The euro/dollar was exposed to extreme levels of volatility during trading on Thursday following the European Central Bank’s market shaking decision to taper its monetary stimulus to the Eurozone from April 2017 until the end of December 2017 or beyond.

Although the central bank has decided to maintain its monthly purchases by 80 billion euros until March 2017, the reduction to 60 billion euros from April 2017 till year end could spark fears of a taper tantrum potentially sabotaging growth and pressuring the ECB to take further actions.

With concerns still elevated over the health of the European economy and mounting political instability from Italy weighing heavily on sentiment, investors may turn to Draghi for further clarity on why the ECB made such a move.

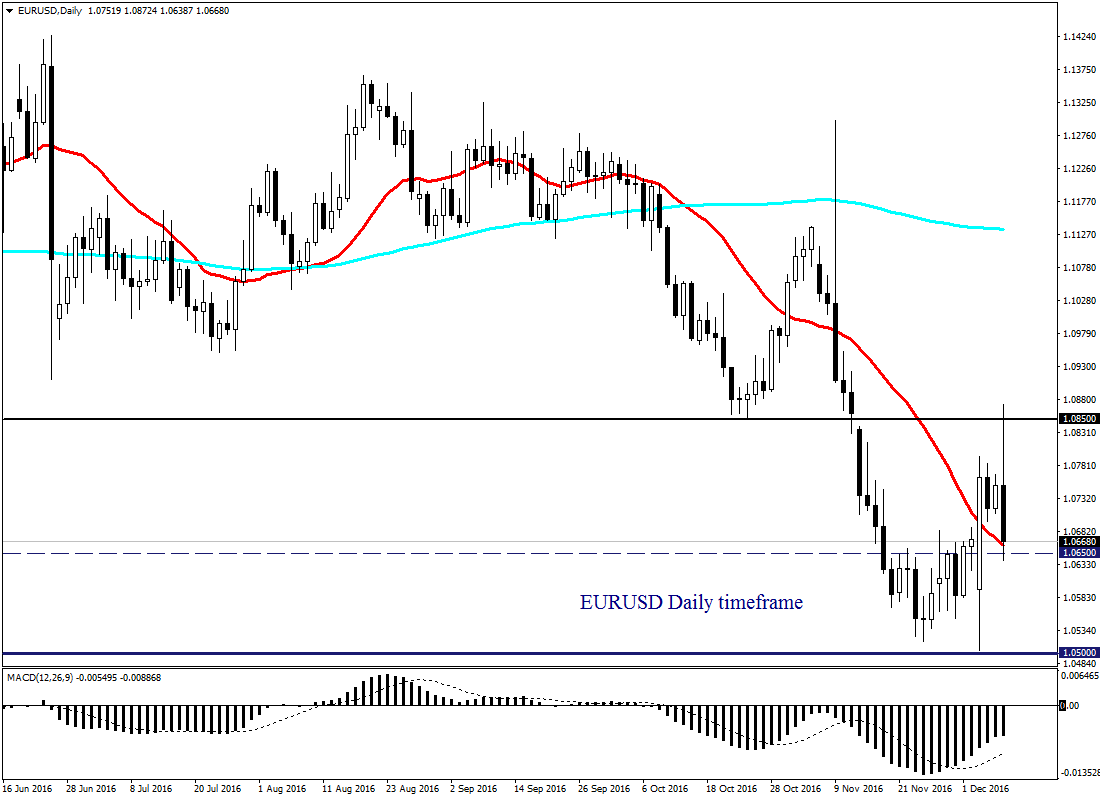

Euro bears jumped into action sending the EURUSD back to 1.065 as uncertainty and anxiety encouraged sellers to attack. This pair has turned heavily bearish on the daily timeframe and a breakdown below 1.065 could trigger a further decline lower towards 1.050.

Advertisement

Sterling is still a seller’s dream

Sterling/Dollar traded in a chaotic fashion this week with prices violently swinging between losses and gains as the conflicting combination of Dollar weakness and persistent hard Brexit fears kept investors on edge.

Advertisement

The overextended Brexit saga continues to erode investor attraction towards the Pound while uncertainty over how the UK economy may fare post Brexit has enticed bearish investors to install repeated rounds of selling. With fears already mounting over the possibility of Britain being left in an extremely unfavourable position after article 50 is triggered next year, bears remain in firm control with the currency seen as a seller’s dream in the medium to longer term.

Since the initial Brexit shocker in June, the Sterling has been under extreme pressure and it could take any unexpected catalyst to trigger another market shaking selloff on the GBPUSD. The pending FOMC meeting next where US rates are expected to be increased could be the meal ticket bears need to drag the GBPUSD back towards 1.250.

WTI hovers around $50

WTI Crude experienced a sharp selloff during trading on Wednesday with prices dipping below $50 as concerns heightened over OPEC’s record high output for November.

Advertisement

Bearish investors were offered further encouragement to drag prices lower after reports of crude oil inventories rising rekindled anxieties over the excessive oversupply in the global markets. Investors have started to digest the painful OPEC reality with the fading positive effects of last week’s unexpected production deal exposing Oil to downside risks.

Scepticism and pessimism have already heightened over OPEC’s ability to fulfil the 32.5 mbpd production ceiling in January while there are some fears over the success of the pending OPEC and non-OPEC meeting this Saturday. WTI bears need decisive breakdown below $50 to encourage a steeper decline lower towards $48.50.

Commodity spotlight – Gold

Gold has taken a beating this quarter with the metal gasping for air as the intensifying US rate hike expectations drag prices deeper into the abyss. Dollars resurgence amid the improving sentiment towards the US economy coupled with risk-on has left the zero-yielding metal exposed to extreme losses.

Advertisement

Bears remain in control with steeper declines expected after the Federal Reserve raise US interest rates next week. From a technical standpoint, previous resistance around $1190 could transform into a dynamic resistance that sparks a steeper selloff towards $1150.

Advertisement

Add a comment