The Central Bank of Nigeria (CBN) has directed all commercial banks to fund their accounts by Thursday to allow for the mopping-up of liquidity.

The development is coming after the monetary policy committee (MPC) raised the cash reserve ratio (CRR) from 27.5 percent to 32.5 percent to tame inflationary pressure.

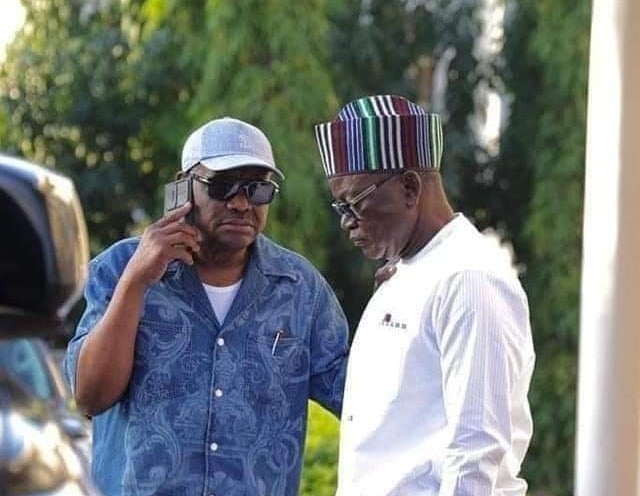

Godwin Emefiele, governor of the apex bank, said this on Tuesday while fielding questions from journalists after the committee’s meeting at the CBN headquarters in Abuja.

CRR is the share of a bank’s total customer deposit that must be kept with the central bank.

Advertisement

CRR is one of the ways CBN regulates the country’s money supply, inflation level and liquidity in the country. The higher the rate, the lower the liquidity with the banks.

Emefiele said the directive would allow the apex bank to achieve its desired results.

“We have increased the CRR, and we expect that this decision at this meeting must be seen to be potent and must achieve the effect that the MPC thinks it should achieve,” he said.

Advertisement

“We expect that all the banks in Nigeria must fund their accounts by Thursday, 48 hours because we will debit them for CRR.

“We will take their CRR to a minimum of 32.5 which means we are going to take liquidity out of their vaults by Thursday.”

He added that if any bank fails to meet up, the apex bank may need to “preclude those banks from foreign exchange market until they meet this 32.5”.

“This message is meant to underscore the fact that this very aggressive decision to rein in inflation must yield results. We do not want to face Nigerians in the next few months, and we begin to take the blame for not being able to rein in inflation and in spite of all of the rates that we raised,” the CBN governor said.

Advertisement

“So we have decided to adopt a two-pronged approach by increasing CRR – we want to see interest rate go up and CRR going up because we must mop liquidity effectively out of the vaults of the bank.”

The committee also raised the monetary policy rate (MPR), which measures interest rate, from 14 percent to 15.5 percent.

Add a comment