The tax debate is a never-ending saga constantly subjected to emotional vituperations depending on which side of the divide one is. This debate has most recently brought to the front burner contending issues with respect to the newly introduced Voluntary Asset and Income Declaration Scheme (VAIDS) and the administration of tax in Nigeria. Let me attempt an analysis of these issues.

No doubt, Nigeria is blessed with an abundance of natural and human resources. Nigeria has a population of about 186 million people. Of this number, about 77 million were employed as at 2015 according to the National Bureau of Statistics (NBS). Furthermore, as released by the Joint Tax Board (JTB), only about 10 million people, out of this number, are registered for personal income tax across the 36 states and the Federal Capital Territory (FCT). These numbers just do not add up. How does one explain that 10 million people carry the tax burden that at least 77 million people are expected to share? This is 13 for the cost of 100. Little wonder oil revenues still account for about 70% of government income, a reality that leaves the economy very vulnerable to fluctuations in the oil market. We believe this context above lends credence to the need for a reassessment of the government’s current approach improving the country’s tax base through the Voluntary Assets and Income Declaration Scheme (VAIDS).

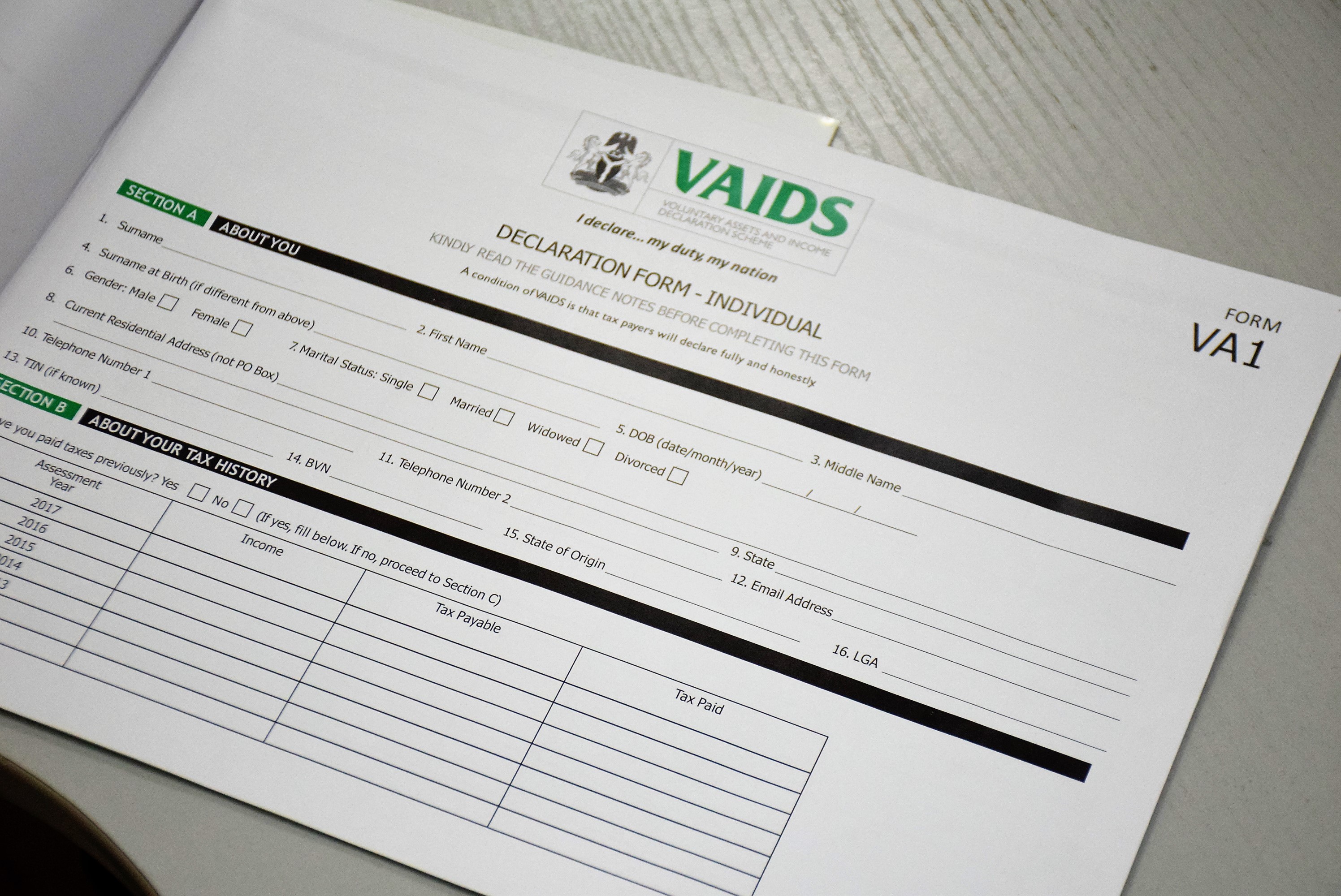

VAIDS was introduced in 2017 by the Nigerian government, to increase Nigeria’s tax to Gross Domestic Product (GDP) ratio from 6% to 15% by 2020, broaden the Federal and State tax brackets, curb non-compliance with existing tax laws & discourage use of tax havens and prevent illicit financial flows and tax evasion. The scheme, which has been lauded by many as a possible tool of improving tax compliance and government revenue, will end on 31st January 2018. For a country with a 6% tax to GDP ratio, it is ordinarily expected that this scheme would be in place for more than 9 months in order to increase tax compliance. VAIDS can be compared to the Offshore Voluntary Disclosure Program (OVDP), a similar scheme in the United States of America (USA), which was introduced in 2009 and would end in September 2018. The OVDP was designed to allow taxpayers with unreported offshore assets to voluntarily resolve past tax and reporting non-compliance in exchange for amnesty on criminal prosecution and penalties. Whilst our VAIDS which ends on 31st March 2018 would have only been in operation for 9 months; the OVDP program in the USA (with higher tax to GDP ratio compared to Nigeria) was designed to last for 9 years! What a contrast in a system with high level of tax evasion and transparency issues.

In scoping the scheme, the government has said it will target all individuals resident in Nigeria as well as companies operating in Nigeria. The scheme also has as its primary targets, multinational enterprises and high net-worth individuals (HNIs). We think this focus might be the albatross of the scheme and the numbers can show this.

Advertisement

The government had noted that the majority of those who pay personal income tax in Nigeria are low income earners and salary earners whose taxes are deducted at source. Furthermore, government at all levels place huge tax burden on multinational enterprises and HNIs compared to other existing businesses in order to increase its tax revenue. The logic of the tax authority, which is perhaps understandable, is that given the limited human resources at their disposal and paucity of relevant data on other businesses, it is more efficient to concentrate on a few HNIs and multinational enterprises who are already in the tax net and who can bring in the expected results than focus on other businesses without adequate financial information or whose business addresses may not be known. If this was the justification for the focus on the multinational enterprises and HNIs, then we advocate for at least a more balanced approach.

We see four possible groups within the Nigerian tax bracket; enterprises (multinational and domestic), HNIs, the formally employed and the informally employed. We could collapse both the formally and informally employed to have a more manageable 3-pronged approach to achieving our tax objectives. A balanced approach to improving the country’s fiscal position will focus on all four if we see VAIDS beyond just a short-term revenue mobilization scheme, but a long-term approach to structuring a framework for effective tax collection. Note that our submission here is that none of these groups should carry more tax burden that it ought to, a situation we think is required to create an efficient and fair tax system.

Multinationals and HNIs do not need any special attention from the tax authority before getting them to contribute their quota to the country’s tax base. Most multinationals and HNIs already pay tax but it must be stressed that some of them do not pay the correct amount of taxes. This is because some of these multinationals and HNIs take advantage of the loopholes inherent in the tax laws and administration of taxes generally. Such loopholes should be blocked through legislative action.

Advertisement

More importantly, the government needs to take a long term view and find means to broaden the composition of each of the components that make up the tax bracket. Broadening the tax base can be achieved through concerted effort by government at all levels to bring as many people as possible within the tax bracket. As a starting point, there is a need to focus on the informal sector of the economy. The IMF had in 2017, valued Nigeria’s informal enterprises at about 65% of GDP. This means that the government cannot shy away from evolving a smart strategy to formalize a lot of these enterprises and bring them under the tax net. This is a pool of about $263billion of productivity. This is critical to achieving the tax to GDP objectives, which will see the government more than double taxes collected within the next 2 years, discounting the rate of GDP growth.

There is also a need to ensure that the personal income tax bracket is broadened. There are at least 67 million taxable income types in the formal sector for starters. At the current minimum wage of N18,000 per month, which comes across as pessimistic, given the large number of incomes, we have an annual pool of about N14trillion in taxable income. Averaging personal income tax of 18%, this adds about N2.5trillion to the current tax base, minimum.

In a bid to bring more people within the tax net, government across all levels should undertake significant enlightenment and sensitization campaigns (radio jingles, talk shows, road walk etc.,) to provide information to the citizenry on the need to pay their tax. A major constraint, however, is that all our tax laws are written in English Language, which many of the people in the informal sector do not understand. There is, therefore, the need to provide the laws to the people in their local languages through translation of the tax laws, particularly the Personal Income Tax Act. A cue can be taken from the Republic of South Africa, where some of the country’s tax laws have been translated into local languages to reach a larger percentage of the population.

In addition, the government needs to embrace technology in the administration of taxes to achieve greater efficiency. Although e-filing of taxes has been introduced, the system is plagued with a lot of hitches and in some instances, income tax filing is still done manually. To improve this process, tax authority can partner with the private sector and other technologically driven organizations to provide seamless and easy platforms for taxpayers to be able to pay their taxes and file tax returns without stress.

Advertisement

Conclusion

On the whole, it is important to note that the goal of this piece is neither to exonerate any category of taxpayer nor overburden any. Rather, the essence is to show that the numbers may not necessarily support the government’s primary focus on HNIs and multinationals. Consequently, we believe that the tax system should show more equity in distributing tax responsibilities and government should be focused on bringing more people within the tax net.

Whilst a case is made for a balanced and even tax system and an expansion of the tax net, the government also has to be responsible, transparent and efficient with how the taxes are spent. Tax apathy and evasion can be reduced where there is a high level of transparency and visible development.

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment