The Central Bank of Nigeria (CBN) has advised state governments to adopt the federal government’s system of using a single account for all its revenue deposits.

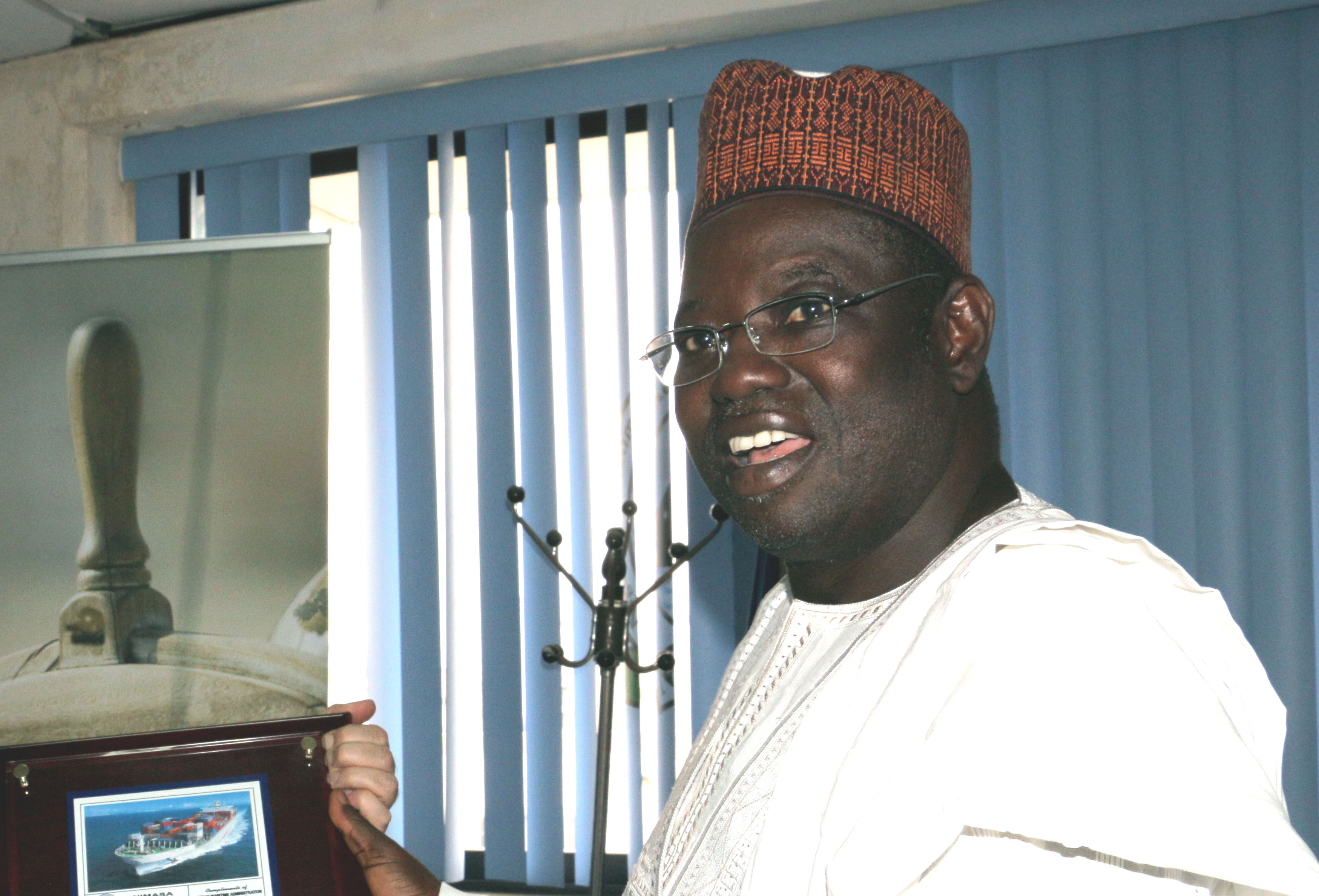

Kure Abubakar, head, client services at the apex bank, gave the advise on Wednesday while presenting a paper entitled: `Understanding Treasury Single Account (TSA)’at the close of a two day workshop on the fiscal responsibility act.

The workshop, which began on Tuesday, was organised for government revenue generating Ministries, Departments and Agencies (MDAs).

Abubakar said the TSA, if adopted by states, could help them to get maximum benefits.

Advertisement

He also urged MDAs to comply with the federal government’s directive and adhere to the September 15 deadline to avoid sanctions.

“There are sanctions and the directive says all erring MDAs will be penalised and that is enough because that is the type of political will we need,” he said.

“If you don’t comply the consequence is yours. I cannot say specific penalties but I believe the president has the authority to penalise either the Managing Director or Chief Executive of such MDA.

Advertisement

“So those that refuse to comply are on their own or they should show reason to the government why they cannot comply.”

He also said MDAs that require a waiver could do so by making a presentation to the president, saying why such should be granted.

“The presidential directive says that you can make a presentation to the president for a waiver if necessary,” he said.

“If the justifications are quite good Mr President in his own wisdom can grant the waiver but for now all the MDAs should work towards achieving the deadline of September 15.”

Advertisement

While commending the federal government on the TSA implementation, Khurima Nthara, World Bank lead economist and programme leader for Nigeria, said the policy had been tested in other countries and it had been effective.

He said the concept would help government to reduce borrowing because it would enable it have a more consolidated view of the cash that it has at hand.

“I think the TSA has got a very simple concept. You want the government to have a good view of all the cash that it has in one single account,” he said.

“You don’t want the situation that one department or ministry has funds lying idle in one commercial bank when another is in need of those cash and the government has to borrow to make sure that the other ministry or department has access to funds.

Advertisement

“So the concept of the TSA is that all funds should be consolidated so that whichever agency is in need of cash at the moment should have access to those funds.”

Advertisement