The monetary policy committee of the Central Bank of Nigeria (CBN) has announced its decision to retain the monetary policy rate (MPR) at 12.5 percent.

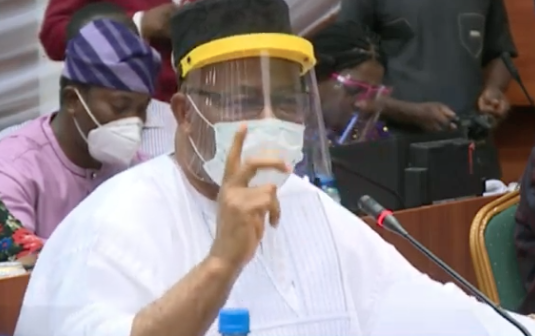

Godwin Emefiele, governor of the apex bank, announced the committee’s decision on Thursday at the end of the committee’s meeting.

Cash reserve ratio (CRR) was retained at 27.5%, liquidity ratio at 30% and asymmetric corridor around the MPR at +200/-500 basis points.

The CBN governor explained that tightening would increase the cost of production which would translate to higher prices of goods and services and harder economic conditions for Nigerians.

Advertisement

“Loosening monetary policy stance would provide the succour for stimulating output growth and rapid recovery but with implications for domestic private investment and capital mobilisation to support the huge domestic financing gap.”

He explained that the committee felt that a further cut in the MPR may not necessarily lead to a corresponding decrease in market interest rate considering the current economic realities.

Emefiele said there was also a need to allow time for the “transmission effect to permeate the economy”.

Advertisement

He described it as a “relatively cautious option” to hold rates in order to evaluate the effectiveness of policy actions already taken to counter the effects of the COVID-19 pandemic.

“Committee noted at this meeting that the economic fundamentals have marginally improved by the end of June 2020 following the gradual pickup of economic activities as the positive impacts of the various interventions permeate within the economy.

“The earlier downward adjustment of the MPR by 100 basis points to 12.5 percent to signal a loosening policy stance is yielding positive impacts as credit growth increased significantly in the economy.”

According to Emefiele, eight members voted in favour of holding rates while two members voted in favour of reducing MPR.

Advertisement

Add a comment