The Economist, a British newspaper, has branded the Central Bank of Nigeria (CBN’s) defending of the naira as “disastrous”, saying the currency has been “floating like a stone” having technically been allowed to float for a single day.

In an article put up by the medium on Thursday, it argued that the Godwin Emefiele, the CBN governor, was following the directives of President Muhammadu Buhari on the state of the currency.

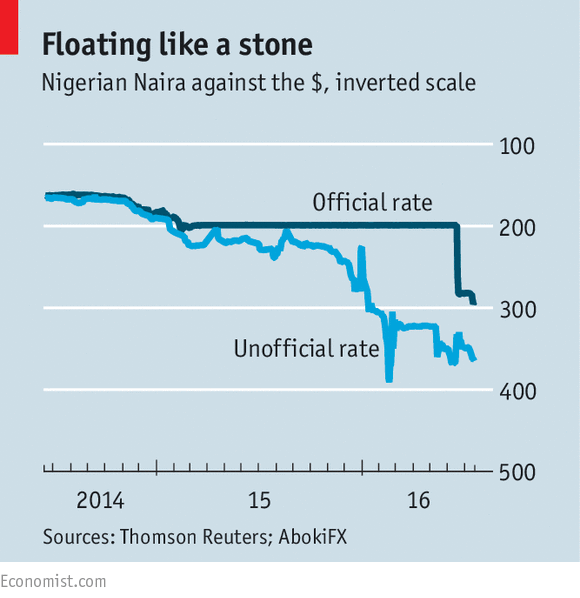

“SOMETIMES the worst is not bad enough. Or such is the case for Nigeria’s currency, which nosedived by 30% when the central bank first removed its peg to the dollar on June 20th,” the London based newspaper said.

“The naira is now this year’s poorest-performing currency in Africa. Internationally, only the currencies of Venezuela and tiny Suriname have fared worse. Yet were it truly free, it would be weaker still.

Advertisement

“In fact, the naira’s free float seems to have lasted exactly a day. Since its sharp drop on the first day of its devaluation, the currency has more or less flatlined at about 282 per dollar.

“This is rather odd given the pent-up demand for dollars after the central bank governor, Godwin Emefiele, restricted the supply in a bid to defend the currency at its old peg of 199 to the dollar. Many analysts expected it to plummet as low as 350 when businesses hoovered up a backlog exceeding $4 billion.”

The Economist said bankers in Nigeria were of the opinion that the naira stability came about after the central bank sold dollars and traders were “bullied” to keep to an unofficial peg.

Advertisement

It added that CBN was ignoring its own policy on allowing a float, in order to please Buhari, “who fears a weak currency”.

“These sorts of flip-flops hardly reassure foreign investors, whose dollars Nigeria desperately needs to fill a gaping trade deficit. Nor do they encourage Nigerian exporters to repatriate foreign exchange, since they still expect a further fall in the value of the local currency.

“Starved of an inflow of fresh dollars, the new interbank market on which the naira trades has been painfully thin: little more than $50m in foreign exchange changes hands there daily, according to Renaissance Capital, an investment bank. (By contrast foreign exchange flows in South Africa are worth billions of dollars a day.)”

It said there was reason for hope, noting that “by happy coincidence, the naira began to slide again in mid-July after the governor took an ear-bashing from foreign investors over his manipulation of the exchange rate (which he denies)”.

Advertisement

“By the time The Economist went to press it had reached 295 to the dollar, its lowest ever official rate. This is still about 20% stronger than on the black market—which is surely a more accurate representation of the naira’s worth,” it said.

“The central bank’s policy of defending the naira has been disastrous, creating shortages of products such as milk and fuel and bringing factories to a standstill for want of imported inputs. The economy contracted by 0.4% in the first quarter of this year thanks to cheap oil and monetary mismanagement. The IMF expects GDP to shrink 1.8% this year.

“Worse still, inflation hit 16.5% in June—the highest rate in almost 11 years. With a weaker currency, it might surpass 20% by Christmas, calculates Chris Becker of Investec, a South African bank. Whatever happens, Nigerians will hurt more yet.”

The Economist says the black market rate is “surely a more accurate representation of the naira’s worth”.

Advertisement

Add a comment