The Central Bank of Nigeria (CBN) says it has collaborated with International Money Transfer Operators (IMTOs) to collectively commit to doubling remittance flows through formal channels into Nigeria.

IMTOs accept cash to transmit to persons resident in Nigeria or another country. They also carry out cross-border transfer services for personal purposes such as money transfer services towards family maintenance and money transfer services for foreign tourists visiting Nigeria.

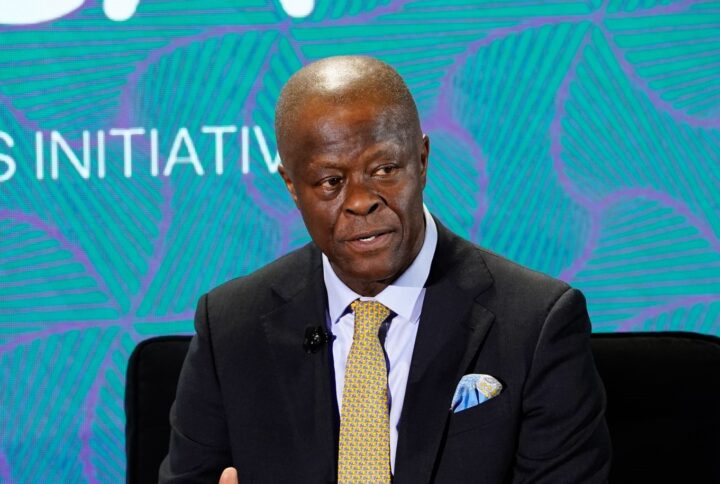

Yemi Cardoso, CBN governor, spoke on Saturday on the sidelines of the ongoing annual meetings of the International Monetary Fund (IMF) and World Bank Group.

“We’ve had very productive discussions with leading International Money Transfer Operators (IMTOs) where we collectively committed to doubling remittance flows through formal channels into Nigeria in the immediate short to medium term,” he said.

Advertisement

CBN SETS UP TASK FORCE

Cardoso said CBN has also set up a task force to address bottlenecks hindering flows through formal channels.

He said the task force would report directly to him.

Advertisement

“This target is both ambitious and achievable and we are wasting no time setting up a collaborative task force reporting to myself to drive progress and address any bottlenecks that hinder flows through formal channels, ” Cardoso said.

On March 7, Hakama Sidi-Ali, CBN’s acting director of corporate communications, said remittance inflow increased to $1.3 billion in February, more than four times the $300 million received in January.

Sidi-Ali said foreign investors purchased more than $1 billion of Nigerian assets in the review period, with total portfolio flows of “at least US$2.3 billion recorded thus far in 2024 compared to US$ 3.9 billion seen in total for last year”.

The CBN had on August 11, 2023, said diversion of diaspora remittances to parallel market weakens naira.

Advertisement

The apex bank said a lot of diaspora remittances arrived in Nigeria in dollars and ended up in the parallel market without being officially documented.

Meanwhile, on February 1, the apex bank removed the allowable limit of exchange rate quoted by the IMTOs.

To boost liquidity, the bank said IMTOs must quote exchange rates for naira payout to beneficiaries based on the prevailing market rates at the foreign exchange market.

Advertisement

Add a comment