The monetary committee of the Central Bank of Nigeria (CBN) has announced its decision to maintain the monetary policy rate (MPR), which measures interest rate at 13.5%.

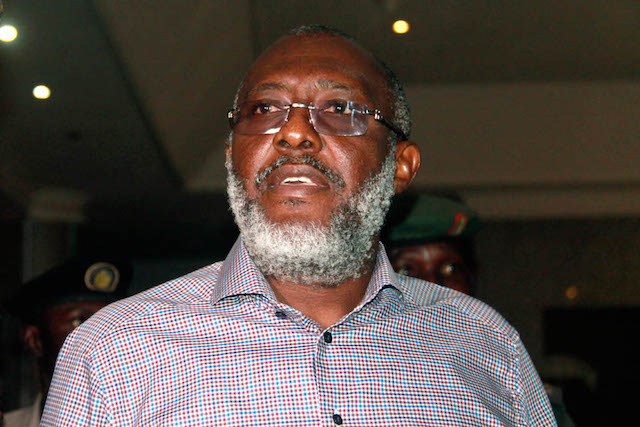

Addressing journalists on Tuesday after the committee’s two-day meeting, Godwin Emefiele, the CBN governor, said the upward movement in inflation was expected.

Saying the decision was made to protect prices, Emefiele said the cash reserve ratio (CRR) will be retained at 22.5%, liquidity ratio at 30% and asymmetric corridor at +200 -500 basis point.

“The committee noted the uptick in headline inflation year-on-year from 11.24% in September to 11.61% in October 2019,” he said.

Advertisement

“This was anticipated as part of the seasonal end of the year uptick in prices but was further accentuated by the border closure and expected temporary food supply shock which will adjust over the medium to long-term as the economy increases investments in food production.”

Providing context to the committee’s decision, Emefiele said: “While tightening may encourage capital flows, it also has the downside consequence of stifling the already fragile recovery in output growth.

“The committee also noted that a reduction in the policy rate will improve growth prospects but in view of the uptick inflationary pressures, it decided that the balance of risk was in favour of protecting prices, interest rates, growth in domestic credit amongst other positive developments.

Advertisement

“Committee felt that there would be more gains in the short to medium term in holding policy at its current position. In its consideration to hold, the monetary policy noted with pleasure the positive outcomes of actions already taken by the bank.”

The apex bank projects that the country’s economy will grow by 2.38% in the fourth quarter of 2019 driven by the non-oil sector.

CBN staff research projects that growth will pick up on the back of recent activities to boost credit to the private sector with the loan to deposit ratio directive, CBN’s interventions in some selected sectors and fiscal actions aimed at supporting growth.

Advertisement

Add a comment