they lend through commercial banks. BNDES is the only DFI in Brazil. It is a mega DFI. As you can see at BOI we comb the world to know the best practice by implementing exchange programmes with world’s best DFIs.”

Olagunju further disclosed that BOI is currently in partnership with 11 Microfinance banks under the BOP Scheme to which the sum of N1.1 billion had earlier been disbursed.

Advertisement

He said “the inclusion of LAPO MFB (N1.0 billion), FORTIS MFB (N500 million) as well as LOTUS CAPITAL (N500 million) will bring the number of such partnerships to 14 and the total sum disbursed for on-lending to micro entrepreneurs under the programme to N3.1 billion”.

Add a comment