Abdullahi Abiola, a businessman, has asked the Central Bank of Nigeria (CBN) to clear matured forex exchange forward contracts to banks and manufacturers.

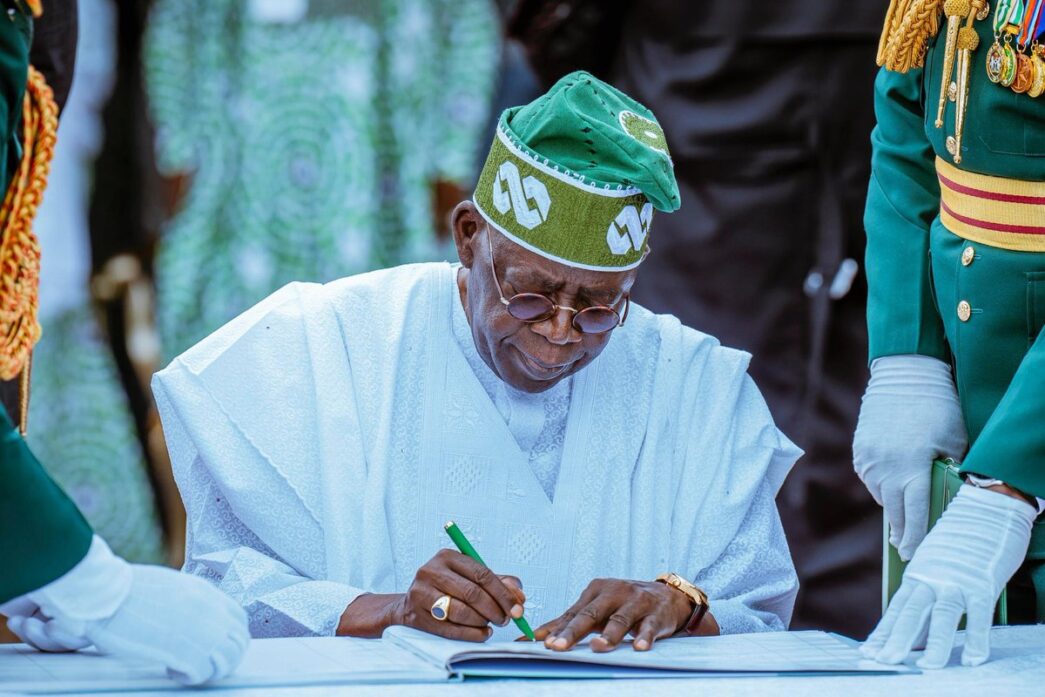

In a statement on Monday, Abiola also urged President Bola Tinubu and Wale Edun, minister of finance and coordinating minister of the economy, to intervene in the matter and salvage manufacturers from the protracted situation and current losses.

The businessman said such intervention will avert the collapse of struggling businesses and attendant economic implications including unemployment.

Abiola, a printer whose business involved importing foreign printing materials, lamented that the apex bank’s inability to honour matured FX contracts for over one year since the beginning of Tinubu’s administration has placed him under severe interest rates as high as 35%.

Advertisement

He said the uncleared FX backlog has forced him to shut down some segments of his operations and downsize his workforce.

“Interest rates paid to banks have eaten all my profits and threatened my capital. The situation has been compounded by unprecedented energy costs, which have quadrupled in the last year,” he said.

Abiola said businesses with substantial foreign exchange liabilities like his are seriously challenged because of his company’s inability to fulfill its offshore obligations due to the CBN’s non-delivery of dollars.

Advertisement

He said the situation was avoidable if the CBN had promptly cleared the forwards to guarantee business stability, productivity and job security in the country.

According to the Manufacturers Association of Nigeria (MAN) and the Nigerian Association of Chambers of Commerce Industry Mines and Agriculture (NACCIMA), many businesses borrowed money from deposit money banks as working capital to open clean lines of credit for their companies based on forward contracts allocated by the CBN.

MAN had said the CBN has not cleared $2.4 billion worth of forward contracts, putting severe strain on manufacturers as commercial banks continue to charge dollar accounts along with other naira bank charges such as 35 percent interest rate on the facilities that these companies have with their banks.

MAN described the situation as a “worrisome breach of contract” which has further exacerbated currency risk for businesses, leading to substantial financial losses and operational disruptions.

Advertisement

Add a comment