BY ODEWALE ABAYOMI

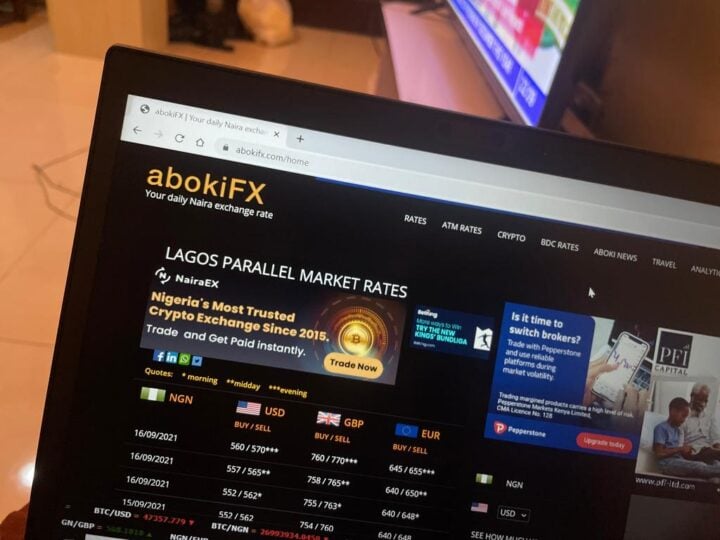

Amidst the growing popularity of abokiFX, a website which publishes black market exchange rates, and as naira depreciates at the parallel market, the Central Bank of Nigeria (CBN), being suspicious, recently accused the platform of publishing arbitrary and speculative rates. Apart from forces of demand and supply, economic variables and policies which largely influence the exchange rate; a popular, manipulative, non-transparent and speculation-riddled exchange rate website is capable of crippling and wrecking a nation’s economy. How transparent are the exchange rates on AbokiFx?

AbokiFX now unofficially wields a powerful influence. The pertinent question remains, what are the yardsticks, indices, and driving factors of exchange rates on AbokiFX and other similar websites? The exchange rate is sensitive. Handlers of exchange rates must publish a fair and accurate value of the naira against other currencies – gathered from trusted and verified sources.

Proliferation and wide acceptance of unauthorised exchange rate blogs are capable of misleading and distorting economic reality. If frivolous websites publishing such critical information on exchange rates are not regulated, anybody can wake up and publish spurious exchange rates that are capable of sabotaging the already battered economy. The harm is spiked forex volatility. This, particularly, is the concern of CBN.

Advertisement

Let us examine the gap between the official rates and bureau de change (BDC) dollar exchange rates before and after the advent of AbokiFX. AbokiFX started operations in 2014. Bear in mind that Nigeria witnessed economic recession in 2008 and 2016 (before and after AbokiFX started operations).

Before the advent of AbokiFX (2004 to 2013): The disparity between the official and parallel market exchange rates was very close and intangible. Despite the economic meltdown in 2008, the difference was roughly N3.08. While the highest exchange rate margin within this period was in October 2005, with a margin of N13.9.

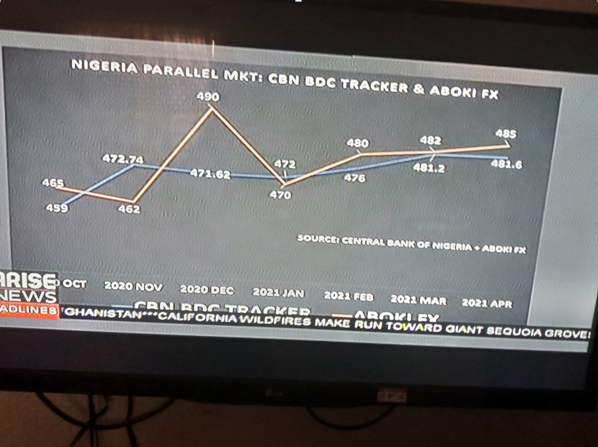

After the advent of AbokiFX (2015 and 2021): The gap between the official and parallel market exchange rates gradually widened. In 2016, during the recession, the difference was N156.82 and it reportedly hovers at about N159 currently. Even in November 2020 when CBN was supplying BDCs, the margin was N91.74. Within this period, CBN had consistently devalued naira at least on three occasions in anticipation that official and parallel market rates will converge — still, the gap widens.

Advertisement

From the data, the gap between official and BDC rates was close before AbokiFX started operations and wide after it started operations. What changed? The possibility of speculation and artificially induced manipulation can not be ruled out.

As the custodian of Naira currency, CBN tracks the exchange rate of licensed BDCs – through CBN BDC Tracker. There is also a disparity when we compare figures from CBN BDC Tracker and AbokiFX’s rates at the parallel market between October 2020 and April 2021. Averagely, AbokiFX’s rates were above CBN BDC Tracker’s. For instance, in December 2020, the AbokiFX rate was N490 per dollar while CBN BDC Tracker puts BDC exchange rate at N471.62 per dollar.

CBN is constitutionally empowered to oversee Nigeria’s currency, and as such, CBN can query anybody or organisations engaging in activities capable of jeopardising the nation’s currency.

CBN should embrace robust fiscal and strong monetary policies that would drive a productive and globally competitive economy. CBN needs a creative approach in relegating speculators without genuine dollar demands – who often create artificial pressure. In resuscitating the naira, it is imperative to checkmate illicit arbitrage and round-tripping by embracing exchange rate unification. In the process, the parallel market becomes non-lucrative.

Advertisement

Notwithstanding, myriads of factors are responsible for Nigeria’s forex crisis but, the influx of spurious exchange rate aggregators cannot be overlooked. The damage to the economy is enormous when mainstream media further rely on shady websites for parallel market exchange rates. Again, how transparent are the exchange rates on AbokiFX?

ODEWALE Abayomi, a writer on economy and politics, tweets @ODEWALEAbayomi.

Views expressed by contributors are strictly personal and not of TheCable.

2 comments

So how exactly can we track the BDC daily rate ? Let’s have where the CBN can publish the official and BDC rate .

The rate is still very high and everyone is speculating the price

This article does not make a compelling argument. It says nothing about the transparency of the rates of AbokiFX and chooses an outlier comparison in December 2020 which has a difference of N20 between AbokiFX and the CBN BDC rates. Other months were between 2-10. Those could have been highlighted as well.

Now on the meat of the article, if CBN published the BDC monitor chart, there won’t be any need for Aboki FX, but even the article writer had to take a picture from a TV program. This tells more about the transparency of the CBN BDC tracking data than those of Aboki FX.

Can someone actually check the data aggregation process of AbokiFX and establish if there is a real manipulation. Parallel market rates published consistently is a public good that prevents buyers and sellers from information asymmetry, a major weakness when market forces are left to fully determine the market.