The Central Bank of Nigeria (CBN) has asked stakeholders in the financial sector to ensure the development of a robust, inclusive and actionable national fintech strategy.

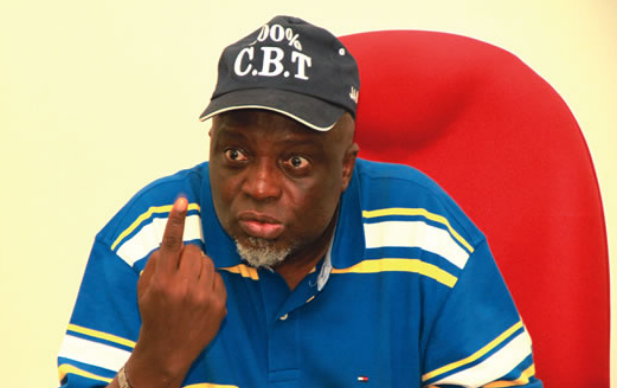

Aishah Ahmad (pictured), CBN deputy governor in charge of financial systems stability, gave the charge at the virtual meeting for development of a national fintech strategy in Nigeria in collaboration with the Alliance for Financial Inclusion (AFI).

She urged all stakeholders to invest time and needed resources to the development of the national fintech strategy for the overall benefit of users of financial services, the financial system, and the nation at large.

Ahmad explained that digital financial services (DFS) were at the core of fintech strategy that would be used to drive broader development in the financial ecosystem.

Advertisement

She said these services were key in driving financial inclusion by reducing cost to serve, increasing transaction efficiency, and improving security and transparency of financial services.

Highlighting the efforts of the CBN in this regard, Ahmad said the apex bank had made efforts in evolving legal and regulatory frameworks, as well as the development of enabling infrastructure such as payment systems to support DFS in the country.

She noted that the development of payment service bank guidelines, issuance of three licenses, supervisory and open banking framework were all designed to broaden the range of financial products and enable the sharing of data across the banking and payment ecosystem.

Advertisement

The CBN deputy governor, while appreciating the AFI for its continued support for financial inclusion across jurisdictions, urged full commitment of participants to ensure the success of the project.

In his remark at the virtual meeting, Alfred Hannig, executive director of AFI, commended the CBN and stakeholders for moving Nigeria forward in its inclusion target by an additional 5.2 million adults, from 48.4 million to 53.6 million — representing 50.5 percent of the adult population who are now formally included in the financial system.

He called for the application of a strong relevance to financial inclusion filter as Nigeria considers ways to harness fintech and innovation for the benefit of the excluded or unserved.

Advertisement

Add a comment