The Central Bank of Nigeria (CBN) has again denied reports that it sold forex to individuals at different rates, maintaining that it does not deal directly with bank customers.

A document uploaded on the central bank’s website appeared to show that some bank customers got forex for as low as N0.61/$1 and others for as high as N470/$1.

The CBN rate is N305/$1 while the interbank goes for N314/$1.

Abubakar Malami, the attorney-general of the federation, has reportedly asked the CBN governor, Godwin Emefiele, to explain the said discrepancies following a petition by a citizens’ group.

Advertisement

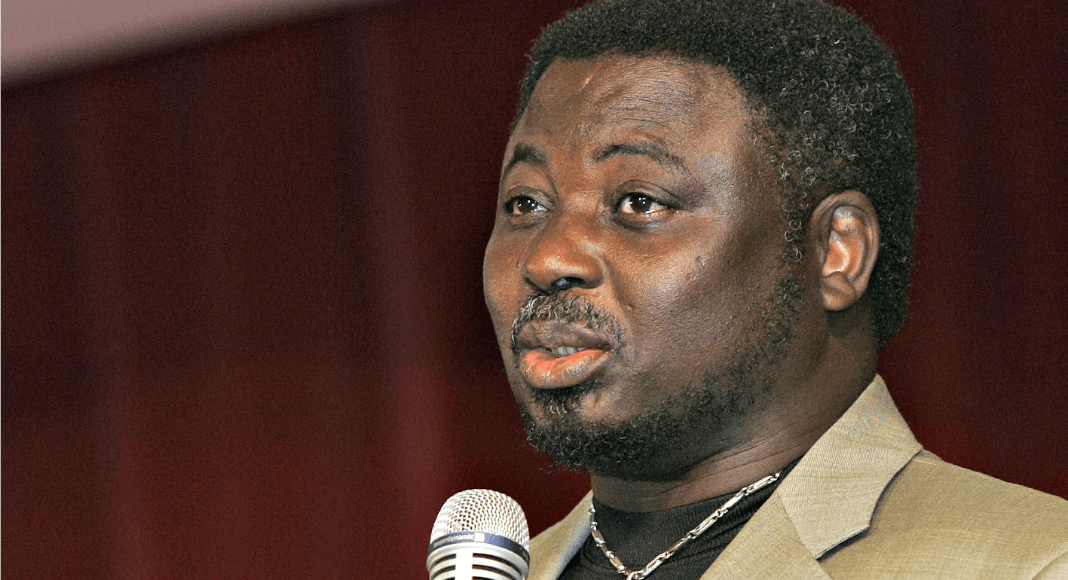

In a statement issued on Thursday, Isaac Okorafor, the CBN spokesman, said the allegations of discrepancies arose from the reporting style of banks for the various currencies — and not the US dollars only.

“The transactions concerned were consummated in third currencies such as Japanese Yen and South African Rand (YEN/ZAR); JPY/NGN, EUR/USD, USD/ZAR. As a result, there is no way any DMB or the CBN will deal in forex transaction at the rate of 61kobo/USD, N18/US$1 or N3/US$1, as was erroneously reported,” he said.

Okorafor said if third currency transactions are “properly translated” they will be in line “with the prevailing forex rate range in the interbank market”.

Advertisement

The statement in full

The attention of the Central Bank of Nigeria (CBN) has been drawn to a media report suggesting that the Office of the Attorney General of the Federation and Minister of Justice has issued a query to the Central Bank of Nigeria (CBN) over issues relating to the sale of foreign exchange.

While it is perfectly normal for any agency of Government to seek clarifications on any matter from other agencies of Government, we wish to state that neither the Governor of the CBN nor the Director, Legal Services Department has received any communication with regard to the issue.

The CBN, as a responsible and responsive arm of Government, will always provide clarifications on any matter within its purview for the purpose of educating and enlightening all concerned.

Accordingly, we wish to reiterate our position by making the following clarifications:

Advertisement

- The CBN DOES NOT deal directly with any Bank customer on foreign exchange transactions. Such transactions are consummated strictly between the customers and their respective Deposit Money Banks (DMBs);

- The figures of FOREX sale published in national dailies or on CBN website, over which insinuations are being formed, were transactions consummated between the DMBs and their customers;

- Pursuant to our policy of transparency, we publish the reports of purchases and sales of forex between the DMBs and their customers, as submitted by the banks without editing. This practice of publishing the figures on our website has been on since October 2016;

- Following observations of different exchange rates after the last publication on our website (www.cbn.gov.ng), we called for explanations from the banks concerned.

- In response to our queries to them, and apart from some observed formatting errors, the concerned banks reported that the returns were sent based on the foreign currency rates on which the transactions were conducted. The transactions concerned were consummated in third currencies such as Japanese Yen and South African Rand (YEN/ZAR); JPY/NGN, EUR/USD, USD/ZAR. As a result, there is no way any DMB or the CBN will deal in forex transaction at the rate of 61kobo/USD, N18/US$1 or N3/US$1, as was erroneously reported.

- The aforementioned are third currency transactions and when properly translated, will be in line with the prevailing forex rate range in the interbank market.

Consequently, to prevent any such occurrence in the future, the CBN has directed ALL Deposit Money Banks to render their returns in a uniform format converting all forex sales and purchases to NGN/USD. All third currency transactions are also to be converted to NGN/USD.

Again, we urge all concerned stakeholders to always verify information on matters relating to the Bank before going public in order not to trigger volatility in the market.

Add a comment