The Central Bank of Nigeria (CBN) monetary policy committee (MPC) says the recession of the Nigerian economy is “imminent”, maintaining status quo on the monetary policy rates.

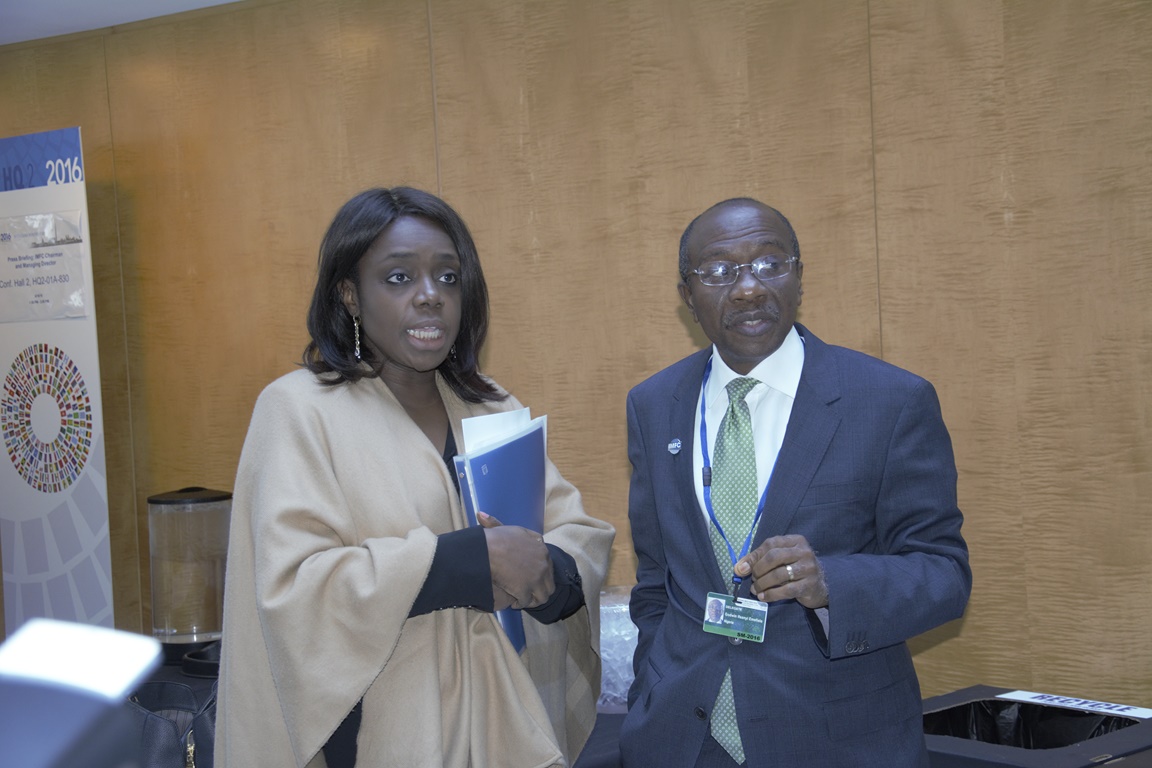

Speaking on the state of the economy, Godwin Emefiele, the central bank governor, said: “The conditions that led to the contractions in the first quarter of 2016 were still largely unresolved. The recession which was signalled in July 2015, now appears imminent.”

Emefiele, who spoke on behalf of the committee, said the previous decisions of the MPC need time to crystallise, hence, there was no need for adjusting rates.

Stating the decision as the least risky option, the committee asked the CBN to work on a flexible exchange rate system, with no mention of devaluation.

Advertisement

The bank said the monetary policy rate (MPR) and cash reserve ratio (CRR) will remain at 12 percent and 22.5 percent respectively. Liquidity ratio was also held at 30 percent.

The MPC asked the bank to adopt a flexible exchange rate system, to allow for inflow of foreign exchange and needed investment.

“The Committee expressed concern over sustained pressure in the foreign exchange market and the necessity of implementing reforms to engender greater flexibility of rate and transparency in the operation of the inter-bank foreign exchange market,” it said.

Advertisement

“Accordingly, the Committee noted that it was time to introduce greater flexibility in the management of the foreign exchange market.

“The Committee reaffirmed commitment towards maintenance of price stability and reiterated the need to reappraise the coordination mechanism between monetary and fiscal policy and initiate reforms, for the purpose of more efficient policy synchronization and management.”

The committee decided to “introduce greater flexibility in the inter-bank foreign exchange market structure and to retain a small window for critical transactions”.

Emefiele said the apex bank would unveil plans for the flexible exchange rate system in the course of time, adding that the implementation of budget 2016 will further reflate the contracting economy.

Advertisement

TheCable had earlier reported that the CBN would not be devaluing the naira, but would adopt a new flexible exchange rate system.

Speaking on the recession, Emefiele said: “The Committee recalls that in July 2015, it had hinted on the possibility of the economy falling into recession unless appropriate complementary measures were taken by the monetary and fiscal authorities.

“Unfortunately the delayed passage of the 2016 budget constrained the much desired fiscal stimulus, thus edging the economy towards contractionary output. As a stop-gap measure, the Central Bank continued to deploy all the instruments within its control in the hope of keeping the economy afloat.

“The actions, however, proved insufficient to fully avert the impending economic contraction. The conditions that led to the contractions in the first quarter of 2016 still largely the recession which was signaled in July 2015 now appears imminent.”

Advertisement

Add a comment