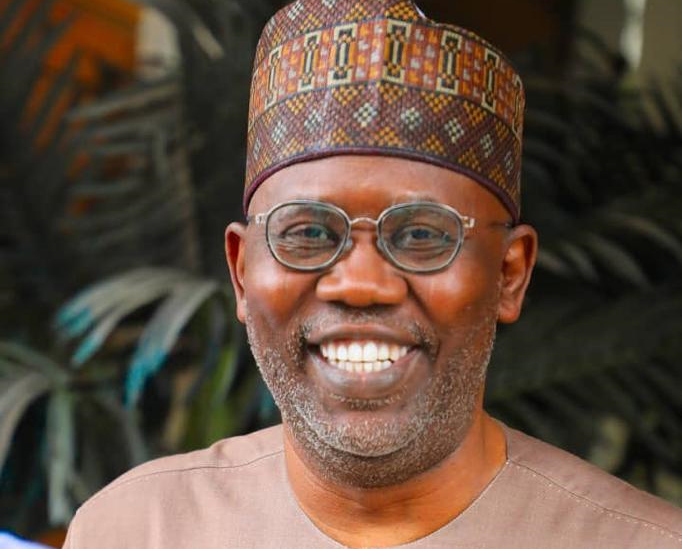

Justice Inyang Ekwo of the federal high court, Abuja, on Friday upheld the “no case” submission by Mohammed Bello Adoke, former attorney-general of the federation, on charges of money laundering.

The Economic and Financial Crimes Commission (EFCC) had charged Adoke and Abubakar Aliyu, a property developer, in 2017 alleging money laundering to the tune of N300 million.

Although there is no mention of the OPL 245 transaction in this case, the same particulars were also charged by the EFCC before Justice Abubakar Kutigi of the FCT high court in 2020.

While the EFCC admitted before Ekwo that it was a mortgage that Adoke took from Unity Bank, it alleged before Kutigi that the money was a bribe from the sale of the oil block by Malabu Oil & Gas Ltd in 2011.

Advertisement

On March 28, 2024, Kutigi pointed out the contradiction, while dismissing the charges against Adoke and other defendants, chiding the EFCC for wasting the court’s time for four years.

In his own ruling on Friday morning, Ekwo said the EFCC did not provide any evidence to prove the essential elements of the offence against Adoke, who was listed as first defendant.

He upheld the no case submission, discharging and acquitting Adoke.

Advertisement

However, Ekwo ruled that Aliyu, the second defendant, has to open his defence because he has a case to answer on some of the charges against him.

After the EFCC closed its case against Adoke and Abubakar in November 2023, both had made a no-case submission, asking the federal high court to dismiss the charges because the commission did not establish a case.

Adoke described the charges as “baseless and frivolous”.

WHAT’S THE ISSUE?

Advertisement

In 2011, Adoke had taken a mortgage of N300 million from Unity Bank to buy a property valued at N500 million from Abubakar.

However, he failed to pay his own equity contribution of N200 million and the mortgage was cancelled in 2013.

Abubakar said he returned the N300 million to Unity Bank after finding a new buyer — the Central Bank of Nigeria (CBN).

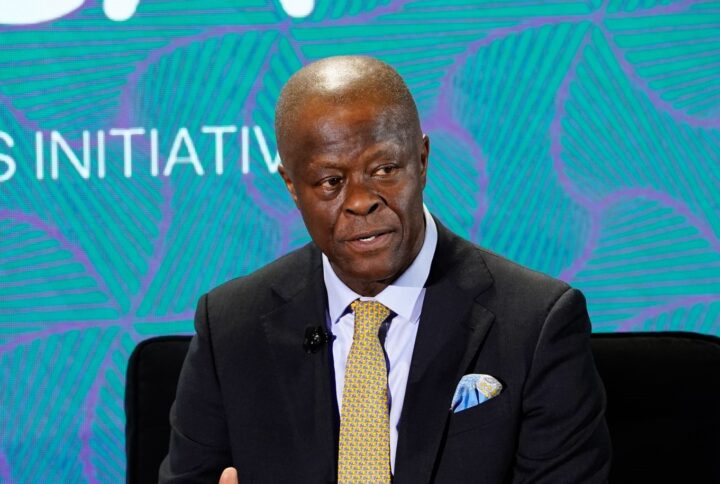

But in 2017, the EFCC accused Adoke of handing the dollar equivalent of N300 million to Rislanudeen Mohammed, then acting managing director of Unity Bank, to refund the loan.

Advertisement

The commission said it was a breach of money laundering laws as it was above the N10 million threshold allowed, arguing further that a bureau de change (BDC) — which the bank used to convert the dollar to naira — is not a financial institution.

It accused Adoke and Abubakar of conspiring to commit the offence of money laundering.

Advertisement

Mohammed, in his testimony as prosecution witness for the EFCC, claimed he collected $2 million cash from Adoke and gave it to a BDC to convert to naira to refund the mortgage.

He said after the money was repaid, the bank returned the land documents to Abubakar and closed Adoke’s mortgage account.

Advertisement

Mohammed however said it was not a case of money laundering since a BDC is legally a financial institution.

He said he did not report the transaction to the security agencies such as the EFCC and the National Drug Law Enforcement Agency (NDLEA) because there was nothing suspicious about it, and that his office did not reprimand him as he did not commit any offence.

Advertisement

TheCable understands that Mohammed later apologised to Adoke in private, saying that the EFCC had threatened to arrest his wife and daughter if he did not agree to testify — albeit falsely — that he collected the cash directly from the former AGF.

Adoke said Ibrahim Magu, the former acting chairman of EFCC who oversaw the charges, has also apologised to him.

Except the EFCC appeals, this now closes all court cases against Adoke over the OPL 245 transaction of 2011.

Add a comment