C&I Leasing Plc says the emergence of Peace Mass Transit as its majority shareholder will be a path to inviting more equity to the business.

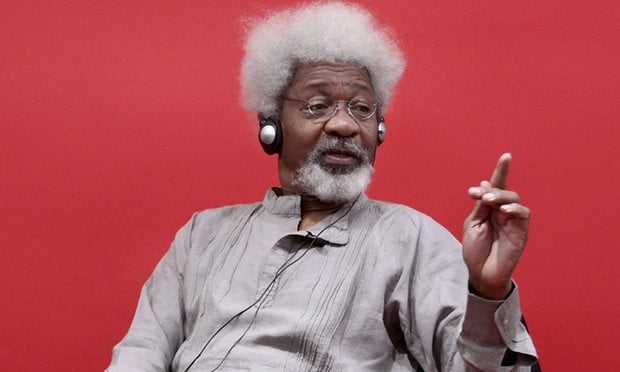

Andrew Otike-Odibi, the company’s chief executive officer, told journalists on Wednesday that the impact of the acquisition would be positive for all the company’s stakeholders.

C&I Leasing had, on Tuesday, notified the Nigerian Stock Exchange and the investing public of the purchase of 313,326,316 units of the Neoma Africa Fund L.L.C unsecured variable coupon redeemable convertible loan stock in registered units of N4.75 each by Peace Mass Transit Ltd.

The loan stock, when fully converted, will result in the issuance of 987,500,000 ordinary shares of the company which will represent 55.82 per cent of the issued shares of the company.

Advertisement

“C&I Leasing is 30 years, and in 30 years we have seen some board changes, we have seen a significant management change, where the former managing director handed over to the current managing director,” Otike-Odibi said.

“C&I Leasing is going into yet another change. I will say that taking the business on its own, business structure and business model is very solid, the ownership of the business can only add value to that structure and that model.

“So, for the minority shareholders, I did not see any fear or any concern.

Advertisement

“Rather, I see a reason for value enhancement in the sense that the impact of this acquisition will be positive for all the stakeholders of the company.”

The CEO explained that the loan conversion into equity would be concluded before the end of the first quarter after which Peace Mass Transit’s shareholding would be between 65 and 67 percent.

Otike-Odibi said that Peace Mass had earlier bought some stake in the company during its rights issue of 2019, while the loan stock is 55.82 percent.

He said that the purchase and eventual conversion of the shares would strengthen the company’s credentials in raising new equities.

Advertisement

“We see this as a new road into inviting more equity to the business; one of the things that have held the company back from raising additional equity has been the loan stock issue.

“With the loan stock being converted to equity now, it now helps the company to open up to raise additional equity,” he said.

On the outlook for 2021, Otike-Odibi said that COVID-19 had brought out new opportunities for the company.

He said that the company would play more on digital space due to the emerging opportunities in the technology space brought by the COVID-19 pandemic.

Advertisement

Add a comment