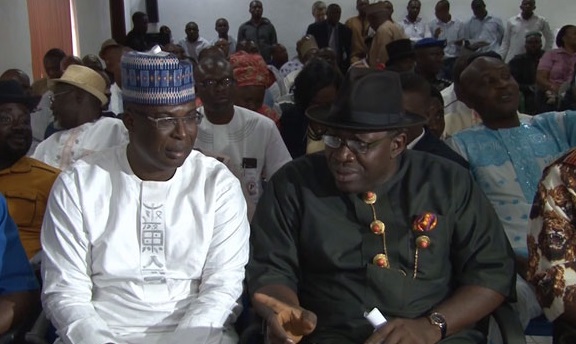

Nigeria's CBN governor.

Godwin Emefiele, the governor of the Central Bank of Nigeria (CBN), says the bank would be creating employment for at least one million graduates in 2016.

The bank chief expressed that this would be done by harnessing the power of small and medium enterprise across the 36 states of the federation.

Speaking at the opening ceremony of the seventh annual bankers’ committee retreat in Lagos, Emefiele said CBN was going to work with commercial banks in delivering this.

“We need to get more and more people to be employed, and we will need the support of the banks to begin to see how we lower our risk acceptance criteria to give support to our young graduates,” he said.

Advertisement

“In the course of the next few weeks, we will be unfolding a plan of support of the CBN to create employment for at least one million young graduates in Nigeria in 2016.

“That will entail support from Nigerian banks and our development institutions to see how we will channel these concessionary loans to companies that are MSMEs.”

Emefiele admitted that there has been intense pressure on Nigeria’s foreign exchange, following the drop in commodity prices generating Nigeria’s foreign exchange.

Advertisement

“The drop in commodity prices is a major thing that has affected the country. What that means is that your revenue has dropped and we are facing very serious pressure on our external reserves and exchange rate.

“What that does is that we all need to think about how we should come together and see what we can do as a people to shield ourselves from what is happening.

“So, we need to do whatever we can to protect the economy. We are entering a phase where we believe that the SMEs must be the only priority for growth in our economy.

“I must say that the Nigerian banking sector has not played an active part in supporting the SMEs, but this is not without reasons,” he said, blaming the bank’s passive role on hanging debts.

Advertisement

Emefiele, who was stern in his approach, said the banks must give young graduates a chance to access the CBN’s N220bn micro, small and medium enterprise (MSME) fund.

“I am saying if you refuse to support, your money that we would have released through the cash reserve ratio (CRR), we will take that money and lend it through any channel that will give these young graduates jobs.

At the last monetary policy committee (MPC) meeting of the CBN, the committee reviewed its CRR, from 25 percent to 20 percent, making over N700bn available for lending.

The committee also warned earlier, that the country was heading for a recession in 2016, if proactive measures are not taken to avert the crisis.

Advertisement

Add a comment