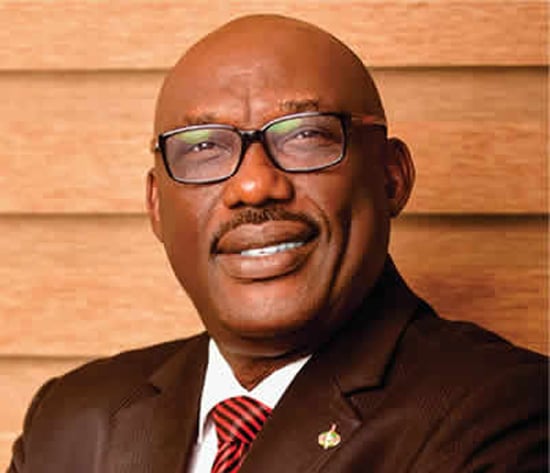

Babajide Sanwo-Olu, governor of Lagos, has signed into law the bill seeking to empower the state to collect value-added tax (VAT).

According to Gbenga Omotosho, the commissioner for information and strategy, the governor signed the “bill for a law to impose and charge VAT on certain goods and services” after returning from an official trip to Abuja on Friday.

“By this act, the bill has now become a law,” he added.

Earlier this week, the VAT bill passed the first and second reading at the Lagos state house of assembly.

Advertisement

During the plenary session, Mudashiru Obasa, speaker of the house, said the VAT bill, when passed into law, would lead to a higher revenue stream.

Consumers pay VAT when they purchase goods or obtain services. All goods and services — produced within or imported into the country — are taxable except those specifically exempted by the VAT Act.

The VAT rate was raised in Nigeria from five percent to 7.5 percent in 2020.

Advertisement

VAT collection by the Federal Inland Revenue System (FIRS) on behalf of the federal government has been a subject of controversy in recent weeks.

The FIRS, which administers the tax, transfers the generated revenue to the three levels of government via the federation accounts allocation committee (FAAC).

Recently, a court in Port Harcourt restrained FIRS from the collection of VAT and empowered the Rivers state government to take charge.

After the ruling, the Lagos state government began to domesticate the law to guide the collection of its VAT.

Advertisement

Add a comment