BUA Cement Plc maintained its high speed track on revenue growth at the end of 2020 and reinforced profit growth in the year from a decline in the preceding year.

The company’s management accounts for the full-year ended December 2020 shows a turnover of N209 billion and an after tax profit of N70 billion.

The cement producing company generated sales revenue of N53 billion in the final quarter and an after tax profit of N17 billion for the quarter. The performance kept the company on the high growth pedestal it has followed over the past five years on earnings performance. Turnover has multiplied several folds from N5.6 billion in 2015 – which is the dividend of its business combination.

The company’s bottom line has also multiplied from a loss of N3.3 billion in 2015 to the peak figure reported for the 2020 financial year. This is a rebound from a profit decline of 5.4 percent the company reported in 2019.

Advertisement

The high points of the company’s performance in 2020 are sustained overall growth in sales revenue and cost reductions that enabled the management to defend profit margin. Turnover has been growing at a galloping speed in the preceding years and the upbeat was maintained in 2020.

The company’s closing sales revenue of N209 billion for the 2020 financial year represents an increase of 19 percent for the year. This is however a slowdown from over 47 percent growth in turnover in 2019 to N175 billion.

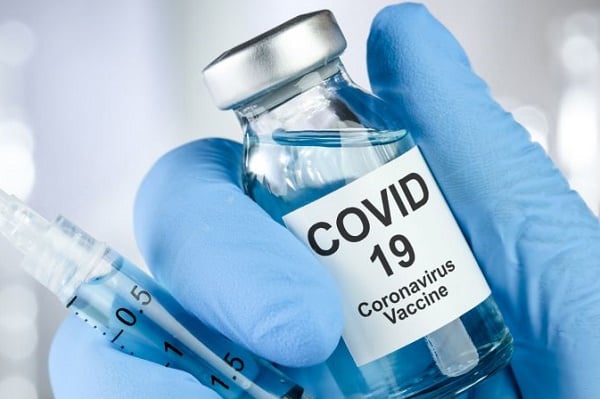

The slowdown in revenue growth in the year is attributed to the effects of coronavirus pandemic and the accompanying economic lockdown last year. Sales revenue performance was weak in the first half while growth accelerated in the second half.

Advertisement

The company’s after tax profit of N70 billion for the year represents an increase of 16 percent. The previous year ended with an after tax profit of N60 billion – which was a decline from N64 billion in the prior financial year.

BUA Cement faced a major challenge on the side of costs in 2020. Input cost was the problem. Cost of sales grew ahead of sales revenue at close to 23 percent to stand at N114 billion against the 19 percent growth in turnover. The result is that input cost made some incursion into sales revenue in the year and claimed 54 percent of it. The increase was driven largely by energy cost, which accounted for up to 41 percent of cost of sales.

The company realised gross profit of N95 billion for the year, which is an increase of about 16 percent. The rapid growth in input cost slowed down the growth rate in gross profit during the year.

A support from impairment write back in the previous year was not sustained last year. Impairment write back of up to N3.7 billion had helped to build operating profit in 2019. In 2020, the figure dropped by 68 percent to N1.2 billion.

Advertisement

Two major cost savings were however recorded in the year. There was a 10 percent drop in administrative expenses to N9.5 billion and net finance cost went down by 34 percent to N3.4 billion at the end of the year.

Operating profit grew by 15.5 percent to N82 .5 billion. The company raised a balance sheet debt of N66 billion during the year.

The cost-income balance of the company weighed slightly against income, which constrained profit margin. Profit margin was slightly down from 34.5 percent at the end of 2019 to 33.7 percent at the end of the 2020 financial year. The effect of that is that the company could not grow profit as fast as revenue at 16 percent compared to 19 percent.

The company earned N2.08 per share at the end of December 2020 compared to N1.79 per share in the same period in 2019. Dividend was yet to be announced for the 2020 operations at press time. The company paid a cash dividend of N1.75 per share for the 2019 operations.

Advertisement

Add a comment