The Central Bank of Nigeria (CBN) has granted Wema Bank a national banking licence, the commercial bank revealed on Thursday, saying the development would upgrade it from its current regional bank status.

The bank said it got the new licence because its capital base currently stood at N43.8 billion and having met the regulatory requirements for the national banking licence as stipulated by the apex bank.

In 2010, the bank downscaled to a regional bank which could operate only within core areas of business in south-south, south-west and the federal capital territory.

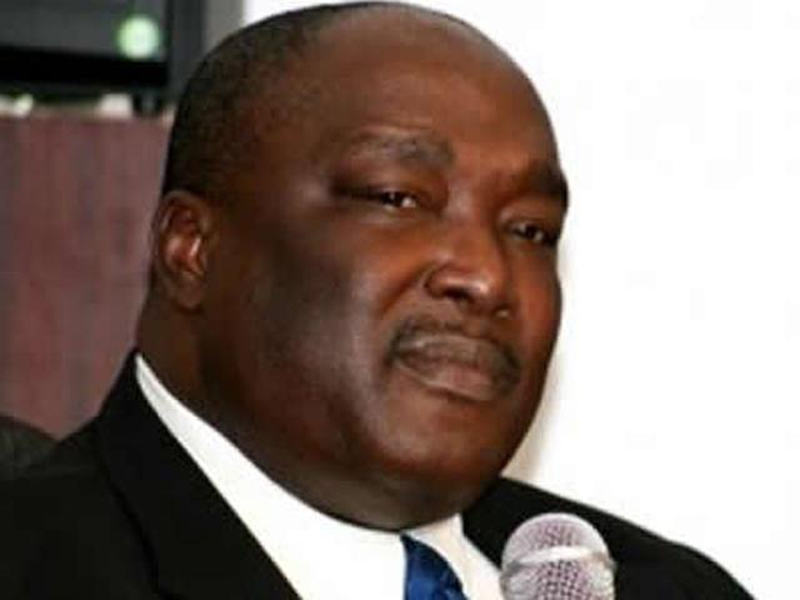

But describing the upgrade as “a milestone”, Segun Oloketuyi, managing director of the bank, said the feat would assist the financial institution keep its commitment.

Advertisement

“Six years ago, we took a decision to refocus the bank’s operations on its areas of strength and build a sustainable institution,” he said.

“We took advantage of the new licensing regime and applied for a regional authorisation with a pledge to expand in the near future once the turnaround project was completed.”

Oleketuyi said the bank’s transformation was implemented in three phases to stabilise the bank, “prepare the building blocks for growth and to go for growth”.

Advertisement

He added that the bank has now reached the third phase of the transformation project.

Oleketuyi said that the new licence had created opportunities to scale up growth, adding that the bank would continue to strategically select its business locations across the country.

He also said the bank would focus on areas where return on investment would be maximised and shareholder value enhanced over the medium to long- term.

“To ensure that this approval is leveraged appropriately, we are already in the process of raising 100 million dollars in tier 2 capital and would commence a tier 1 capital raise in Q1 2016.

Advertisement

“This will further position the bank to pursue its growth strategy.

“The bank remains on course in its turnaround programme as evidenced by its robust balance sheet and sustained profitability which would be maintained through its national authorisation.”

He expressed gratitude to stakeholders, saying the Wema’s transformation project had succeeded largely due to the great support received from customers and shareholders.

“Our priority remains delivering delightful and memorable service to our customers,” Oloketuyi said.

Advertisement

The bank, in 2012, applied for a regional licence following the reforms that outlawed universal banking.

The CBN later announced new minimum capital requirements for a regional bank (N10 billion), national bank (N25 billion) and international bank (N50 billion).

Advertisement

As regional bank, Wema Bank could only operate in a maximum of 12 of Nigeria 36 states (bordering two neighbouring geo-political zones) and Abuja.

Advertisement

Add a comment