The Central Bank of Nigeria would probably be expecting applause after claiming to have nipped in the bud the monumental fraud involving some of its officers at its Ibadan, Oyo State, branch.

A staggering N8bn was involved in what the CBN described as a “systematic scheme” that has been on for several years in which its officers have colluded with some bankers at other commercial banks to turn ‘waste’ into ‘wealth’ at the expense of the tax payer. It is not exactly a classic heist tale but a systematic fleece in which mutilated higher denomination notes, originally meant for destruction, were swapped with lower denomination notes. While the recycled mutilated notes got back into circulation, the new notes ended in the pockets of the banker-robbers.

The greedy bankers chose the apparently less combustible branch in Ibadan to feed their appetite for filthy lucre. And filthy, indeed, these perpetrators must be, to have targeted the dirty, mutilated notes slated for destruction. The suspects did not steal the dirty notes for they knew the rate of being detected would be high. Instead, they swapped them for lower denomination currencies. In carrying out this robbery, they simply took boxes filled with wads of lower denomination currencies, substituted them with mutilated ones and then replaced the packs of mutilated notes with ordinary newspaper cuttings in naira note size.

CBN says it detected the fraud in September 2014 during a routine internal audit of the Bank’s Cash Destruction activities and that those involved are six middle-level officers. But CBN’s clarification came on Monday only after the Economic and Financial Crimes Commission had blown the lid off the scandal, announcing that five top officials of the bank and 16 others from some commercial banks who allegedly connived with the CBN officers to perpetrate the fraud had been arraigned in court.

The public deserves to know where the truth actually lies in this matter.

Advertisement

Yes, a name-and-shame tactic has been adopted in which the photographs and details of the culprits were published on newspaper covers. But how precisely was this fraud detected? CBN claims that its Briquetting Panel uncovered it and reported to the bank’s management and upon further investigation ordered by the CBN Governor, realized that the fraudulent scheme had gone on for years. Satisfied that some of its officers were culpable, it then dismissed a few and placed others on indefinite suspension before handing them over to the EFCC.

But the anti-graft agency has a slightly different account. It said it got wind of the fraud after receiving a petition in November last year alleging that over N6.5bn was cornered and discreetly recycled by top executives of the CBN at the Ibadan branch. Indeed, EFCC said it was a member of the Briquetting Panel from Osogbo that raised the alarm after confronting the Head of the panel and other members whose conduct she found unsatisfactory. The whistle blower’s allegation, according to the EFCC, was that the discovery of N500 notes to the tune of N5bn meant for destruction, which were replaced with newspaper cuttings, was omitted from her report by the panel.

If indeed there was an omission of a crucial part of a member’s report in what the Briquetting Panel eventually submitted, was it deliberate? Why did the CBN not take action on its discoveries before a petition was sent to the EFCC? This case stinks and one can guess that more revelations might still come out of this mutilated notes scandal.

Advertisement

I have always wondered why commercial banks give customers torn and mutilated notes in bails, which are hardly ever complete. Now we can conclude that the new notes meant for customers have been substituted with mutilated ones earmarked for destruction. How then can we trust CBN that the Ibadan scandal is an isolated case? But our apex bank has not always held itself high for trust. It has merely perfected the art of threading on thorny paths.

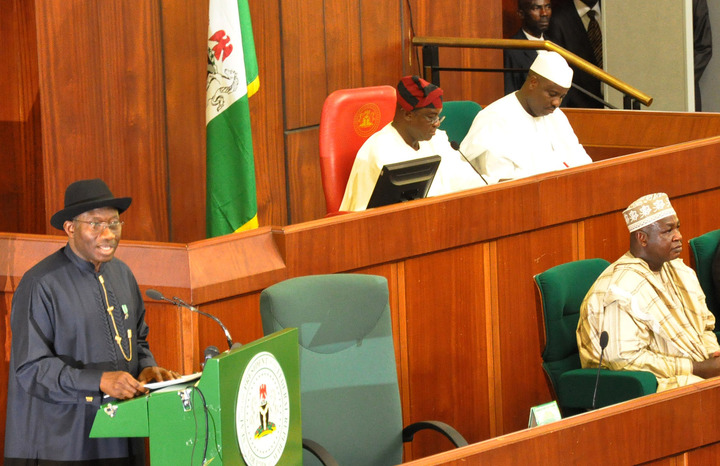

It was in the twilight of Sanusi Lamido Sanusi’s tenure as CBN Governor that we saw the Financial Reporting Council, for the first time, indicting not only the governor but the Acting Governor as well as other deputy governors of the bank for some alleged financial recklessness and were recommended for sack. Although former President Goodluck Jonathan used his discretion, choosing to relieve only Sanusi of his position, the dent on CBN has remained indelible. How can an apex bank turn itself into Santa Claus, creating selective bonanza in the guise of Corporate Social Responsibility and turning its top officials into contractors masquerading as influence peddlers?

The bribery scandal over the polymer bank notes is still fresh in our memories. Although former CBN governor Charles Soludo has been cleared of personal complicity in that case, the blot on CBN’s reputation remains. The regulator, from every indication, needs a watchdog. And nowhere is the need to keep a tab on the apex bank more imperative now than in the need to unravel the identity of its senior official that was alleged to be a major Boko Haram financier.

Although CBN had last year responded to the inquiry by SERAP, the good governance civil society, claiming that its investigation revealed that no staff member of the bank was found culpable and by its statutory role, it could not have been used as a conduit to support a terrorist organization. I’m afraid the onus is not on CBN to unravel this case. The Australian negotiator, in the Boko Haram insurgency, Dr. Stephen Davis, was the first to allege that a top CBN staff was directly linked to the terrorist sect. Prof. Wole Soyinka also claimed that his independent enquiries showed that the same individual was indeed culpable. But he did not stop there, the Nobel Laureate said a foreign embassy, which was involved in an independent investigation into some money laundering that allegedly involved the CBN, confirmed and indeed provided the name of the said culprit to former President Jonathan.

Advertisement

As President Muhammadu Buhari swings into battle mode to confront a terror group that has again demonstrated its capacity to destroy, even in the few days of the new administration, unraveling the identity of the CBN official with a tie to Boko Haram as alleged by three different sources should be one of the first things to do.

Add a comment