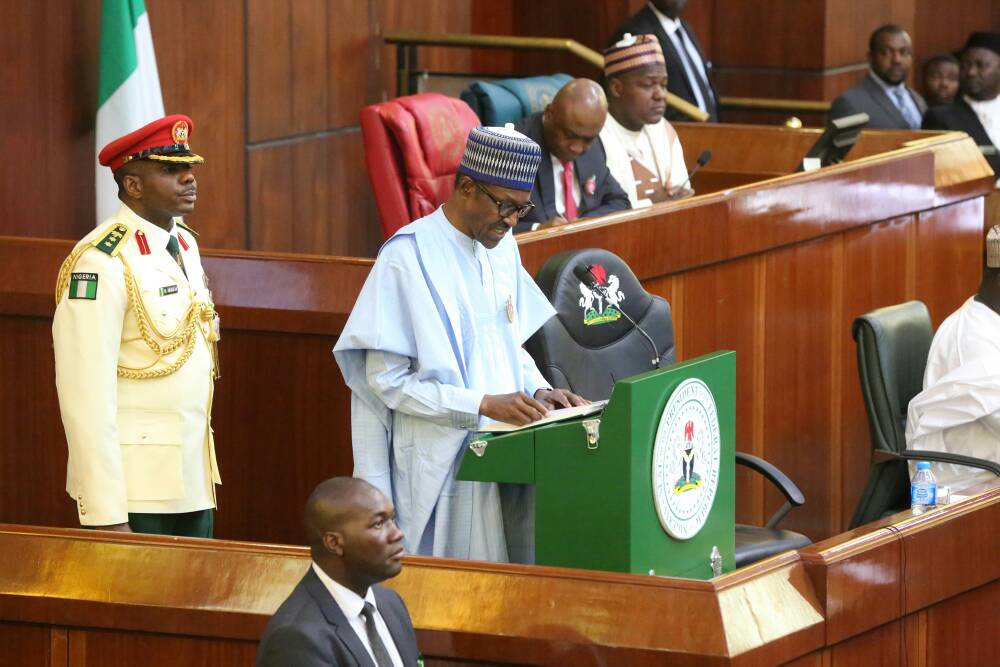

On Tuesday, President Muhammadu Buhari presented his third national budget since he became president. It was reminiscent of his previous ones, but had very fine subtle messages for Nigerians, international spectators and investors.

By this time in the life of the administration of President Goodluck Jonathan, his minister of finance, Ngozi Okonjo-Iweala had already taken over budget presentations. President Buhari is not likely to hand over budget presentations to Kemi Adeosun, anytime soon. And this is not because she is not fit for it, but because the president’s style is different, and he seizes budget presentations to pass home salient points, which are good for his political image.

Despite the scandals which rocked the 2016 budget, it was still Buhari’s first statement that financial change was here. From Budget of change to budget of recovery and now budget of consolidation. Can you guess the name of the next budget?

The budget 2018 presentation was a very big avenue for the president to show Nigerians that he was physically fit to lead and perhaps to run for a second term in 2019. President Buhari was literally standing for at least 70 minutes, no flinching, no trembling, no wavering!

Advertisement

THE GOOD

There are many bright spots in the 2018 budget; the budget perhaps is the most ambitious in size and intent, since the president took office in May, 2015.

At a time when oil prices are hovering around $64, keeping the budgetary benchmark for oil at $45 per barrel is quite impressive. At times like this, Nigeria is known for its Oliver Twist nature. As oil prices soar, we seek to review budgetary benchmarks upward to enjoy the proceeds that may never come.

In 2016, the budget benchmark was set at $38 per barrel, despite warnings from the media and business analysts in and out of the nation. In that year, oil prices fell as low as $27.10 per barrel, tipping Nigeria into its worst recession in nearly three decades.

Advertisement

We are glad nothing like this will happen in 2018!

On the flipside, if we go with the plan in play, the results will be remarkable. At $45 per barrel, and a production level of 2.3 million barrels a day, Nigeria will see $37.78 billion (N11.5 trillion) come in from sale of crude oil in 2018. All of these will not get to the government based on sharing formula with oil companies, but a considerable amount will. On the other hand, if oil sells at an average of $60 a barrel in 2018, considering current prices, the country will get nothing less than $50 billion (N15.25 trillion) from oil.

If the governors do not sue the federal government to share excess crude oil accruals, the government should be able to add about $5bn to the excess crude account in 2018. But this is only an ideal calculation. The ideal rarely happens.

On the good side too, the input of non-oil revenue into the 2018 budget will surpass that of oil revenue in Nigeria, for the first time in over 40 years. This is very very good. But how sustainable will it be considering loot recoveries and tax amnesty will not last forever?

Advertisement

THE BAD

When would this deception stop? The naira is not 305 to the dollar!

I understand the Central Bank of Nigeria’s position on the naira staying officially at 305 per dollar. The CBN has made remarkable progress in keeping the naira strong despite all odds. In this same country, less than a year ago, the naira traded at 520 to the dollar. Today, a dollar is hovering around N360 at the parallel market and the interbank market.

To say the dollar is N305, as projected in the 2018 budget is to extend the reign of dollar subsidies. I understand that if the CBN allows the exchange rate systems to unify around N350 per dollar, there would be a return of fuel subsidies or an increase in pump price of petrol, hence the need to keep it at N305/$1.

However, this dollar subsidy regime may not be the best for the country at a time when we seem to be getting quite a number of things right — financially.

Advertisement

In 2017 we spent N2.98 trillion on salaries and other non-debt recurrent expenditure. In 2018, we would be spending N3.494 trillion on the same issues, yet we could only increase capital expenditure by 0.1 percent. This does not speak well to me.

THE LOGIC OF DEBT FOR DEBT

If you are concerned about the Nigeria my generation will lead or govern, you must worry about debt issues, and living in a country that spends nearly 20 percent of its budget on servicing debts.

Advertisement

For 2018, Nigeria will borrow N2.005 trillion to balance the budget and pay N2.014 trillion to service existing debt. Seems like an incongruous debt-for-debt situation. This is troubling but inevitable.

On the bright side, the current government is taking some loans to pay off some loans and one would wonder why anyone would take on new debts to settle old debts. A closer look at this prism however shows that the government is making a good decision that may be saving us billions of naira.

Advertisement

In plain terms, local debts have interest rates as high as 18 percent per annum, while international debts have interest around six to seven percent. If government owes N1 trillion and services it with N180 billion every year, then the same government borrows N1 trillion internationally to offset the debt. It incures N1 trillion debt, but gets to service that debt with N60 billion to N70 billion per year. That is saving at least N110 billion per year by the logic of debt-for debt. Hence, it may not be all bad to take loans to pay loans.

If all goes well with budget 2018, it posseses the power to set the limping economy back on its fast-paced right foot.

Advertisement