The Central Bank of Nigeria (CBN) has directed Nigeria Customs Service (NCS) and other related parties to adopt the closing rate in the official foreign exchange (FX) window for import duty.

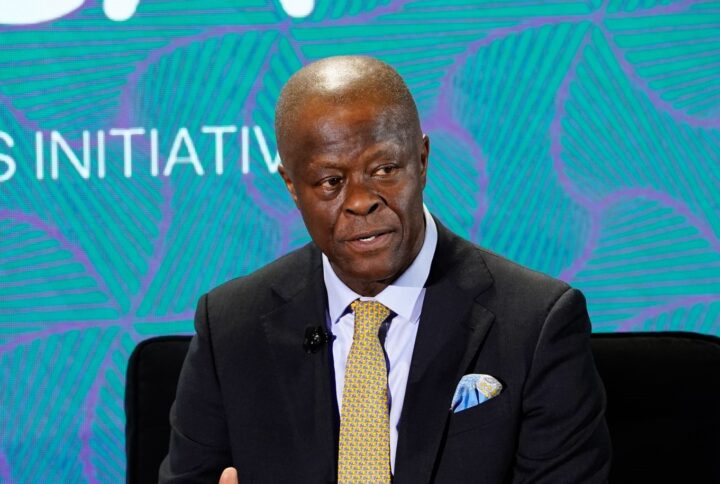

The apex bank gave the directive in a statement signed by Hassan Mahmud, its director, trade and exchange department, on Friday.

According to the CBN, the FX rate at the point of importation should be used for import duty assessment until the termination date and clearance are finalised.

“Following the liberalization of the FX market on the Willing Buyer-Willing Seller trading principle, the Central Bank of Nigeria has noted the concerns of Importers of goods and services in the irregular changes in the Import Duty Assessment levies applied by the Nigeria Custom Service,” CBN said.

Advertisement

“These developments have further built uncertainties around the pricing structure of goods and services in the economy and created abnormal increases in the final sale prices of items, which is largely driven by uncertainties, rather than traditional market fundamentals, with implications to near term inflation trends.

“To this effect, the Central Bank of Nigeria wishes to advise that the Nigeria Custom Service and other related Parties adopt the closing FX rate on the date of opening Form M for the importation of goods, as the FX rate to be used for Import Duty Assessment.

“This rate remains valid until the date of termination of the importation and clearance of goods by importers.

Advertisement

“This would enable the Nigeria Custom Service and the importers to effectively plan appropriately and reduce the uncertainties around varying daily exchange rate in determining their revenue or cost structure, respectively.”

The financial regulator said the directive is to take effect from February 26 2024, and the closing rate on the date of opening of Form M for the importation of goods and services would be the rates that would apply for the import duty assessment.

The Form ‘M’ is a declaration of intention to import physical goods into Nigeria.

CBN said the new directive supersedes the requirements of “Memorandum 9, J (2) of the Central Bank of Nigeria Foreign Exchange Manual. (Revised Edition), 2018”.

Advertisement

“While the CBN is mindful of the initial volatility and price distortions in the aftermath of the FX market liberalization, the bank is confident that these reforms would in the medium term, it would ensure stability in the market and entrench market confidence necessary to attract investment capital for the growth and development of the Nigerian economy,” the apex bank said.

On February 16, 2024, the financial regulator announced the reviewed allowable limit of price deviation for exports and imports.

CBN increased the allowable limit to 15 percent – up from 2.5 percent – citing global inflation and other related challenges.

Advertisement

Add a comment