After what may look like some interesting political manoeuvre on his part during his ministerial screening at the Nigerian Senate screening on August 5, 2023, Olatunbosun (Bosun) Tijani assumed office as minister for communications, innovation and digital economy on August 21, 2023. Tijani assumed office when an increasing number of Nigerians were doubting the economic efficacy of the Renewed Hope policies, due to the significant decline in their purchasing power since May 29, 2023, when the government assumed office and began implementing some macroeconomic policies.

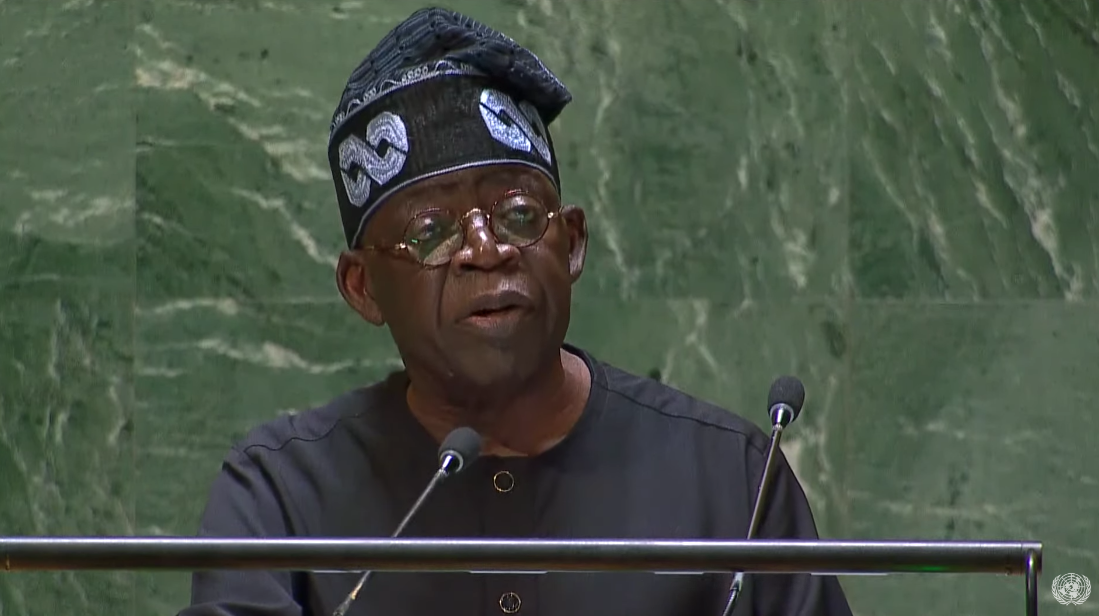

There are however policy goals in the Renewed Hope policy document of President Bola Tinubu that can significantly enhance Nigeria’s economy, especially in the information and communications technology (ICT) sector, if successfully implemented. Its contemporary relevance is buttressed by the recent G77+China Summit on Science, Technology & Innovation in Cuba on September 15-16, where the role of science, technology and innovation in development was prominent.

Unveiled on October 20, 2022, the Renewed Hope policy document contains sections on 16 sectors, including a section on the digital economy. Within the digital economy section, a subsection, particularly page 51 of the policy document talks about ‘Tech Manufacturing’, with emphasis on the economic opportunities in domestic manufacturing of digital devices such as smartphones. The policy projections built around import substitution are that if the $750 million spent annually on the importation of smartphones alone is retained locally through local manufacturing, then the economy will be better for it. It will also create well-remunerated jobs for Nigerians, and renew hope in the socio-economic prospects of the country.

While not second guessing what may have informed the policy focus on renewing hope, it may be important to state that the period between May 2015 and May 2023 has not been the best, socioeconomically, for Nigeria. There was a significant rise in insecurity, two economic recessions, high unemployment, high inflation, purchasing power decline and high levels of discontentment. Many young people and professionals started migrating (japa) in very large numbers due to these factors. This was however in contrast to the period between 1999 and early 2015 when there were significant socioeconomic improvements as largely attested to by the current minister of finance and coordinating minister for the economy, Olawale Edun. This was further characterised by reverse migration from Nigerians in the diaspora. This reverse migration reached a peak when Nigeria became Africa’s largest economy in 2014 and was largely driven by developments in the ICT and finance sectors.

Advertisement

A bit more understanding of Nigeria’s ICT sector is required, so that this policy objective can be better situated and why it facilitated a lot of concrete hope that led to development and reverse migration.

The current state of the ICT sector can be traced to Decree 75 of 1992, which led to the establishment of the Nigerian Communications Commission (NCC) under Ibrahim Babangida as head of state. This aided the National Telecommunications Policy (NTP) of 2000, which was given legal backing by the Nigerian Communications Act (NCA) of 2003 which brought the NTP into legal force. Due to these reforms which broke the monopoly of the government-owned Nigerian Telecommunications Limited (NITEL), Nigeria has moved from 400,000 fixed phone lines and less than 200,000 regular internet users in 1999, to 222.5 million phone users and 154.8 million internet users in 2022.

Also, the sector’s contribution to Gross Domestic Product (GDP) has risen from 3.08% in 2001 when the significant implementation of the NTP began to 16.22% of GDP in 2022. This has come with the attendant increase in the number of jobs, tax revenue and contribution to the effectiveness and efficiency of other critical sectors of the economy.

Advertisement

The financial sector witnessed similar liberal reforms under both the Babangida and Obasanjo administrations, leading to the emergence of ‘new generation banks’, which were more tech-savvy and innovative, and provided good competition to older banks. Supported by the Banks and Other Financial Institutions Act (BOFIA) 1991 (and amended in 1997, 1998, 1999, 2002 and 2004) and the 2005 banking sector reforms, these reforms supported the branch expansion approach of many of the newer banks, which has subsequently enhanced the real estate sector of the economy, as well as the ability of Nigerian banks and financial institutions to finance major economic and commercial functions. Nigerian private banks such as UBA, Zenith Bank and Access Bank now have branches and operational presence in many African countries, the United Kingdom, the United States, China, France, United Arab Emirates, among other major countries. The contribution of the finance and insurance sectors to real GDP totalled 4.25% in Q2 2022.

Between the telecommunications and finance sectors, a handshake of sorts has effectively taken place, with the emergence of financial technology (fintech) companies, mobile banking operations and other related activities. Mobile network operators such as Globacom, MTN, and Airtel have acquired payment service bank (PSB) licenses from the Central Bank of Nigeria, allowing them commence the provision of financial services. In turn, both sectors have been further deepened by their economic footprints, attracting major investment and creating jobs in the country. Nigerian fintech companies have received the most foreign investment in the sector when compared to other African countries. Nigerian fintech companies raised venture capital funding of $1.2 billion in 2022, followed by Kenyan fintechs with $1.1 billion and Egyptian fintechs with $820 million. The telecommunications sector has, on its part, attracted domestic and foreign direct investment worth $75.6 billion, as of 2021.

Both the ICT and financial sectors created many high- and middle-income jobs and largely contributed to Nigeria becoming Africa’s largest economy in 2014. Both sectors also provided the structural basis for the establishment of firms such as CcHUB, for which Bosun Tijani is famous.

The economic outcomes and opportunities from reforms in both sectors led to increased hope and contributed to reverse migration by Nigeria’s diaspora — an opposite of the current ‘japa’ migration trend of many young and middle-aged Nigerians due to sustained economic decline and loss of hope in the last eight years. And it is from the same sector(s) that hope can be renewed.

Advertisement

With the telecommunications sub-sector of the ICT sector recording $75.5 billion in domestic and FDI as of 2021, and the number of phone lines and internet users nearly equal to population size, the Nigeria ICT sector is effectively a matured market with marginal room for the high growth levels that led to hope in previous years. Where there is however room for significant growth in the sector is in tech manufacturing, which is also a major goal in the policy document of the current administration.

In addition to the $750 million spent annually in Nigeria on the importation of smartphones as contained in the Renewed Hope document, a 2018 survey conducted by NCC shows that only 23% of software in use is obtained locally, while 77% of software in use is foreign. Also, only 14% of hardware comes from local companies, while 86% of hardware is foreign. For Base Transceiver Stations (BTS) products, a meagre 12% is manufactured in Nigeria, while 88% is foreign. The manufacturing sector constitutes just 10% of GDP, and 12% of jobs in the formal economy, and has suffered a 32.8% reduction in employment generation capacity in the first half of 2023, when compared with jobs generated in the first half of 2022 according to the Manufacturers Association of Nigeria (MAN), the situation and challenges are better understood.

What then are the feasible prospects for tech manufacturing in Nigeria? Most of the consumer electronics and tech products imported into Nigeria are manufactured by big tech firms with global supply chains. Some of the contemporary geopolitical events however provide some opportunities for Nigeria to be a part of the global tech manufacturing value chain, if the politics are well played.

The reference to geopolitics is because the United States (US) views some of the technology developments in China as a threat to its national security and interests.

As a result, the US through the Department of Commerce’s Bureau of Industry and Security, imposed in 2015, bans that restrict China’s ability to obtain, develop, and manufacture advanced semiconductors and other new technologies. The US government has gone further with the ‘The CHIPS and Science Act’ of 2022, worth $280 billion, which provides significant funding for tech companies that are however prohibited from expanding semiconductor manufacturing in China, or any countries that pose a threat to US national security. There is also the ‘Chip 4 Alliance’ proposed by the US government in March 2022, which aims to bring together three of the strongest semiconductor giants in Asia– Taiwan, Japan, and South Korea, to weaken China’s growing dominance not just in the semiconductor industry, but other areas of critical importance such as 5G. Countries such as Japan, Netherlands, Canada and the United Kingdom have had to impose semiconductor and 5G technology restrictions on Chinese companies such as Huawei.

Advertisement

This geopolitical space also provides some guide for harnessing opportunities for Nigeria as can be glimpsed from the December 13-15, 2022, US-Africa Leaders Summit. The summit was a move by the US to strengthen its economic relations with African countries. That Nigeria has not applied to join the BRICS bloc, which is increasingly anti-US, are geopolitical pathways that can be explored for domestic tech manufacturing.

But is Bosun Tijani able, ready and equipped to play the global geopolitics involved in facilitating tech manufacturing to Nigeria?

Advertisement

His appearance at the senate screening appears to suggest so, but first, some look at his background. Prior to his 2002 Economics degree from the University of Jos, he earned a diploma in Computer Science from the same school. He subsequently obtained an MSc in Information Systems and Management from the Warwick Business School in 2007, and a PhD in innovation and economic development from the School of Business, University of Leicester in 2023. He is a Visiting Adjunct Professor at Wits School of Governance, University of the Witwatersrand. Prior to the establishment of CcHUB, Tijani had working stints at the International Trade Centre Geneva, Hewlett Packard, and Pera Innovation Network.

Given the nature of global ICT manufacturing that includes supply chains, outsourcing and geopolitics, Tijani seems to have the technical, business and economic skills, in addition to his current government and political platform, to pull off the next stage of development in Nigeria’s ICT sector, and contribute to the enhancement of manufacturing activities in the country.

Advertisement

From a more practical perspective, we can also forecast what Tijani’s activities will look like in championing tech manufacturing. At federal executive council (FEC) meetings, or before the meetings, he will have to promote joint memos with the federal ministry of industry, trade and investment (FMITI) for tax incentives granted by the Nigeria Investment Promotion Commission, which is a parastatal under FMITI. What about economic policies that can only be led by the minister of finance and the coordinating minister of the economy? Tech manufacturing and other manufacturing activities will require regular interface with the Manufacturers Association of Nigeria (MAN), Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture (NACCIMA), Nigeria Economic Summit Group (NESG) and Nigeria Employers Consultative Association (NECA), which normally are the remit of the trade and finance ministries, will the ministries willingly cooperate with him or see him as overstepping his boundaries? Does Bosun have the political and interpersonal skills for such manoeuvres? Hopefully, the private sector background of both the finance and trade ministers will provide some common ground for teamwork.

Domestic tech manufacturing will also involve closer interaction and coordination with the ministries of education; and science, technology and innovation. This is because education curriculum and training updates will be required for Nigerians to have the relevant skills, and prevent the repeat of the experience some foreign technology firms had in easily recruiting well-trained techies. In addition, the geopolitical nature of tech manufacturing earlier discussed, may mean that Bosun will require diplomatic cover and support for such engagements. Thankfully, the presidential press statement after the recent visit of President Tinubu to the United Arab Emirates (UAE) made strong reference to the return of economic diplomacy as an objective of the government. Economic diplomacy was officially introduced to Nigeria’s foreign policy in the 1980s by Ike Nwachukwu, the fine infantry officer, gentleman and foreign affairs minister. That becomes a policy focus which Tijani can harness in having the ministry of foreign affairs provide foreign technical support for some of the negotiations with foreign tech firms, especially as technology is now a foreign policy issue.

Advertisement

Will events such as the visit of Bill Gates and Mark Zuckerberg to Nigeria, which Tijani features, now include parts for Microsoft manufacturing in Nigeria? Or does the tech manufacturing objective mean the encouragement of Nigerian firms to begin the manufacturing of Nigerian-owned consumer devices in Nigeria? Whichever way, his task is well cut out and he will need to display political skills similar to what was on display during his senate screening, or more, to achieve the objective of tech manufacturing for renewed hope in Nigeria.

Tijani actually has to start renewing hope in the ICT sector as at least 2,000 telecoms experts migrated in 2022 alone due to sectoral and socioeconomic challenges. He will also have to grapple with optimising the country’s 5G sector, as Nigeria realised only $800 million from the 5G license auction in 2021 and 2022, compared to $19 billion by India.

There are locations and factors that look good for tech manufacturing in Nigeria. The Enyimba Economic City (EEC), which is a Special Economic Zone (SEZ) located in the Aba area of Abia state, is an ideal location for the location of tech and consumer device manufacturing in Nigeria. Plans are at different stages for semiconductor and other high-tech manufacturing in the city. Alongside Governor Alex Otti, who is a former bank chief executive, individuals such as Prof. Ndubisi Ekekwe of FASMICRO semiconductors and Prof. Greg Ibe of Skills G and Gregory University, can provide substantial human and financial support towards the realisation of high-tech manufacturing. The EEC has similarities with Shenzhen (SEZ), which birthed leading tech companies such as Huawei and Tencent. Such effort and model can always be cascaded to other locations across Nigeria.

To conclude on the geopolitical realities of tech manufacturing, a bit more look at countries such as China, Taiwan, Japan and South Korea, will show some similarities and variations, which Tijani may have to juxtapose for effective goal attainment. These countries largely shared features such as affordable labour, infrastructure and economic incentives to attract tech manufacturing to their countries. China, however, subsequently adopted a somewhat arm-twisting policy towards foreign technology firms that operated in China, which entailed forcing them to share patented information with local joint-venture partners. China was subsequently able to gain access to a lot of the technology know-how of these foreign tech firms, who largely complied because of the business benefits in the world’s second-largest economy. This policy approach contributed significantly to China’s impressive economic performance which has seen nearly 800 million people lifted out of poverty in the last 40 years, and the eradication of absolute poverty- an undisputable economic miracle. Will Tijani tend towards leveraging Nigeria’s market size to ensure the domestication of technology or the more compliant approach of Taiwan, Japan and South Korea?

It is worth noting that existing policies such as the ‘National Policy for the Promotion of Indigenous Content in the Nigerian Telecommunications Sector (NPPIC) of 2021, which was designed to promote the development of indigenous content in Nigeria’s telecommunications sector, can provide speedy institutional support for the realisation of tech manufacturing. There is the Nigeria Office for Developing the Indigenous Telecom Sector (NODITS), established in 2021 as part of the NPPIC, that can further support the process. Thankfully, the NODITS is domiciled in the Nigeria Communications Commission, which is one of the government agencies under the supervision of Tijani. By some extension, achieving tech manufacturing can also support Presidential Order 005 on Planning and Execution of Projects, Promotion of Nigerian Content in Contracts and Science, Engineering and Technology and Presidential Executive Order 003 on Support for Local Content Procurements by Ministries, Departments and Agencies of the Federal Government of Nigeria.

With successful domestic tech manufacturing, Nigeria effectively becomes a more integral part of the 4th industrial revolution. High-skilled jobs, capital retention and economic development will be the spin-offs from high-tech manufacturing. That will also mean that by the time for Tijani’s performance assessment, which in the words of Kingsley Ozumba Mbadiwe, the legendary politician and first republic minister of communication and aviation, translates to “When the come, comes to become”, Nigerians will easily attest that economic and ICT policy objectives have been met, and hopefully, hope renewed.

The acronym of his name Bosun Tijani ‘BT’, which is similar to the BT of British Telecom, may suggest someone destined for telecoms manufacturing success. The digression is however for believers in destiny.

Similar to how ICT contributed significantly to making Nigeria the largest economy in Africa in 2014, with a higher level of FDI, reverse migration, and high hopes, Bosun Tijani’s ability to implement domestic high-technology manufacturing in Nigeria, will provide a huge economic elixir. Among the current federal ministers, he seems to embody the most hope by the young and upwardly mobile sub-set of the population, which needs to be retained with good high-tech jobs and associated economic fortunes. Will Bosun Tijani renew hope through tech manufacturing, and reduce japa?

Uwanaka writes from the African University of Science and Technology, Abuja. He can be reached via [email protected]

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment