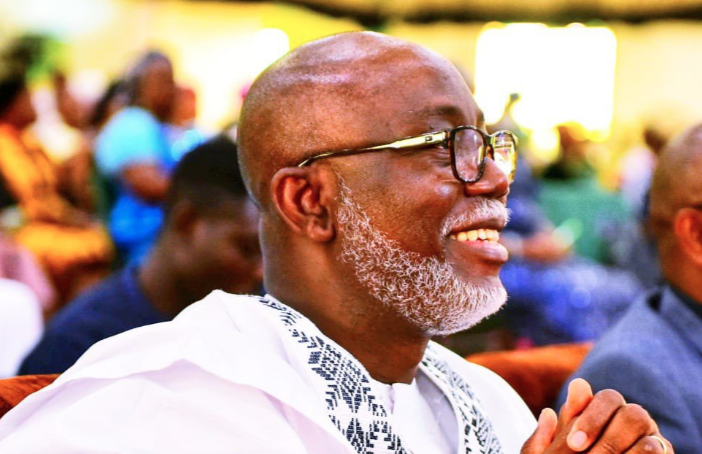

Olayemi Cardoso, governor of the Central Bank of Nigeria (CBN), says the financial regulator will direct banks to recapitalise.

Cardoso made this known at the 58th annual bankers’ dinner and grand finale of the 60th anniversary of the Chartered Institute of Bankers of Nigeria (CIBN).

Recapitalisation is the process of infusing funds into banks to enable them to meet the mandatory capital adequacy set by a central bank.

It is also to stabilise a company’s capital structure and secure shareholders’ funds.

Advertisement

The last time CBN enforced banks to recapitalise was in 2004, when Charles Soludo, former CBN governor, raised their capital base from N2 billion to N25 billion.

Cardoso said banks will be directed to increase their capital base because they are not liquid enough to service the $1 trillion economy President Bola Tinubu is aiming for in the near future.

“Esteemed guests, considering the policy imperatives and the projected economic growth, it is crucial for us to evaluate the adequacy of our banking industry to serve the envisioned larger economy,” Cardoso said.

Advertisement

“It is not just about the stability of the financial system in the present moment, as we have already established that the current assessment shows stability.

“However, we need to ask ourselves: Will Nigerian banks have sufficient capital relative to the financial system’s needs in servicing a $1.0 trillion economy in the near future? In my opinion, the answer is “No!” unless we take action.

“Therefore, we must make difficult decisions regarding capital adequacy. As a first step, we will be directing banks to increase their capital.”

In 2023, some Nigerian banks have been raising funds to increase their capital base and also requesting approval from shareholders for fundraising.

Advertisement

Access Bank secured $300 million from its parent company, Access Holdings, in April.

In March, Wema Bank informed its shareholders of its plan to issue bonds worth N25 billion.

Also, FCMB announced plans to borrow N20.68 billion and Fidelity Bank sought shareholders’ approval to trade 13.2 billion shares for capital through a public offer and rights issue.

Advertisement